[ad_1]

Jay Powell, the Federal Reserve chair, triggered a sudden sell-off in long-term US Treasury debt and equities after he vowed to keep monetary policy loose even as the economy improves and inflation begins to rise.

Speaking on Thursday afternoon, Powell said the central bank expected to be “patient†in withdrawing support for the recovery, given that the labour market remained far from the central bank’s goal of full employment and had made little progress in recent months.

With such a dovish tone, Powell failed to alleviate fears that the central bank is reacting too slowly to the recent rise in inflation expectations and long-term Treasury yields.

The Fed chair suggested that although central bank officials were closely watching the market movements, it would take much more to perturb them.

“As it relates to the bond market, I’d be concerned by disorderly conditions in markets or by a persistent tightening in financial conditions broadly that threatens the achievement of our goals,†Powell said.

Yields on 10-year Treasuries spiked 0.06 percentage points at one point to 1.54 per cent, reviving a rout in the $21tn market for US government debt. Strains emerged last week as liquidity deteriorated, culminating in a weak auction of 7-year Treasury notes on February 25 that sent yields sharply higher.

US stocks also sold off sharply as Powell spoke, with the S&P 500 down 1.5 per cent in afternoon trading. The tech-heavy Nasdaq Composite dropped over 2 per cent, turning negative for the year.

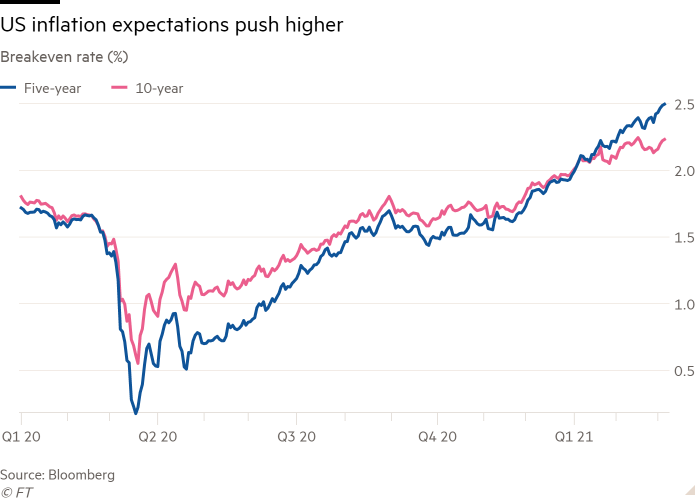

Trading has been volatile for days as investors grapple with the prospect of a stronger-than-expected recovery and higher inflation later this year. One market measure of inflation expectations, the 5-year break-even rate, hit 2.5 per cent on Wednesday for the first time since 2008. Inflation erodes the value of bonds’ income payments, making them less attractive.

Powell did say that if the Fed faced an unhealthy spike in prices this year, it would be able to handle it. “We have the tools to assure that longer-run inflation expectations are well-anchored at 2 per cent. Not materially above or below. And we’ll use those tools to achieve that,†he said.

Such statements may not be enough to satisfy investors bracing for stronger than expected growth due to vaccination rollouts and large fiscal stimulus, combined with ultra-easy monetary policies.

“The bond market will feel quite unprotected by what Powell said today from an inflation perspective,†said Padhraic Garvey, global head of debt and rates strategy at ING. “There is plenty of room for yields to move to the upside.â€

Given the Fed’s stance and expectations of a robust rebound, Garvey reckoned that 10-year yields could rise to 2 per cent in the third quarter of this year.

“Powell did nothing to suggest he is any more concerned with the recent jump in long-term yields than he was last week when he referred to rising yields as a ‘statement of confidence’ in the US economy,†said Mike Schumacher at Wells Fargo.

[ad_2]

Source link