[ad_1]

Bond investors are bewildered after last week’s stellar US economic data sparked a rally in haven US Treasuries — a market reaction that breaks the typical dynamic for fund managers.

Generally, highly rated government bonds love bad news. But last Thursday, a price rally pushed the yield on the benchmark 10-year note to its largest daily drop in months. The apparent trigger: data showing the biggest monthly jump in retail sales in 10 years and mounting evidence the labour market and economic activity is bouncing back quickly.

Mike Riddell, a portfolio manager at Allianz Global Investors, described the market move as “bonkersâ€. In the aftermath, investors are unusually unsure how the $21tn US government bond market will respond to any further good economic news.

“The global reflation narrative is in the price,†he said. “We’re at a temporary equilibrium where the market has decided that we’re priced correctly, and people are testing the upside and downside.â€

At the start of this year, typical patterns prevailed as brighter economic data hurt the bond market in the so-called reflation trade. Expectations for rising inflation drove the worst performance for long-dated Treasuries since 1980 in the first quarter. Now, that reliable dynamic appears to be cracking.

“We’re spending so much time talking about what the hell is happening,†said Richard McGuire, head of rates strategy for Rabobank. “That in itself is the point. There is so much uncertainty out there.â€

One contributing factor here is the overly large scale of the bets against bonds that investors have already placed, strategists say.

The reflation trade has become crowded as the “obvious†post-pandemic play, according to Derek Halpenny, head of research for global markets at MUFG.

Data compiled by the Commodity Futures Trading Commission show that some hedge funds added to their negative bets on bonds for the week ending Wednesday.

“The rally in rates on Thursday may have been partly driven by fast money unwinding of shorts,†wrote analysts at TD Securities in a recent note.

Subadra Rajappa, head of US rates strategy at Société Générale, said hedging-related activity linked to an uptick in debt raising by big banks — with Bank of America, JPMorgan and Goldman Sachs all issuing billions of bonds last week — also contributed to the move.

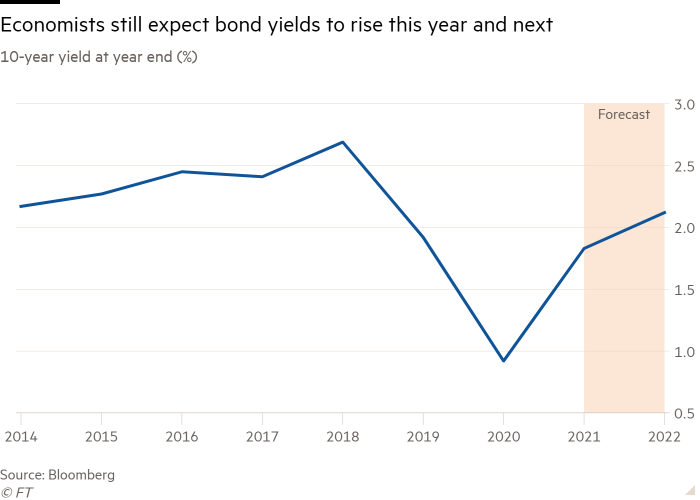

Despite the recent pullback in yields, rate forecasts make clear that any reprieve in the Treasury sell-off is expected to be brief. Analysts are targeting the benchmark bond yield to hover closer to 2 per cent by the end of the year, according to Bloomberg.

“In a bear market you can get sharp bull market rallies, and I would characterise this as one of those,†said Tim Magnusson, senior portfolio manager at Garda Capital Partners. “If you fast forward a few months down the road, you will see higher Treasury yields than we have today.â€

The persistence of the rally hinges in large part on foreign investors, particularly in Japan, market participants say. Ian Lyngen, an analyst at BMO Capital Markets, said bursts of buying could be attributed to a “bid from Tokyoâ€.

“The inclination of Japanese investors to push the next leg of rally promises to be a defining characteristic of the price action over the coming weeks, and we will be especially intrigued to see how willing this critical participant in the US rates market was to add Treasuries,†he said.

Heightened foreign demand has already helped to alleviate some concern about the Treasury department’s massive upcoming auctions. After much anxiety at the start of the month, two large sales of new debt went smoothly last week. Another test comes on Wednesday, with a $24bn auction of 20-year debt.

Any sign that inflationary pressures expected this year will be more pronounced and prolonged than investors and the Federal Reserve anticipate could deliver the next blow to bond prices.

The US central bank has primed the market for elevated inflation prints in the coming months, but has assured investors the rise will be “transitory†and that it plans to keep monetary policy ultra-accommodative for the foreseeable future. Market measures of inflation expectations indicate that investors largely buy into the first view, but with creeping concerns the Fed may be forced to adjust its stance sooner than forecast.

“If the economic data is extremely strong over the next several months you could see the Fed change their tune,†said Mark Kiesel, chief investment officer for global credit at Pimco. “Let’s say the US economic recovery . . . is so strong, the vaccines are successful and this creates significant momentum in the overall global economy that you actually do start to build in more inflation risk premium and the Fed has to start preparing the market for a taper.â€Â

Eurodollar futures, a closely tracked measure of interest rate expectations, indicate the Fed will initiate lift-off by the end of 2022 — years earlier than what officials have suggested.

Even if this timing does not bear out exactly, Treasuries look unsustainable at these levels, said David Kelly, chief global strategist at JPMorgan Asset Management.

“Ultimately the economy that is going to exist in a year’s time is not one that can support 10-year Treasury yields below 2 per cent,†he said.

Additional reporting by Eric Platt in New York

[ad_2]

Source link