[ad_1]

President Biden wants to spend yet another $3 trillion on “families, schools, and infrastructureâ€â€“that is, on Democratic constituencies. That’s on top of the $1.9 trillion in helicopter money advertised as a stimulus package.

The US government borrowed about $3.5 trillion over the past year and will borrow another $4 trillion during the next twelve months, plus whatever part of the $3 trillion passes into the Biden Administration’s hands.

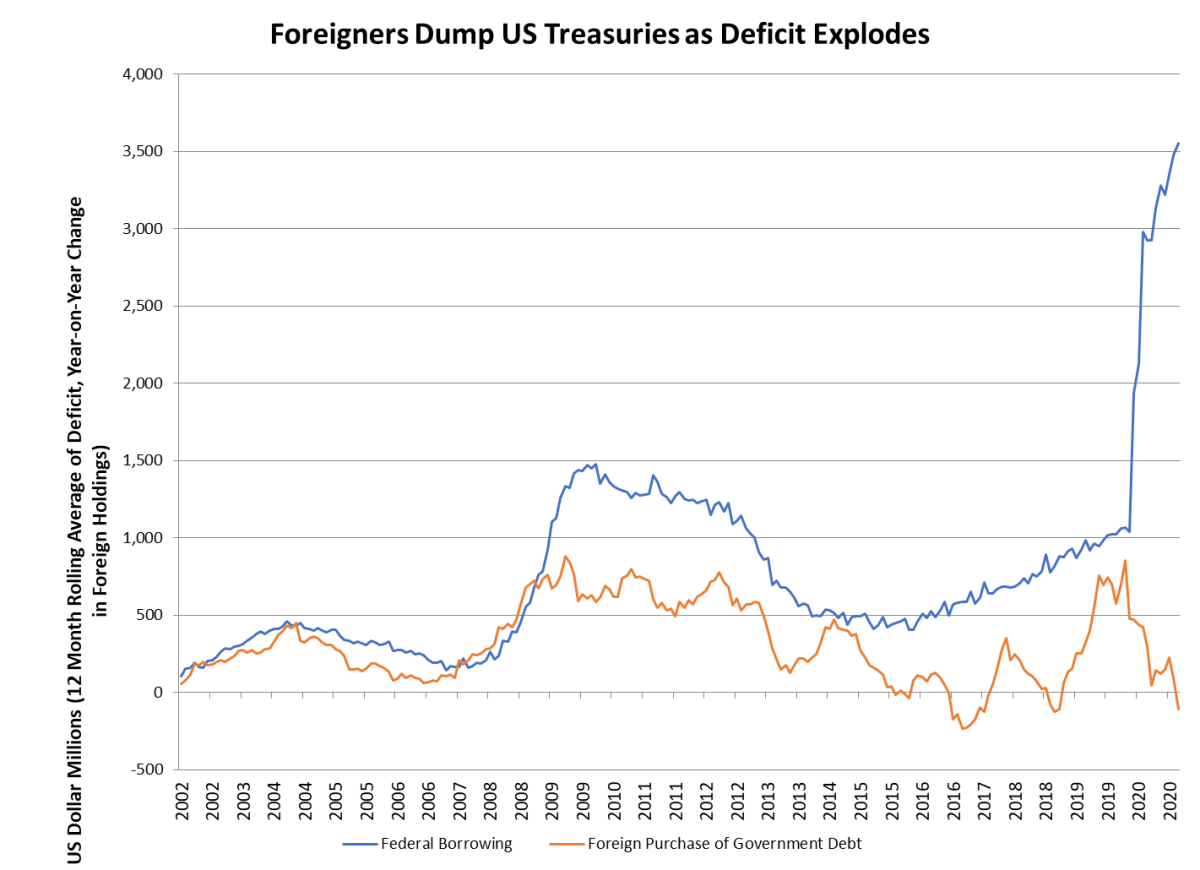

We have had big increases in federal borrowing before, for example after the 2008 financial crisis, but foreigners – both private investors and central banks—financed about half of the surge in federal debt.

Not this time around: Foreign holdings of US debt actually shrank during the past twelve months while borrowing spiked.

Add another $3 trillion to the government’s borrowing needs over the next couple of years, as Biden proposes, and the result is a recipe for disaster.

The US already is in stagflation: Surging input costs for businesses are restraining growth, because business can’t pass the costs along to customers and have to contract operations instead.

In the short term, it’s hard to know whether the “stag†or the “flation†will predominate. Commodity prices, for example, have been dropping for the past couple of weeks, suggesting that higher input costs are choking off demand.

The most likely result, though, is that US interest rates will continue to rise, especially at the longer end of the yield curve, and the dollar will rise with them.

The US will enter into a vicious cycle in which higher federal borrowing pushes rates up, higher rates constrain economic activity and the federal deficit increases even faster due to higher interest costs.

The dollar has strengthened during the past several weeks and probably will strengthen further.

The Federal Reserve will do everything in its power to keep rates down. It’s the only big buyer of Treasury securities.

Fed Chairman Jerome Powell is like a fellow who goes into a bar without any money, and orders a drink. When the barkeeper brings the check, he orders another drink. That can go on for quite some time, but not forever.

At some point – perhaps toward the end of the year – the vicious cycle will kill off demand for dollar assets, and the dollar will crash.

[ad_2]

Source link