[ad_1]

Vanguard is betting that demand for financial advice will explode over the next decade, as the world’s second-largest asset manager steps up its push into the fragmented market.

The Pennsylvania-based group is opening an office next year in Dallas, which is regarded as having an attractive pool of potential clients to tap as well as investment advisers to recruit.

Since taking over in 2018, chief executive Tim Buckley has made the business of financial advice, including how to build up retirement savings and when to draw down on them, a focus for Vanguard.

The group has aggressively cut mutual fund fees in recent decades, a strategy it intends to replicate with financial advice. Vanguard also expects that technological advances, such as automated digital services, will cut the cost of providing advice and increase the size of the market.

Investment advisers registered with the Securities and Exchange Commission oversaw $97.2tn on behalf of 42m clients at the end of 2020.

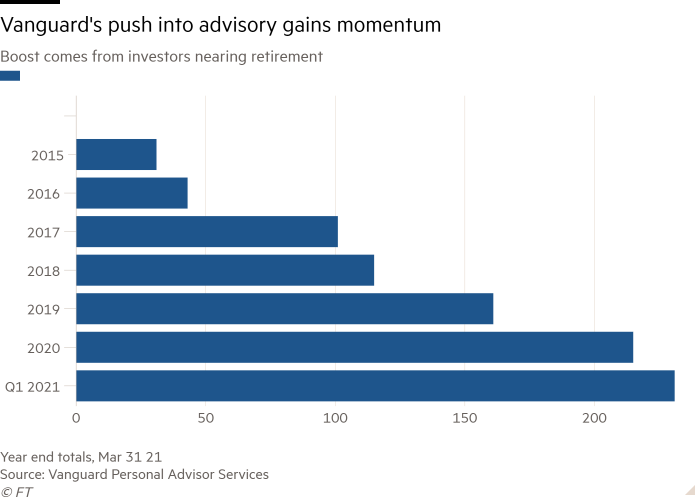

“Growth is accelerating and this year it is nearly double what we saw at the same time last year,†Jon Cleborne, head of Vanguard Personal Advisor Services, told the Financial Times. “Advice is really in the early innings, the need will keep growing as baby boomers retire and millennials face new challenges in their objective of saving for the long term.â€

Launched in 2015, VPAS, provides a combination of digital tools and human advice for clients who have at least $50,000 to invest. An annual fee of 0.3 per cent, is less than the industry average of 1.01 per cent according to Vanguard. Last year, the group launched a cheaper, digital-only advisory service aimed at younger clients with a minimum investment of $3,000 required.

Cleborne said that tech investment for the advisory business represented “a very significant capital allocation within the firmâ€, running into “hundreds of millions of dollars†annually.

Vanguard has been under pressure to improve the experience for clients after complaints about online outages and delays in speaking to advisers during volatile markets.

“If you are running money now, you want to be an adviser and there is room to bring low-cost advisory to the market,†said Greggory Warren, financial services sector strategist at Morningstar. “Vanguard in some respects thinks there is enough low-hanging fruit among investors with less than $500,000 in assets.â€Â

Of the clients that seek advisory services, 80 per cent already have a pre-existing relationship with Vanguard. “We still have a long way to go with our existing clients. The advisory pie will get bigger,†Cleborne said.

Opening an office in Dallas will expand the 900 advisers Vanguard already has. “There is a large concentration of certified financial planners in Dallas,†said Cleborne. “We do train advisers and target recent college graduates, but we also think Vanguard is an attractive brand for existing advisers.â€Â

Buckley’s ambitions for the financial advice business extend beyond the US.

In April, Vanguard rolled out a new low-cost retirement advice service for UK investors. Those with a minimum of £50,000 will be able to obtain retirement saving advice from Vanguard for an annual cost of 0.79 per cent, which includes fund fees, transaction and platform charges.

According to the Financial Conduct Authority, less than 10 per cent of adults have taken financial advice. Vanguard has signed up more than 280,000 clients since arriving in the UK in 2009, adding 100,000 new customers this year.Â

The group eventually plans to launch a similar pension advice service in Germany and other European markets.

[ad_2]

Source link