[ad_1]

Agricultural commodities are at the start of a “mini-supercycle†with prices expected to be boosted for several years by demand from China and for biofuels, according to some of the world’s top traders.

Executives from Cargill, Cofco, Viterra and Scoular said this week that the markets for corn, soyabeans and wheat will remain strong over the next two to four years.

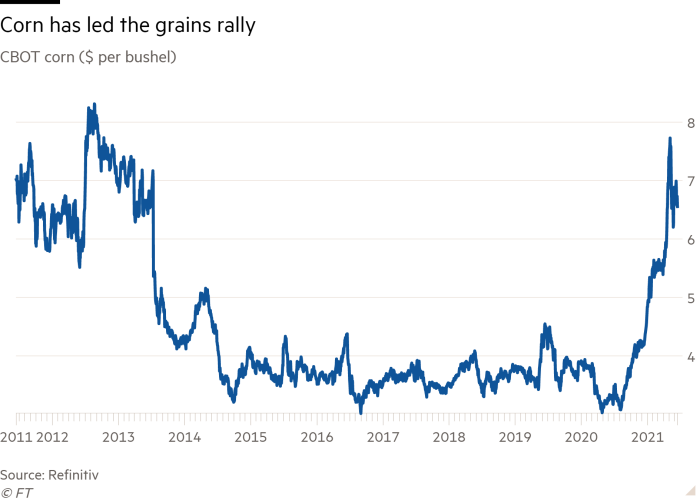

Prices have fallen back from their multiyear highs over the past few weeks as the US dollar has risen and rain is forecast for the US midwest, but corn futures prices are double compared to a year ago at $3.29 a bushel, soyabeans at $14.31 are 65 per cent higher, and wheat is almost a third higher at $6.54.

“We’re certainly seeing a mini supercycle,†said David Mattiske, chief executive of Viterra, majority owned by Glencore, told the FT Commodities Global Summit. “We’re in a demand driven environment with the themes of growing population, growing wealth, people consuming more. And added into that we’ve got increased demand for plant based fuel.â€

Sustained higher prices will be a boon for farmers who have felt the financial strain of several years of stagnant crop prices. However, it will mean higher food costs for grain and oilseed importers, especially poorer countries struggling with the economic effects of the pandemic as well as rising food prices.

Grains and soyabean markets saw a big boost in the second half of last year after governments and companies rushed to stockpile during the pandemic. China, which had a poor corn harvest, made large purchases, importing a record 11.3m tonnes last year, with more than a third of the total coming from the US.

According to Alex Sanfeliu, head of Cargill’s world trading unit, the two big harvests a year for corn and soyabeans — one in the US and the other in Brazil — means supercycles in grains and oilseeds tended to be shorter than other crops, but he predicted a bull market for the next two to four years. “The characteristics of the super cycle are there,†he said.

Last year’s large imports of corn by China, which had previously aimed for self sufficiency, took traders and analysts by surprise and stoked a debate about whether this was “restocking†after the shock of the pandemic or whether the purchases would continue.

Several executives believe the gap will persist, pushing the rising power to continue importing corn. Marcelo Martins, head of grains and oilseeds at Cofco International, the trading arm of the Chinese state conglomerate, said there was an imbalance on the supply side due to a poor harvest. “[The supply deficit] is here to stay,†he said.

Meanwhile, biofuel demand, which was driving up soyabean and soya oil prices, is “unprecedentedâ€, according to Paul Maas, chief executive of US agricultural trader Scoular. As governments push for a reduction in fossil fuel usage, many are increasing the amount of biofuels blended into petrol. “The increased demand is real and we’re on the front end of seeing how that all plays out,†said Maas.

Despite the enthusiasm, Gary McGuigan, head of global trade at Archer Daniels Midland, added a note of caution. “We’ve seen quite a correction in prices over the past weeks or so,†he said, adding that while the demand dynamics were “definitely changing†it was too early to call a mini supercycle.

One of the big uncertainties was China. “Out of all big demand driven areas in the world, China is the most opaque and the most hard to predict,†he said.

[ad_2]

Source link