[ad_1]

One thing to start: Vernon Jordan, a close ally of former US president Bill Clinton and prominent activist who spent his career battling racial injustice and voter suppression, died this week aged 85. Read more on the accomplished civil rights leader and dealmaker’s legacy here. Go deeper with this 2018 Lunch with the FT with Jordan and DD’s Sujeet Indap.

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance from the Financial Times. Want to receive DD in your inbox? Sign up here. Get in touch with us anytime: Due.Diligence@ft.com.

A news avalanche from Greensill Capital

When the FT broke the story in February that Germany’s financial regulator BaFin was pressuring Greensill Capital to reduce its exposure to the metals magnate Sanjeev Gupta, DD suspected things were going to move fast. This week we’ve seen just how fast.Â

If you’ve not been following the details, now is the moment to start.Â

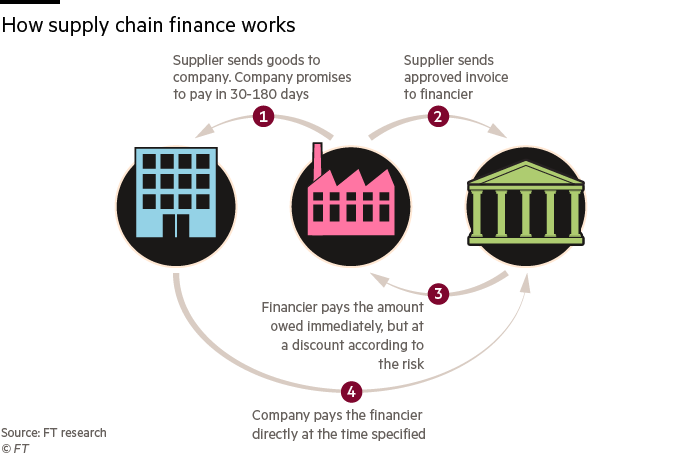

The tale centres on Lex Greensill, a well-connected Australian banker, and his eponymous company Greensill Capital — which attracted $1.5bn in investment from SoftBank’s Vision Fund and counts former UK prime minister David Cameron as an adviser. It provides supply chain finance, a controversial method that DD’s Rob Smith explains here. And as of late last year, it was seeking to raise funds at a $7bn valuation.

Greensill has been the main lender to Gupta, who has been dubbed the “saviour of steel†in the UK for buying unloved metals plants. Gupta’s steel empire is built on opaque and complex financing, much of which was provided by Greensill.

DD has been flagging the extent of Greensill’s exposure to Gupta for some time. Those worries prompted Credit Suisse to freeze $10bn of funds linked to the group on Monday, depriving it of a key source of funding.Â

In doing so, the bank said: “A certain part of the [funds’] assets is currently subject to considerable uncertainties with respect to their accurate valuation.†Greensill’s future has been hanging in the balance since.

Here’s what has happened since then:Â

-

Greensill Capital has sought protection from Australia’s insolvency regime

-

An Australian court has denied Greensill an injunction after it tried to prevent its insurers pulling coverage. Greensill’s lawyers said that if the policies covering loans to 40 companies were not renewed, it could trigger “adverse consequencesâ€, putting more than 50,000 jobs around the world at risk

-

BaFin has taken direct oversight of the day to day operations at Greensill Bank, a Bremen-based lender that is part of the finance group

-

The FT broke the news that Credit Suisse had larger and broader exposure to Greensill Capital than previously known, with a $160m loan on top of an unusual relationship via the Swiss bank’s asset management division

-

A second Swiss fund manager, GAM, has also severed ties with GreensillÂ

-

Apollo Global Management has held talks over a potential deal that would let it cherry-pick some of Greensill’s best assets

-

Canadian asset manager Brookfield walked away from talks with Gupta over a proposed loan worth hundreds of millions of dollars, in a blow to his attempts to secure funding beyond GreensillÂ

That’s a lot of news in 24 hours. We’ll be back with more in the coming days, so stay tuned.Â

Private equity’s gilded age

This week US Senator Elizabeth Warren rolled out her Ultra-Millionaire Tax Act, a proposal for an annual tax of 2 cents on every dollar of a household’s net worth above $50m. Billionaires would need to cough up 3 cents.Â

While the plan faces a significant challenge in the Senate, where Democrats hold a slim majority, it’s a bout of potentially bad news following a bumper year for private equity chieftains such as Blackstone founder Stephen Schwarzman and Apollo’s Leon Black, who took home at least $615m and $225m last year, respectively.

To put it in perspective, Schwarzman made one-fifth more than he earned the previous year running the world’s largest private equity group, while Black brought home slightly more than the amount he has pledged to donate to causes that “protect and empower women†following revelations of his professional ties to the late sex offender Jeffrey Epstein.

That happened even though the private capital industry grappled with huge paper losses earlier in the pandemic as dealmaking and credit markets went on hiatus.Â

So how did private equity executives, whose salaries alone are typically modest by the standards of public companies, manage to pull in so much dough last year?Â

In part, it’s a weapon called “carried interestâ€, which grants them part of the profits on successful investments. On top of that, there are sizeable dividends for significant shareholders such as Schwarzman and Black.

On that front, they had a little help from the Federal Reserve, whose unprecedented stimulus programme helped shares in Blackstone, Apollo and KKR nearly double from their March lows.

One of the leading advocates of that aggressive Fed action was Apollo’s soon-to-be chief executive Marc Rowan, who lobbied Jared Kushner over an expansion of the Fed’s purchases of securitised debt.

Foreign buyers zero in on the UK

As the UK left the EU at the end of last year, many of the UK’s best-known companies were hatching Brexits of their own.

Nearly two months after Brexit, the value of British businesses sold to overseas buyers is the highest on record for that period, at close to £20bn, according to Refinitiv.Â

Among the more recent targets was GW Pharmaceuticals, a British pioneer in cannabis-based medicines that was acquired by US group Jazz Pharmaceuticals for $7.2bn.

“UK plc is on sale,†said Richard Bernstein, who runs fund manager Crystal Amber, adding that investors were failing to properly value British industrial companies, leaving them as prime pickings for opportunistic bids.

The influx of deals comes as the private equity groups behind many of them have found themselves equipped with record cash, left over from the slower pace of acquisitions in the early days of the Covid crisis.

Take TDR Capital, that arranged with the billionaire Issa brothers to pay just £780m of their own money to take a majority stake in Asda, a supermarket group valued at £6.8bn. DD’s Kaye Wiggins and Rob Smith break down the deal here.

US buyout group Warburg Pincus is similarly looking to the UK with its planned takeover of UK security company G4S by its US rival Allied Universal, in which Warburg owns a stake. That follows a deal to buy UK motor group AA alongside TowerBrook Capital Partners in November.

But some investors warn UK companies not to get suckered by the flood of deals before they reach their true value. “We do have good tech [companies] but they tend to be taken out before they can reach their potential,†said Trevor Green, head of institutional funds at Aviva.

Job moves

-

Goldman Sachs’ general counsel Karen Seymour is departing the bank. Kathy Ruemmler, Goldman’s current head of regulatory affairs and White House counsel during the Obama administration, will take over the top job. More here from Bloomberg.

-

Separately, Goldman research analyst Heath Terry has joined billionaire investor Dan Loeb’s Third Point Ventures as a managing director. More here from Reuters.

-

Simpson Thacher & Bartlett has hired Geoffrey Bailhache as a partner. He will join the firm’s London office from Blackstone, where he is a managing director and general counsel for Europe, the Middle East and Africa.

-

Jones Day has hired Brian Rabbitt, who previously served in senior roles at the US justice department and SEC, as a partner in its Washington, DC office.

-

Global Counsel has appointed former parliament member and Asda chief executive Archie Norman as a non-executive vice-chairman. He also serves as the chairman of Marks and Spencer, chairman of Signal AI, and adviser to Lazard & Co and Coles Group.

Smart reads

The art of the deal NFT art — digital masterpieces backed by blockchain technology — enables artists to protect their intellectual property, guaranteeing their works are unforgeable. Bullish collectors can’t get enough. (BBG)

End of an era The golden years of “liquidity premiums†are winding to a close as the pandemic takes aim at companies’ valuations, writes Freshfields partner Ethan Klingsberg. Expect a mob of activists knocking on their doors any day now. (FT)

News round-upÂ

Wall Street broker BGC Partners takes legal action over alleged $35m theft (FT)Â

Merck to manufacture Johnson & Johnson vaccine (FT)Â

Hertz receives $4.2bn rescue offer in effort to exit bankruptcy (FT)Â

Jack Ma’s Ant defies pressure from Beijing to share more customer data (FT)

UK engineer Renishaw put up for sale (FT + Lex)

Rainmaker Moelis joins exclusive club With Spac triple play (BBG)

Ant Group boss tries to quell employee discontent with promise of eventual IPO (WSJ)Â

Instacart valued at $39bn in funding round ahead of IPO (FT)

Spac led by tech founders targets Europe’s unicorns for US listings (FT)

[ad_2]

Source link