[ad_1]

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance from the Financial Times. Want to receive DD in your inbox? Sign up here. Get in touch with us anytime: Due.Diligence@ft.com.

The latest pandemic travel trend

In February, Mark Machin, head of the Canada Pension Plan Investment Board, took a break from running the country’s largest pension fund and the blistering Ontario winter to enjoy a holiday in the United Arab Emirates.

The country provides an oceanside oasis to tourists that can prove they’re Covid-free, after all. But as it turns out, Machin arrived for more than just some rest and relaxation — he was chasing the elusive Covid-19 jab, which has hit extensive delays in his home country.Â

And he succeeded, though it’s unclear how Machin, a British citizen, obtained a vaccine meant only for Emirati residents. His resignation came shortly afterwards.

Machin is not alone. Earlier this year, tycoons, politicians and royalty descended upon the UAE, where well-connected friends can secure them access to the vaccine.

As of now, only senior officials and royals can secure exemptions for non-residents, insiders told the Financial Times. Locally this is referred to as “vaccine wastaâ€, aka using one’s clout to procure a jab.Â

Acquirers of such wasta include British financier Ben Goldsmith, SoftBank executives — including Vision Fund head Rajeev Misra — and Claudio Descalzi, the chief of Italian energy company Eni.Â

“It was never our intention to get vaccinated, but when the opportunity presented itself we gratefully took it,†Goldsmith told the FT. “The UAE is vaccinating anyone who asks for it — we just happened to be in the right place at the right time.†Only UAE residents are routinely eligible for the vaccine.Â

Others described a more thoroughly planned-out vaccination experience to the FT. Wealthy vaccine tourists often arrive in private jets, said one businessperson who made the trip.

Meanwhile, wealthy foreigners from India, Pakistan, Lebanon and elsewhere have legally opened offshore companies to apply for residency and receive a vaccine, said a financial adviser.

But for those who don’t have the means to throw together a shell company at the last minute, here are some tips on how to get vaccinated.Â

Bad news for wealthy Brits looking to take a quick vaccine trip: the UAE in recent weeks was placed on the UK’s travel red list, meaning visitors will have to spend time in an airport hotel upon their return — not nearly as enticing for UK citizens.

Hakluyt doesn’t want to be the 007 of advisory groups any more

Secrecy is practically built into Hakluyt’s DNA.Â

The London-based private intelligence group, founded by a band of MI6 officers, has spent the past 25 years cultivating an enigmatic air of “what exactly is it that they do?â€, which seemed to be the point.

Stroll by its discreet Mayfair townhouse, and nothing appears too out of the ordinary. Except perhaps the Gurkha security guards that have been reported to linger outside.

Hakluyt is typical of a “this-tape-will-self-destruct-in-five-seconds†approach that clients “lap upâ€, an investigator at a rival company once told the FT’s Tom Burgis.

At 34, Chandra entered the top job as one of the few minorities at the group. “I’m brown, I didn’t go to one of those schools . . . so even me being in this role is indicative that this place doesn’t care [about candidates’ background],†he told the FT.Â

The group, which is 85 per cent male, doesn’t currently have any specific targets for ethnic diversity but says it aims to interview as many women as men for open roles. (Although DD has heard these efforts haven’t extended very far past the C-suite.)

Hakluyt’s ranks include ex-lawyers, ex-bankers, and even some ex-FT journalists. Former UK Treasury official Dan Rosenfield was a Hakluyt consultant before becoming Prime Minister Boris Johnson’s chief of staff last year. And, naturally, there are still a few former intelligence officials in the mix. But only seven.

Under Chandra, Hakluyt has updated its single-page website to something slightly more robust, and, he says he can’t think of any clients the company should’ve been “embarrassed†to work with in the seven years that he has been there.

And things like snooping on an NGO are no longer characteristic of the new Hakluyt, for example. (In 2001 The Sunday Times reported it had used a German-born agent to spy on Greenpeace.)Â

And the cyber security assignments that have recently landed other private intelligence groups in hot water simply aren’t a “Hakluyt-shaped problemâ€, says Chandra. But what is?

Hakluyt’s international advisory board provides some clues into its enigmatic client list — counting veterans of Unilever, Coca-Cola, Rolls-Royce, Tata and UK Intelligence hub GCHQ.

And now that the advisory has opened its Silicon Valley office, there’s no doubt it is looking to shake hands in Big Tech.

Is Tiger Global buying the Valley?

DD readers might not be able to pick out Tiger Global Management founder Chase Coleman from a crowd of financial titans.

But Silicon Valley insiders have certainly taken note of the $50bn group’s torrid pace of investment this year.

In January and February, the fund invested in one start-up about every two days, nearly doubling its pace of investment from the same period last year.

Coatue Management, a frequent co-investor with Tiger Global, has also upped its pace by about half.

Venture capitalists told DD’s Miles Kruppa that both companies are leading a flurry of dealmaking that has helped push already toppy Silicon Valley valuations even higher.

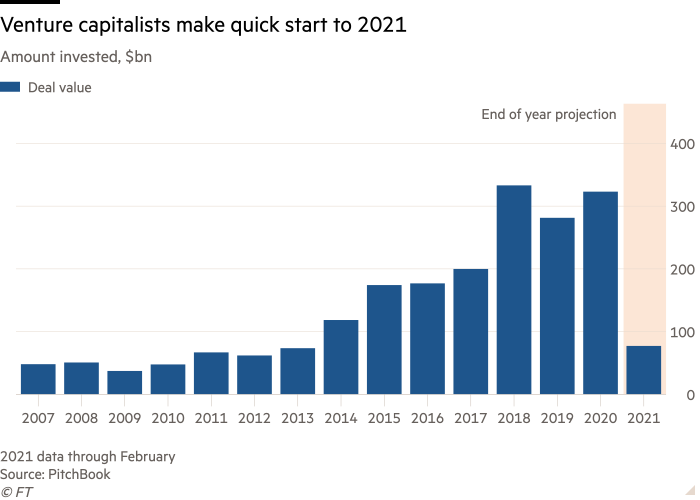

Investors were on track through to the end of February to plough more than $460bn into start-ups this year, according to PitchBook data. That would easily set a new high in PitchBook’s record books, though the data doesn’t go as far back as the 2000 dotcom bubble.Â

“There’s a tremendous amount of competition,†Arun Mathew, a partner at the venture capital group Accel, told DD. “There’s just so much capital in the market at all stages.â€

One venture capitalist said that more active groups had resorted to preparing short slide decks, rather than fully-fledged investment memos, to underwrite their positions.

Investors don’t seem ready to call a bubble in venture capital, at least compared to the scepticism brewing over blank-cheque companies, which have given billion-dollar valuations to moonshot ideas that had been rejected by more traditional backers.

But it seems fair to say that, these days, the “fear of missing out†is driving venture dealmaking just as much as risk-return calculations.

Job moves

-

Perella Weinberg Partners has hired Marie-Soazic Geffroy as a partner in its advisory business in London. She will join this summer from Morgan Stanley, where she was a managing director and vice-chairman.

-

Nomura Asset Management chief executive Junko Nakagawa has been nominated to replace the only woman on the Bank of Japan’s board, former banker Takako Masai, whose term will end in June.

Smart readsÂ

Gutting Goldman Two years into David Solomon’s tenure as Goldman Sachs chief, an unusually high number of executives have left or are planning to do so. Insiders say it’s not a coincidence. (NYT)

Failing firewalls The past few months have delivered consecutive blows to Microsoft’s security mechanisms, from the sprawling SolarWinds breach to the Chinese state-sponsored Hafnium hack. The software group has some cleaning up to do. (FT)

Founding fathers David Nussbaum and David Miller received little more than the side-eye from bankers when they first invented the special purpose acquisition vehicle, a shortcut for companies to enter the public market, almost three decades ago. Now they’re the billionaires behind a Wall Street revolution. (WSJ)

News round-up

Sanjeev Gupta’s metals businesses miss UK tax payments (FT)

Australia’s IAG denies exposure to Greensill after share plunge (FT)

China M&A surges on Covid recovery as focus shifts inwards (FT)

CVC Capital Partners is said to near $2.6 billion deal for Pharma firm Cooper (BBG)Â

SoftBank-backed Coupang boosts IPO price, aims for $58 billion valuation (Reuters)Â

Cerved/financial data M&A: joining the Ionisphere (Lex)Â

Vodafone to raise €2.8bn via Vantage tower IPO (FT)

[ad_2]

Source link