[ad_1]

The US economy created 379,000 jobs in February, pointing to a sharp rebound in the country’s labour market amid a rapid decline in coronavirus cases nationwide.

The increase in employment last month was more than double its pace in January, when the economy created 166,000 jobs after shedding 306,000 positions during the pandemic’s winter surge in December.

The jobs report initially rekindled a sell-off in US government debt, with the yield on the 10-year Treasury bond climbing 0.05 percentage points to 1.62 per cent — its highest since February 2020. The sell-off later subsided and the yield, which moves inversely to the price, slipped back to 1.56 per cent.

The early-morning sell off had extended losses that racked up on Thursday after Federal Reserve chairman Jay Powell failed to quell concerns about the rise in yields in recent weeks.

Treasuries came under extreme pressure last week, as investors positioned for higher inflation and the potential for the Fed to tighten its ultra-easy monetary policy earlier than expected.

The tumult in the US government bond market has also cascaded into Wall Street stocks. The Nasdaq Composite fell as much as 2.6 per cent on Friday, before sharply trimming its losses and turning positive.

Still, the tech-heavy index has fallen about 8 per cent over the past two weeks. Tesla, which has been among the highest-profile winners of the market’s rebound from the lows hit last March, fell 4 per cent in afternoon trading on Friday and has tumbled a third from its January peak.

Other once high-flying tech shares have also pulled back as investors shift towards companies they expect will benefit from a broad economic recovery such as banks.

Many economists have recently upgraded their outlook for growth in 2021 on expectations of a swift vaccination rollout and the implementation of president Joe Biden’s $1.9tn stimulus plan.

But Powell sparked the US Treasuries sell-off on Thursday after he said that the US central bank was unlikely to act in response to any temporary jump in inflation or rise in debt yields caused by the economic improvement.

“The broader message that [Powell] gave is one that ultimately should be supportive of the bond market because he made the case that it is going to take a while for the economy to fully recover,†said Stephen Stanley, chief economist at Amherst Pierpont.

Stanley added Powell was “adamant†that inflation would remain in check and underscored the Fed’s patience before adjusting its policy.

“The question is whether the Fed retains full credibility through this period,†Stanley said. “It’s been a long time since we’ve seen the market lose faith in the Fed, but it seems like we are getting a whiff of that.â€

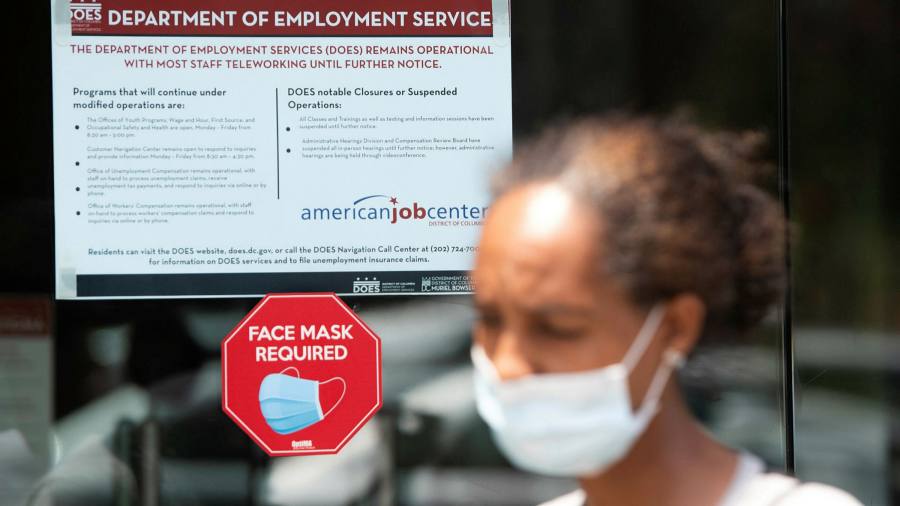

The labour market is one of the weakest spots of the US recovery, after millions of service-sector jobs were shed during the pandemic.

After the dramatic hit suffered in March and April of last year, Americans went back to work in large numbers over the summer, but that progress stalled over the winter months.

February’s job creation was not sufficient to make up for 523,000 net lay-offs during the previous two months.

While the manufacturing sector created 21,000 jobs, construction lost 61,000 positions as unusually cold weather hit many parts of the country. Government also lost 86,000 jobs over the course of last month.

The leisure and hospitality sector recorded an increase of 355,000 jobs, which accounted for the bulk of last month’s gains.

However, it still leaves the world’s largest economy 9.5m jobs short of its pre-pandemic levels. The US unemployment rate edged down to 6.2 per cent.

Economists said the overall figures pointed to further improvements in the coming months.

“You are getting the first benefit of some states loosening up a little bit,†said Stanley. “February is really just a downpayment on what should be much larger gains in the subsequent quarters.â€

US policymakers, from the Federal Reserve to the Biden administration, have lost faith in the unemployment rate as an indicator of the strength of the jobs market because it does not capture those who have stopped looking for work during the pandemic.

[ad_2]

Source link