TELEGRAF – The Market Sentiment Index (CSA Index) for March 2025 experienced a significant decline to 47.6, dropping from its previous position above the neutral threshold of 50, Jakarta (03/04/25).

This figure indicates that the majority of market participants do not have a positive outlook on the movement of the Jakarta Composite Index (IHSG) in the near future.

The downward trend aligns with the weakening IHSG throughout February 2025, which saw a sharp correction of 11.8% and closed at 6,270.

Lack of Positive Sentiment Amid Global and Domestic Pressures

IHSG’s decline during February 2025 was largely driven by a combination of negative sentiments from both global and domestic factors.

On the global front, the aggressive policies pursued by the Trump administration have heightened market uncertainty, particularly regarding potential trade tariff increases on China.

This move further worsened investor sentiment and raised risks to global economic stability.

Additionally, a higher-than-expected inflation surge in the United States has fueled concerns over tighter monetary policies from the Federal Reserve (The Fed).

Such a scenario could lead to reduced capital inflows into emerging markets, including Indonesia.

Uncertainties surrounding potential Fed rate hikes and recession fears in major economies also added pressure to the domestic financial market.

Domestic Challenges Further Weigh on IHSG

Domestically, concerns over a weakening national economy have been a significant factor dragging down IHSG.

Weak purchasing power indicators are evident from the low inflation rate, with February 2025 data even recording a deflation of 0.09% (yoy).

Furthermore, government spending cuts and widespread layoffs have further deteriorated market sentiment.

The situation worsened after Morgan Stanley downgraded Indonesia’s stocks in the Morgan Stanley Capital International (MSCI) index.

This decision added further strain to the domestic stock market, as many global institutional investors rely on the MSCI index as a benchmark for their investment allocations.

Responding to these conditions, NS. Aji Martono, Chairman of the Indonesian Capital Market Professionals Association (Propami), emphasized the importance of incentive policies to stabilize the market.

“The CSA Index for March 2025 reflects a volatile market condition. In this situation, incentives are needed to create a more conducive market environment,” he stated.

Market Outlook and IHSG Recovery Potential

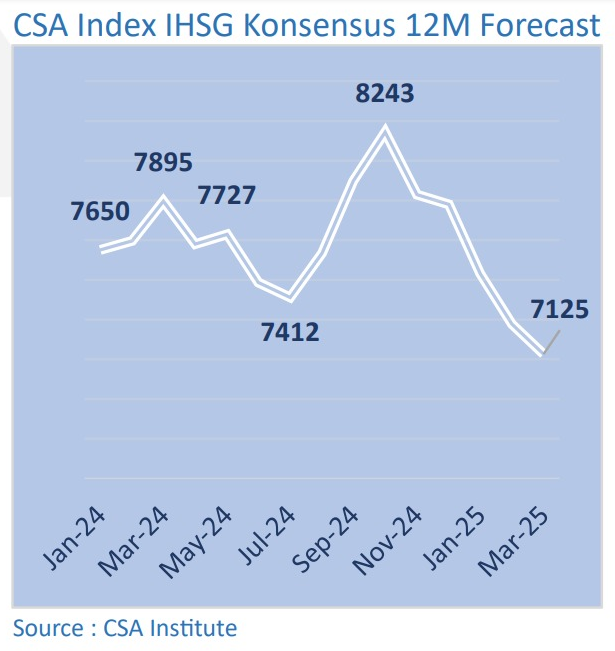

Despite the existing challenges, market participants have set an IHSG target of 7,125 for the next 12 months.

Although lower than the previous target of 8,243 in October 2024, this figure still indicates potential recovery if the market responds well to measures implemented by monetary and fiscal authorities.

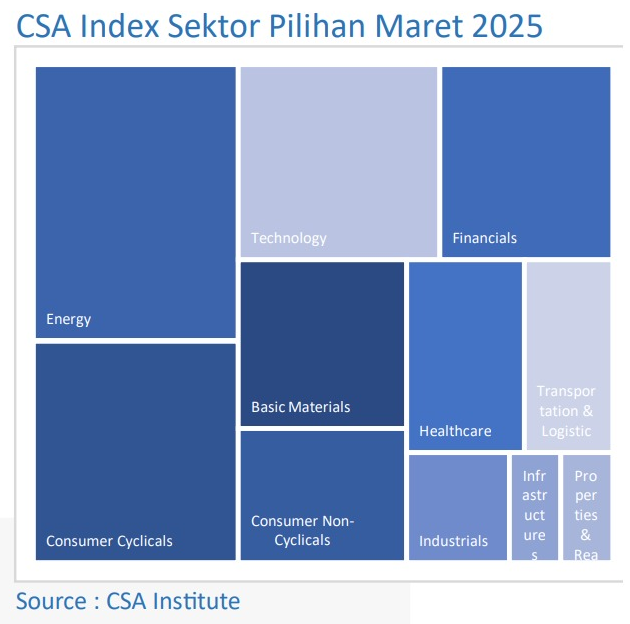

The CSA Index also identified a shift in leading sectors in the stock market.

For the first time, the financial sector is no longer the top choice for investors.

It has now been replaced by the energy and consumer cyclical sectors, which have shown better performance compared to the banking sector, which faced mounting pressure throughout February 2025.

On another note, the momentum of Ramadan is expected to drive increased consumer spending and positively impact the capital market.

If Bank Indonesia maintains an accommodative monetary policy and consumption rises during Ramadan, IHSG has the potential to rebound.

Although uncertainty still looms over the market, the fundamentals of Indonesian issuers remain stable, leaving room for recovery.

Market participants now await concrete actions from regulators and the government to ensure stability in the capital market amid increasingly complex global and domestic economic challenges.