[ad_1]

The broad US stock indices rose sharply in the Wednesday New York session after the Bureau of Labor Statistics reported lower-than-expected core inflation. To the market, that meant the Federal Reserve was less likely to raise interest rates in the foreseeable future, and the yield on the key 5-year inflation-indexed US Treasury – a sensitive barometer of expected Fed policy – fell by 7 basis points. Today’s news reinforces our view that panic over prospective Fed tightening was overdone.

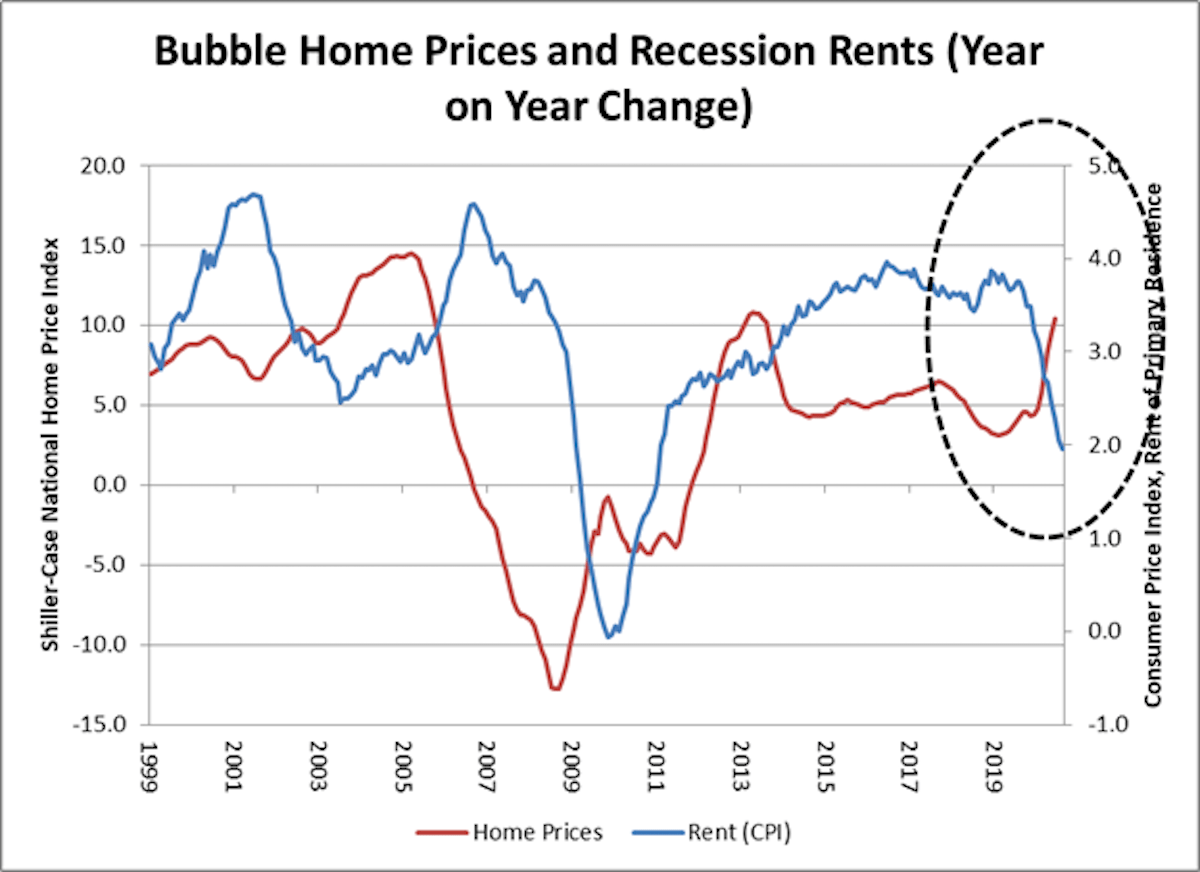

There’s a conundrum in US prices, though: Home prices, driven by the lowest real rates in US history, are booming, with the Shiller-Case national home price index up by 10% year-on-year, comparable to the bubble of the early 2000s prior to the great crash of 2008. But rents (as measured by the rental component of the Consumer Price Index) show hardly any inflation at all; in fact, rents show the lowest rate of increase since the Great Recession of a dozen years ago.

That’s a sure sign of a bubble. People are buying houses because they can (historically low mortgage rates make homes more affordable to more people), because they are moving to places that seem more secure during a pandemic – and, above all, because they need to invest their money somewhere, and they can’t buy high-quality bonds at negative real yields. The price of houses, driven by ultra-expansive monetary policy, has decoupled from the real ability of Americans to pay for them.

With 10 million fewer people counted on non-farm payrolls than in February 2020, demand for rental apartments is weak, especially in cities worst hit by the pandemic. Covid-19 did prompt some price increases, especially in used cars, as urbanites eschewed public transportation in favor of their own means of transport, but that surge in consumer durables prices has proven temporary.

Given that housing represents a third of the US Consumer Price Index, continued distress among a large part of the US population is likely to keep rents in recession mode for some time, despite buoyant home prices. And as manufacturing capacity comes back on line after the pandemic, the supply of consumer durables should mitigate the sort of price jumps we saw in used vehicles.

[ad_2]

Source link