[ad_1]

Please share this newsletter with friends and colleagues who might find it valuable and let them know that, even if they are not subscribers to the Financial Times, they can read the newsletter — and all of the FT — free for 30 days. Welcome and please sign up here.

Covid cases and vaccinations

Total global cases:Â 161.1m

Total doses given:Â 1.4bn

Get the latest worldwide picture with our vaccine tracker

Latest news

-

US retail sales stalled in April as the effect of government stimulus cheques began to fade

-

Early signs suggest that vaccines are effective against the coronavirus variant first found in India hitting parts of north-west England

-

Scientists have urged a fresh investigation into the pandemic’s origin, including claims that the virus may have escaped from a Wuhan laboratory

For up-to-the-minute coronavirus updates, visit our live blog

Fears of a summer of inflation intensified this week as the US consumer price index leapt unexpectedly to 4.2 per cent, spooking already anxious investors who worry that the Federal Reserve will put the brakes on its emergency bond-buying programme.

The increase, the highest jump in the year-on-year figure since 2008, was followed yesterday by a higher than expected increase in US producer prices. Meanwhile, producer prices in China, another closely watched indicator for global investors, rose 6.8 per cent year-on-year in April, its fastest pace of growth in more than three years. In the eurozone, inflation hit 1.6 per cent in April, according to initial estimates, and could get close to 2 per cent later this year.

As our latest Big Read points out, inflation targeting has since the early 1980s been a key aim of central bankers who would increase interest rates as soon as consumer prices looked to be on the up. But in recent times, Fed officials have been at pains to downplay inflation rises as a “transitory surgeâ€.

Similar views have been expressed across the Atlantic. The European Central Bank’s Olli Rehn told the Financial Times this week that the ECB should follow the Fed’s lead by accepting an overshooting of its inflation target to make up for years of listless price growth. Minutes from the bank’s latest policy meeting, released this afternoon, said eurozone growth and inflation were more likely to surprise on the upside, suggesting the future of its bond-buying programme could be on the agenda at its next session in four weeks’ time.

As the FT Editorial Board points out, low inflation cannot be taken for granted. But the almost comical reaction to the idea that interest rates and inflation might have to rise at some point highlights just how thin-skinned some investors have become and how policymakers need to choose their words very carefully, argues markets editor Katie Martin.

As one investment officer tells her, bears need to end their perpetual fretting that the world is coming to an end: “The reality is that the only question that matters is whether the reopening is going OK or not. And it’s going OK. â€

Global economy

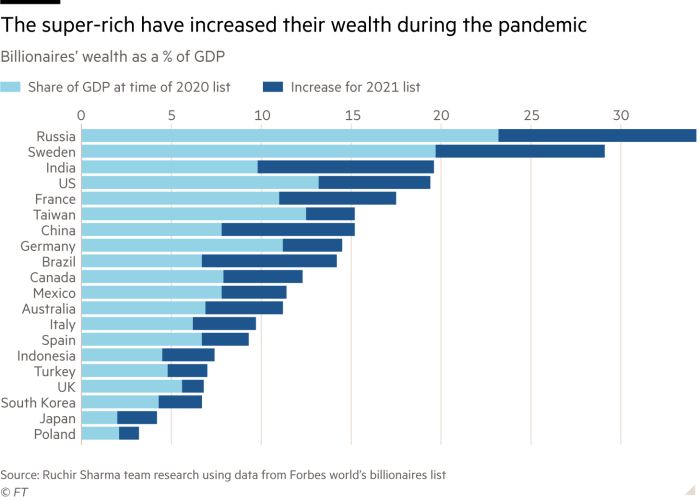

One group that has profited mightily from the pandemic is the global billionaires club. Much of the $9tn in government rescue funds has ended up via financial markets in the hands of the ultra-rich. According to Forbes magazine’s annual rankings, the number of billionaires increased to more than 2,700 over the previous 12 months, with total wealth rising $5tn to $13tn.

New US jobless claims have fallen to a new pandemic low as employers step up hiring as the economic recovery takes hold. Many companies, including McDonald’s and other fast-food chains, are struggling to recruit workers.

Our Big Read discusses the political and economic ramifications of India’s Covid-19 crisis and Prime Minister Narendra Modi’s pandemic management as some experts put the true number of new daily infections at up to 2m and deaths as high as 50,000. Much of the criticism of Modi is coming from the country’s previously supportive urban middle classes.

Business

Amazon’s announcement today of 10,000 new UK hires is the latest sign of ecommerce’s forward march at the expense of bricks and mortar stores. The company’s net sales in the UK jumped 50 per cent last year to $26.5bn. Read our new series on the future of retail.

Apple supplier Foxconn has bounced back strongly after the pandemic lockdowns of its factories in China last year, reporting a 13.5-fold jump in net profit for the first quarter to NT$28.2bn ($1bn).

More than 60m travel and tourism jobs and $4.5tn in income were lost last year because of the pandemic, according to an industry report, meaning the sector’s contribution to global GDP fell to 5.5 per cent from 10.4 per cent in 2019. Airbnb chief Brian Chesky however told the FT the “travel rebound of the century†was on its way, fuelled by a strong recovery in the US holiday market.

Markets

Prices for steel ingredient iron ore, which have rocketed recently on prospects for a global economic recovery, came crashing down today after signs that China was about to crack down on speculative activity. Reports said local government in Tangshan, China’s main steelmaking city, would examine illegal behaviour and suspend production at mills found to be manipulating market prices.

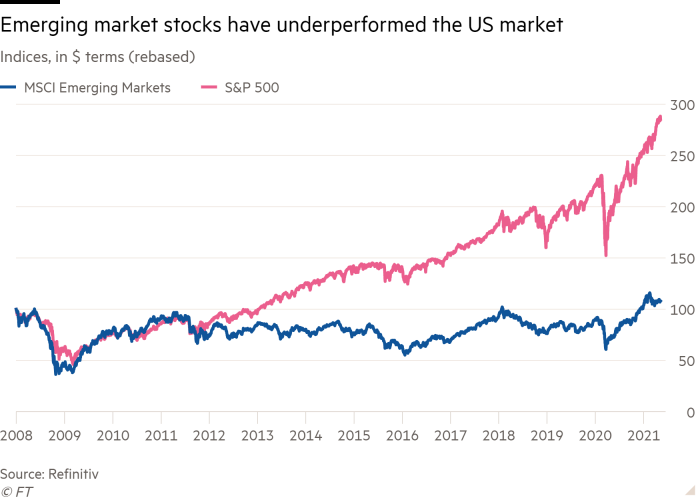

Emerging markets correspondent Jonathan Wheatley looks at prospects for EM investors as the global recovery consolidates, including exchange traded funds and opportunities in China and its fellow “Brics†— Brazil, Russia and India.

Hedge funds involved in merger arbitrage — buying shares in M&A targets and betting against the acquirer, making money as the deal closes — took a pasting during the period of pandemic turmoil dubbed “arbageddonâ€. They are now however hoping to profit from a new surge of M&As as economies reopen: the first quarter of 2021 was the best start to a year’s M&A activity since at least 1980.

Have your say

Chris Wiles comments on Johnson looks at swift easing of homeworking rules in England:

Working in the office isn’t just about getting the job done but it’s also about being ingrained in the company’s culture, values and bouncing those ideas off other people which fuels the innovation and employees’ growth. The reality is businesses need to create office environments that motivate staff to want to work there, some creative alternatives to the old fashioned office style. Maybe the government should offer businesses a subsidy similar to the super tax-deduction for businesses to recreate their office environments. If they do that, it won’t be a case of ordering staff back to work, instead the staff will see the value of being in the office environment created and be more motivated to work there. Both an economic and perhaps innovation bonus would come from it

Final thought

“It’s going to be like New Year’s Eve in Trafalgar Square, but without the smell of Heineken.†UK editor at large Robert Shrimsley has mixed feelings about the return of hugging as social distancing regulations are relaxed and the “great reacquainting†looms.

Recommended newsletters

Editor’s Choice — The FT Editor’s personal selection of favourite stories. Sign up here

City Bulletin — Bryce Elder’s pre-market update and commentary. Sign up here

We would really like to hear from you. Please send your reactions or suggestions to covid@ft.com. Thanks

[ad_2]

Source link