[ad_1]

This article is an on-site version of our Trade Secrets newsletter. Sign up here to get the newsletter sent straight to your inbox every Monday to Thursday

Hello from Washington, where former US Treasury Secretary Larry Summers has warned yet again about inflationary risks, following up his attack on Joe Biden’s fiscal stimulus package with a rebuke of the Federal Reserve for loose monetary policy.

In trade news, we cover the apparent detente between Washington and Brussels over steel and aluminium tariffs. Progress, for sure. But more is needed if Biden is to avoid a collision at the World Trade Organization and more fighting with Europe.

Charted Waters looks at the impact of trade on sustainability.

We want to hear from you. Send any thoughts to trade.secrets@ft.com or email me at aime.williams@ft.com

Will the US go the whole hog and abandon metal tariffs?

Harley-Davidson, the American manufacturer of motorcycles known to devotees as “hogsâ€, recently took to running a newspaper ad campaign against the prospect of an escalating trade war between the US and Europe. “We won’t be pushed out of free and fair trade or give up our freedom to rideâ€, the ad proclaimed, as it railed against impending European tariffs of 56 per cent on its bikes and tried to get consumers to take an interest in transatlantic trade policy (we salute them).

Harley can now breathe a sigh of relief. Its hogs still face steep levies when sent to Europe, but on Monday the European Union said it would not execute its planned escalation (due June 1). This gives Washington and Brussels some breathing room as they try to figure out where to go with the Trump-era Section 232 tariffs on European steel and aluminium, which triggered retaliation from Europe on US goods including clothing and bourbon, as well as motorcycles.

A good sign? Sure. But we’re by no means close to fully resolving what is arguably the thorniest of the several thorny trade problems between the US and Europe.

As a reminder, Trump in 2018 slapped a 25 per cent tariff on steel and a 10 per cent tariff on aluminium from a range of allies, including Europe, Canada and Mexico (those latter ones have since been negotiated away, though former USTR Bob Lighthizer then reapplied the tariff to some Canadian aluminium products).

It’ll be politically tricky for Biden to remove them now (as Europe wants) despite mixed sentiment on them in the US. The powerful US steel industry backs them, as do the less powerful raw aluminium manufacturers. United Steelworkers, the steel workers union, supports them, as does AFL-CIO, the largest federation of US unions, which has 12.5m members. On the other hand, there are plenty of US corporations — mostly those buying steel or aluminium to process into product — who hate the tariffs and blame them for higher prices. Whirlpool and Ford have both recently complained about rising steel costs, while a group of more than 300 businesses manufacturing in the US recently wrote to Biden to plead for relief from the tariffs. The Aluminum Association, which represents the majority of US and foreign companies in the industry — including those that take the input metal and process it into sheet, foil and plate form — are also firmly against them.

In order for a deal to be struck, the US steel industry and other assorted fans of 232 tariffs would need to be assured that removing them would not lead to a flood of imported metal depressing prices. Promising them that Europe will do more to help counter Chinese overcapacity would help, although Brussels already has its own substantial raft of antidumping tariffs on Chinese metal. Clete Willems, a former Trump trade official, says both sides could also do more to work together on the issue of transshipment — whereby steel from countries known to be overproducing dodges tariffs by being processed via a third country. Beefed up monitoring mechanisms and better multilateral communication between US allies would be needed in the first instance. Quotas could also be a lighter option than full-fat tariffs, with a tariff triggered when imports rise above historical norms (usually calculated roughly as the average of the previous three years). Scott Paul, the president of the Alliance for American Manufacturing, said any new arrangement should also include clear enforcement mechanisms.

Biden could also reassure the domestic metals industry that the large multitrillion dollar infrastructure bill, combined with protectionist Buy American principles guiding US government spending, will boost demand for US steel and aluminium. That said, prices are already pretty high, as are prices for steelmaking ingredient iron ore (though they have tumbled over the past week).

But many remain jaded about the long-running problem of global steel and aluminium overcapacity. “The section 232 tariffs have been helpful to the American steel industry and its workers,†said Paul. “One of the limitations has been that it hasn’t directly gotten at this issue of global overcapacity.â€

Washington has another driver, however — it faces the uncomfortable prospect of an embarrassing rebuke from the World Trade Organization. Several countries have challenged the tariffs’ legality, and the US will want to avoid Geneva ruling that levies invoked for national security reasons are unjustified. That would not sit well with WTO sceptics in Washington, who will probably see it as an attack on US sovereignty.

If the Biden administration is at all serious about fixing the WTO, it will need to find a fast way out of its current predicament without upsetting or harming US industry and while securing an agreement from Europe. A stay on escalation by Europe is good news. But we — along with the hogs — will be waiting for more signs of a solution before declaring the trade war over.

Charted waters

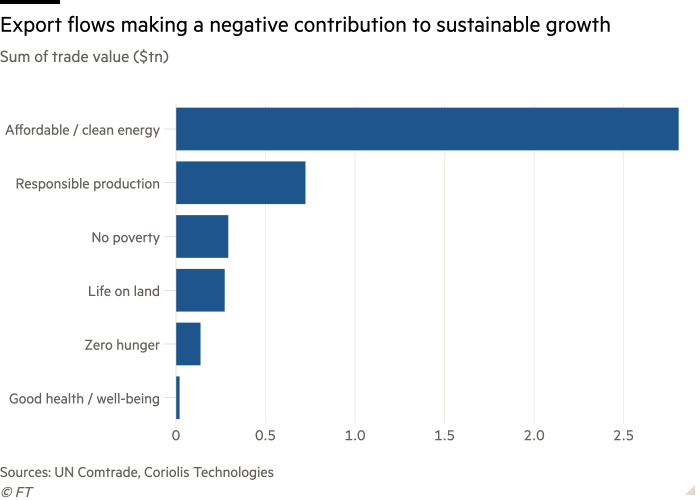

One of the emerging issues in trade (along with pretty much every other sphere of economic policymaking) is how to ensure growth is sustainable. With this in mind, Coriolis Technologies, a producer of data and analytics for trade and trade finance, has come up with a data set that looks at how trade flows contribute (or otherwise) to some of the UN’s 17 sustainable development goals.

The top chart is scaled in billions, the bottom in trillions, with the negative contribution to sustainability from dirty energy far outweighing any positive impact from the greening of power sources. Coriolis uses data on trade flows from UN Comtrade alongside product codes and supply chain research to come up with the index.

“The simple truth is that trade is unsustainable in its current form when you reduce it down to basics like this,†Coriolis’ CEO Rebecca Harding told us. “We will always need to trade, and some of the products that we need to trade will have a negative impact on the world — we just need to work out how we turn simple and obvious facts into simple and obvious solutions. At least let’s start by measuring exactly what we do trade and go from there.†Claire Jones

Trade links

Trade Secrets regulars will have read a lot about EU-China tensions, but less on how the relationship between London and Beijing is developing post Brexit. This is the theme of today’s Big Read, which delves into the difficult balancing act required in reconciling the UK’s new economic, political and security imperatives.

This won’t go down well in DC. One of Taiwan’s few remaining allies, Honduras, has warned it may be forced to switch diplomatic allegiance from Taipei to Beijing to gain access to Chinese coronavirus vaccines.

Nikkei investigates ($, subscription required) the plight of seafarers, some of whom have spent nearly a year without going on land as consumers stuck at home pushed up demand for global shipping and sent freight rates skyrocketing. There’s also a great read that looks at why, despite tensions between Canberra and Beijing, Australia’s iron ore miners are in the throes of the glory days.

For those of you who can’t get enough of the steel tariffs story, we’d recommend this piece from the Wall Street Journal ($) which goes deep on why the policy has largely failed to have their desired impact on jobs and prices.

And finally, the latest edition of Foreign Affairs ($), which focuses on world trade, is well worth a look for those after fresh insights on the big geopolitical questions. Aime Williams and Claire Jones

Any recommendations on articles to include in Trade Links? Send us your tips.

[ad_2]

Source link