[ad_1]

In normal times, car values are a one-way road.Â

The very act of driving off from the dealership wipes a chunk of cash from a vehicle’s value, beginning an unstoppable slide that will carry on until a decade or so later when they are junked as worthless scrap.

Not any more.

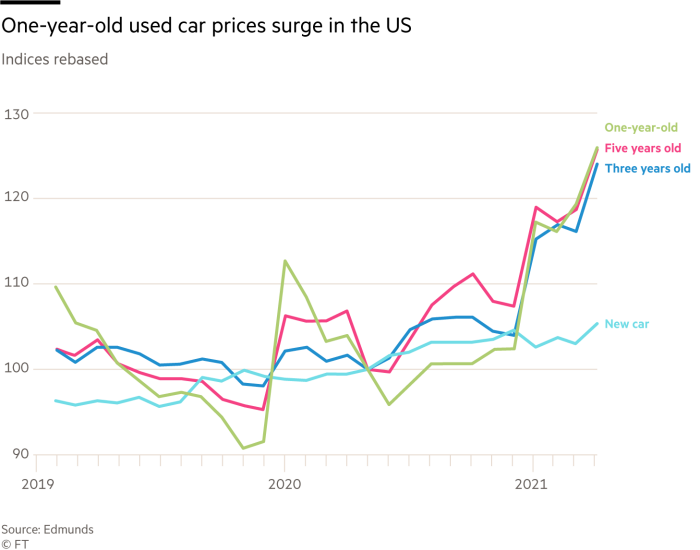

In the topsy-turvy months since the pandemic, used car prices have been steadily rising, caused by a supply and demand imbalance because of the coronavirus crisis and chip shortage.

Before this year, the largest rise ever recorded was 1 per cent in February 2018. In May, they rose by 6.7 per cent, according to data group Cap Hpi, which has tracked live prices since 2012.

“Normally cars depreciate, they don’t go up in value,†said Derren Martin, head of valuations at the data group. “But right now cars are an investment.â€

The rise in prices is being felt across forecourts in the UK, Germany and the US with fears it could add to inflationary pressures in other parts of the economy.

In Germany, used car prices reached an all-time high in April, according to AutoScout24, a leading sales site. The average price during that month was €22,424, more than €800 dearer than at the start of 2021.

In April of 2020, the average price was €20,858, having risen about €200 in a year.

“In the past, due to the season, the price curve usually dropped somewhat at the beginning of the spring and summer months,†said the company, which has about 2m cars on its site.

The reason for the turnround is “likely to be a predominantly scarce supply,†it added, “but the increasing popularity of luxury cars and classic cars is also causing average prices to rise relatively sharply.â€

In the UK, a one-year-old Audi A3 is today worth £1,300 more than the equivalent model a year ago, a rise of 7 per cent, while Mazda MX5 sports cars have risen by 50 per cent.

“I’ve been doing this for 28 years, and I’ve only ever seen this happen twice,†said Daksh Gupta, chief executive of UK retailer Marshall Motors.

The other time was after the 2008 financial crash, when prices rose in 2009 as demand recovered faster than the industry could keep up.

This time, there are two main factors at play.

Demand for vehicles has surged since late last year, as consumers with money saved by working from home and cancelling foreign holidays splash out.

Sports cars and convertibles have fared particularly strongly, but there have been rises in every category, with many motorists still keen to avoid public transport.

A survey in Germany by Deutsche Automobil Treuhand, which gathers data on behalf of industry bodies, found a third of used car buyers were buying a second vehicle to help others in their household avoid public transport.

“This is the highest level of used car demand I’ve ever seen,†said Robert Forrester, chief executive of Vertu Motors.

Visits to Auto Trader, an online car marketplace that specialises in used models, are 39 per cent higher than in 2019 before the pandemic hit.

“Everyone thought it was pent up demand that would fall away, but it has been sustained,†said Ian Plummer, Auto Trader’s commercial director.

But the real squeeze comes from supply.

Chip shortages caused by the pandemic have been exacerbated by storms in Texas and a fire at a Renesas plant in Japan, one of the world’s leading semiconductor makers.

This has left the industry millions of vehicles short, with little hope of making up lost volumes until next year.

At the same time, stocks are low as few motorists are trading new models and rental car groups are not offloading motors.Â

Dealerships are also making more money.

“If they have enough cars, dealers are in a sweet spot at the moment,†said Mark Lavery, chief executive at Cambria. “Demand is bonkers.â€

But eventually the supply of newish cars will run out.

“New car buyers can fathom a one to two-year-old vehicle, but any older and they scoff at it,†said Ivan Drury, head of used vehicles at US data group Edmunds.

The supply and demand imbalance will also get worse before it gets better. Only a resolution of the chip crisis, and the return to normal production levels will stem the tide.

“When is this over?†said Auto Trader’s Plummer. “It all depends on the balance of supply and demand, and how long we remain as keen on cars as we are right now. It’s clearly months, but whether it’s years, we just can’t tell yet.â€

[ad_2]

Source link