[ad_1]

Venezuela’s stock market throws out dizzying numbers.

Its benchmark index generated a 1,000 per cent return in a pandemic-hit 2020 — but that was wiped out by the country’s rampant inflation, which ran at an annual rate of about 4,000 per cent last year.

The exchange ended 2020 with a market capitalisation of 1,270,229,028,210,000 bolÃvars. That amounted to about $1.3bn, compared with the more than $100bn market value of neighbouring Colombia’s bourse.

In his office in Caracas’s Chacao district, the head of the exchange, Gustavo Pulido, points to a screen on which stock prices are quoted. There is no longer room on it to quote prices fully, so they are shown to the nearest thousand.

“Capital markets are absolutely fundamental to Venezuela’s recovery,†Pulido said. “If they’re not involved then it won’t happen.â€

One factor holding back the exchange’s growth is that all share trades must be carried out in bolÃvars. Pulido is pushing for a regulatory shift that will allow the bourse to convert into a multicurrency exchange. He is also talking to his peers at the stock exchange in Chile for advice on incorporating blockchain technology into operations.

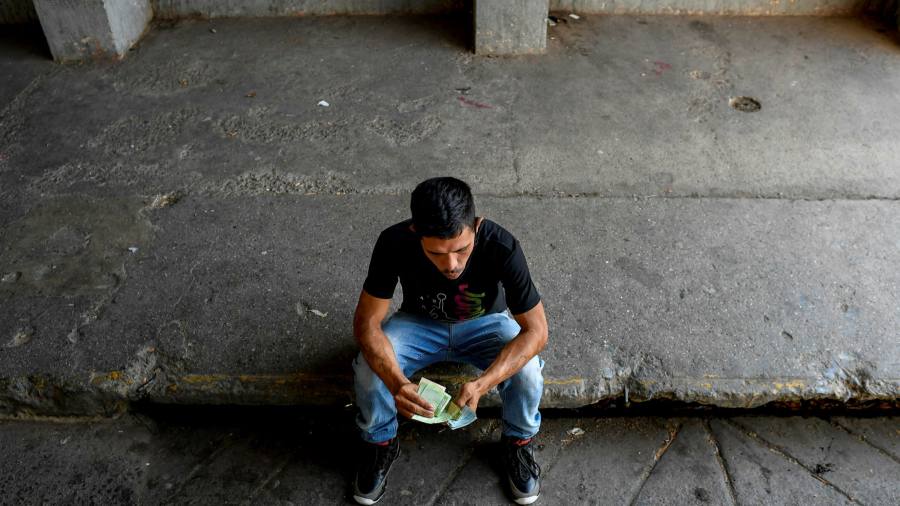

The economic challenge is massive. The country has now been under severe inflation or hyperinflation for 51 consecutive months. Venezuela has been under revolutionary socialist rule for more than two decades, during which time foreign investment has all but disappeared and thousands of companies have gone bust. Gross domestic product has crashed by over 80 per cent in seven years.

“In the same way as the economic crash has been very pronounced, on the day that the economy turns around, the rebound will be strong,†Pulido said.

There are signs of life on the Caracas bourse, which has 27 actively traded companies. The number of shares traded in 2020 was nearly 200 times higher than in 2016. The number of investors has risen fivefold in five years to about 2,500.

Some market-watchers ascribe the latest rise in activity to a government squeeze on the credit market, in a bid to curb inflation. Commercial banks are obliged to keep an eye-watering 93 per cent of their deposits parked with the central bank, leaving them precious little to lend. Hence, companies are starting to turn to the country’s stock and bond markets to raise cash.

Last year, the oldest rum distiller in the country, Ron Santa Teresa, became the first company in 12 years to issue shares in a public offering on the Caracas bourse.

“We wanted to send a signal that capital markets are still alive,†Santa Teresa’s chief executive Alberto Vollmer said. “We’re making the argument that if we can reopen capital markets then we might be able to attract foreign investment back to Venezuela.â€

It went on to break new ground by becoming the first company since the 1990s to issue dollar-denominated bonds, after a rule change last year allowing exporters to do so. A few more companies are currently planning capital raises, Pulido said.

The Caracas stock exchange has a proud 74-year history. In its heyday in the 1980s and 1990s it was one of the most active in Latin America. In 1990, the general index gained 540 per cent in a single year, at a time when annual inflation was a far more manageable 40 per cent.

[ad_2]

Source link