[ad_1]

Having traded commodities since the 1990s, Bill Reed was starting to worry he had seen it all and that things would start to get a “little bit boringâ€. But that was before governments, consumers and banks started to throw their weight behind the energy transition.

“I’ve not been this optimistic about our industry . . . in a very long time,†the chief executive of Castleton Commodities International told the Financial Times. “One thing for sure is that the next 15 to 30 years isn’t going to look anything like the past 15 to 30.â€

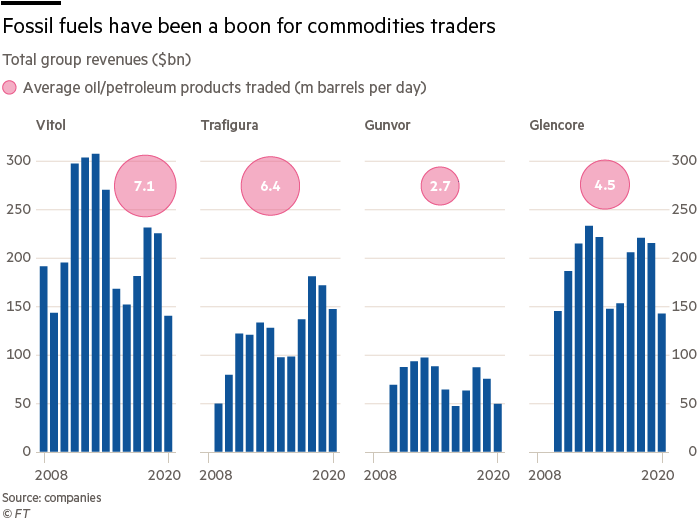

Fossil fuels, particularly oil, have provided bumper rewards for commodity traders that have navigated the extreme market volatility of the pandemic. But the sector now sees the shift away from hydrocarbons not as a threat but an opportunity for profit, as it looks to help manage the world’s move to cleaner forms of energy.

Market leaders are already sinking cash into renewable power and looking to bulk up in fast-growing markets such as carbon trading, while continuing to invest in oil projects in the expectation that a supply gap will emerge over the next decade.

The rush to play a bigger role in solar, wind and hydrogen is not without its risks. These are fiercely competitive markets with much lower returns than in oil trading. The dual-track strategy of investing both in clean energy and fossil fuels also leaves companies vulnerable to accusations of greenwashing by activists that are exerting ever-growing influence on the corporate world.

But according to JF Lambert, a consultant and former trade finance banker, “the big oil traders are making so much money at the moment they can afford to make some mistakesâ€.

For Jeremy Weir, executive chair of Trafigura, there is no contradiction in a dual-track approach because the switch to clean fuels and electrification cannot happen overnight. “We can’t turn off the lights,†he told the FT Commodities Global Summit last week.

Trafigura has announced plans to build or buy 2 gigawatts of solar, wind and power storage projects through a joint venture. It expects to invest roughly $2bn by 2025, with power and renewables set to become a “very strong third pillar†of its business, according to Weir.

“I think it could be a significant profit contributor to our company,†he said. “Within five years and definitely 10 years.â€

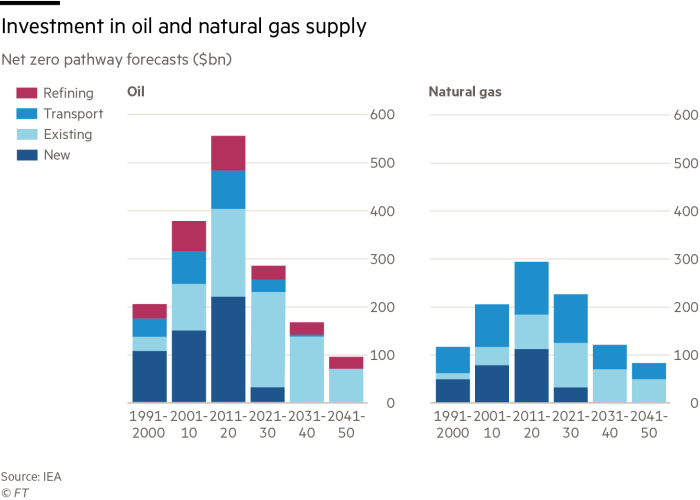

At the same time as building its renewables and power unit, Trafigura is spending €7.3bn to acquire a 10 per cent stake in Vostok Oil, a gargantuan project in the Russian Arctic backed by President Vladimir Putin.

“This oil will be needed for the energy transition,†Weir said. In return for its investment in Vostok, Trafigura will gain access to cheap barrels of Russian crude to push through its huge trading business.

Vitol, the world’s biggest independent oil trader, is also invested in the Arctic project, announcing a deal this month to take a 5 per cent Vostok stake.

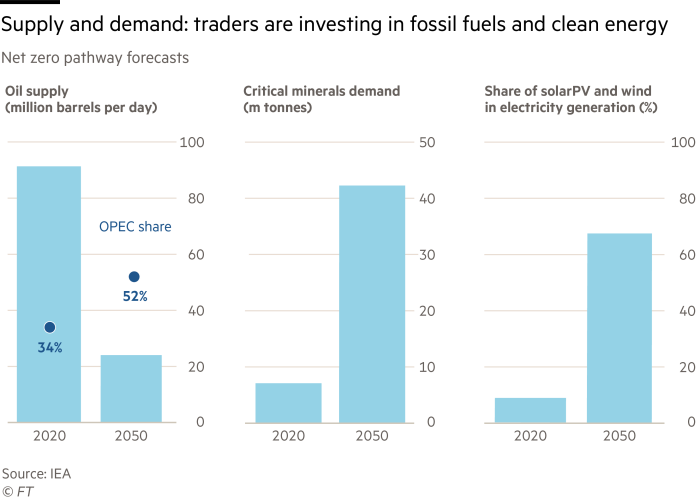

Russell Hardy, chief executive, expects oil demand to recover to its pre-pandemic level of 100m barrels a day next year, rising to 105m-110m b/d before it peaks in 2030.

“There is going to be a gap between 2025 and 2035 in terms of oil production compared to demand and therefore we do feel we can invest some capital in that space,†said Hardy at the FT summit.

Vitol has also spent $1bn this year on US shale assets. Jeff Dellapina, chief financial officer, sees a role for commodity traders in financing upstream oil production as energy majors and banks pull back and leave a funding gap. “It will help but not fill the hole,†he said.

Hardy insists that Vitol’s focus will be on energy transition projects, in particular renewable energy where it has already committed $1bn in capital. He also expects power trading to become a “core competency†for the company because of the need to understand how electricity markets work in a decarbonising world.

“They are more complex in the way they price compared to oil markets because they’re very local,†he said.

Geneva-based Gunvor is another big trader looking to bulk up in power trading but it will also keep trading oil, for which it expects strong demand for the next 10 years, as well as cleaner-burning natural gas which it sees as a big transition fuel.

“Coal is the backbone of power generation, and in different parts of the world its use is actually increasing,†Torbjörn Törnqvist, Gunvor chief executive and co-founder, told the FT summit. “The nearest replacement is natural gas.â€

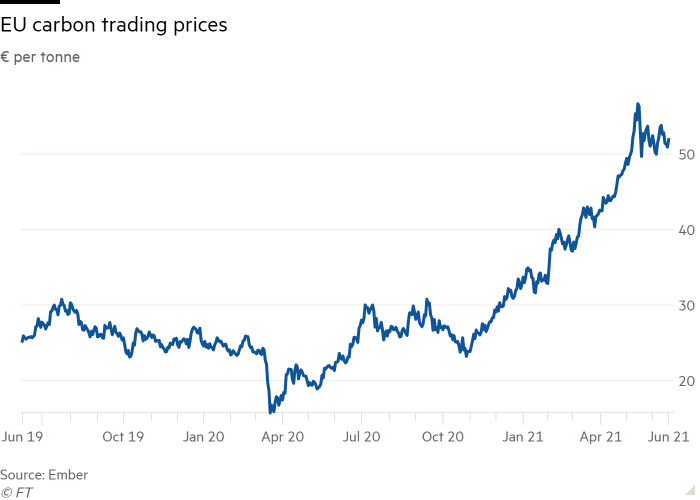

Carbon trading, meanwhile, is capturing the attention of the industry as governments consider mechanisms to price harmful greenhouse gases.

“A lot of counterparties are high emitters,†said Marco Dunand, co-founder of Mercuria, which is to direct half its investments into energy transition projects. “And all of them are looking for a solution to reduce their carbon emissions.â€

“There is great business potential there,†added Alex Sanna, head of oil and gas marketing at Glencore. “Carbon markets will have exponential growth.â€

However, it is unclear whether these new markets can ever be as profitable as oil, which helped Gunvor, Trafigura, Vitol and Glencore to record profits last year.

Trafigura’s power and renewables unit, which includes carbon, lost money in the six months to March, although it is expected to be profitable in the second half of the company’s financial year.

“When you are trading electrons you are trading them every second. There are no warehouses, or tanks . . . where you can store electrons. There are no ships,†said Laurent Segalen, a clean-energy investment banker and founder of advisory group Megawatt-X. “So I don’t see the type of profit in power trading as in oil and gas trading.â€

Nigel Scott, global head of structured trade and commodity finance at Sumitomo Mitsui Banking Corporation, believes the challenge for the commodity traders and the new entities they are setting up is that they are “going into lower-margin space . . . and it is more of utility-type businessâ€.

But as peak oil demand looms on the horizon, and lenders grow more nervous about fossil fuel lending, commodity traders may have no option but to evolve.

“This is a big step in the unknown for most oil traders,†said Lambert. “But the ‘Tina’ concept applies: there is no alternative. â€

[ad_2]

Source link