[ad_1]

“NASDAQ sinks to two-month low as bond yields jump,†ran the lead headline in one of the financial news services. The tech-heavy NASDAQ lost 2.7% and closed at a two-month low, but bond yields didn’t do much of anything.

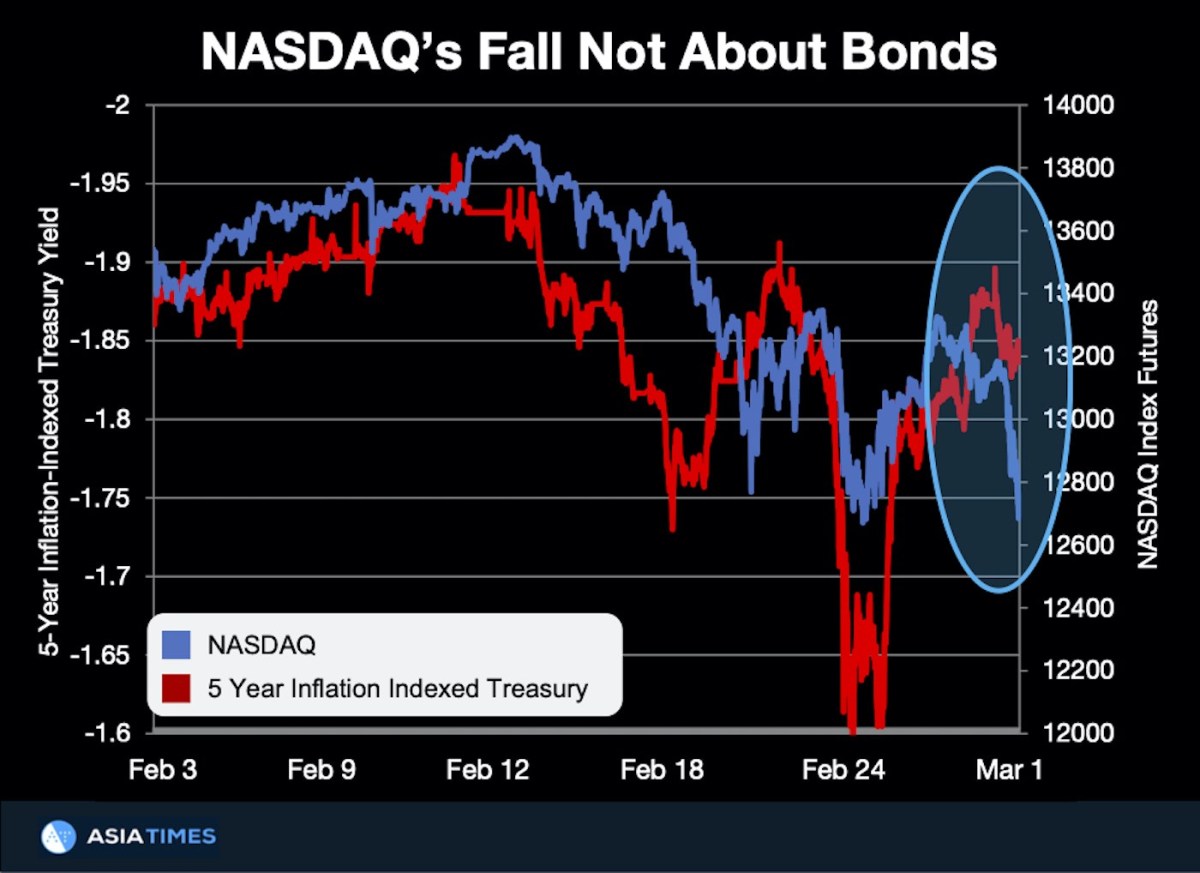

The five-year inflation-indexed Treasury yield, which has by far the biggest pull on stock prices, moved up five basis points to -1.82%, a good 20 basis points below its February 25 spike to -1.62%. The NASDAQ, though, sank to new lows. The Chart of the Day shows the NASDAQ Index against the inflation-indexed Treasury yield (inverted scale).

At its recent peak, the NASDAQ traded at 40 times earnings, a bubble valuation not seen since just before the 2000 tech stock crash. The Dow Jones Industrial Average fell slightly, because the tech components – Salesforce.com, Microsoft, Apple and Intel – all dropped between 2% and 4%.

Part of NASDAQ’s queasiness is due to President Joe Biden’s new Treasury Secretary, former Fed Chair Janet Yellen, who has said that she’s considering a capital gains tax increase. That would whack growth stocks in particular; they don’t pay dividends (which Yellen hasn’t said she wants to tax), so investors buy them for price appreciation.

In fact, there’s a significant statistical relationship between the price movements of individual stocks and their valuations: The higher the price-earnings ratio, the worse the daily return tended to be.

That is, the trend line of the scatter-chart of one-day price movements vs. price/earnings ratios is sloped downwards (and the t-statistic of the regression is -4.3, which means the relationship is highly significant).

Investors should recall in the context Aesop’s story of the Wolf and the Lamb (except the animals in this case would be a bull and a bear).

The Wolf wants to eat the Lamb but feels a bit guilty about devouring him without an excuse, and says: “Last year you insulted me.†The Lamb says, “I wasn’t born last year.†So the Wolf ventures, “You’re eating my grass.†Replies the Lamb, “I only drink my mother’s milk.†Says the Wolf, “I’m not going without supper,†and eats the Lamb anyway.

Fed Chair Jerome Powell is in the position of Aesop’s Lamb: The market wants to get out of bubble stocks, and Powell reassures the market that the Fed won’t tighten monetary policy and push up bond yields to give the market an excuse to sell.

After a month of back-and-forth with the Fed, the market appears to have concluded that it doesn’t need an excuse to sell stupidly rich assets.

[ad_2]

Source link