[ad_1]

Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning.

Didi lost a fifth of its market value after Chinese regulators announced an investigation into the ride-hailing app that last week raised more than $4bn in a New York IPO.

China sparked investor unease in New York before the start of trading when it said it would tighten restrictions on overseas listings, endangering the lucrative pipeline of Chinese companies keen to raise capital on Wall Street.

China’s top government body, the State Council, said it would act to strengthen the protection of sensitive data related to overseas listings, and “consolidate the information security responsibilities of overseas-listed companiesâ€.

“This is direction from the highest level,†said Bruce Pang, head of research at the investment bank China Renaissance. “The landscape of not only China’s market but also its regulatory framework could see dramatic changes.â€

Five more stories in the news

1. Pentagon cancels $10bn Microsoft cloud contract The Pentagon cancelled the highly-sensitive $10bn Jedi cloud computing contract that had been awarded to Microsoft, drawing a line under a contentious government bidding process that was marred by claims of interference from Donald Trump.

2. US pressures EU to drop digital tax plan Washington is piling pressure on the EU to shelve its plans for a levy on digital companies, arguing it could clash with Brussels’ pledge to avoid new punitive corporate taxes while negotiations on a landmark global tax deal are being finalised.

3. Alibaba joins effort to bail out Suning The ecommerce group has joined Chinese local government and other corporate backers in a $1.4bn investment in Suning, the latest attempt to save the country’s biggest bricks-and-mortar retailer and owner of Inter Milan.

4. Binance ‘temporarily suspends’ payments from EU’s Sepa network The crypto exchange said it will suspend euro bank deposits from one of Europe’s key payments networks in the latest sign of how the firm is losing key connections to the conventional financial system following a regulatory crackdown.

5. Nextdoor to go public in $4.3bn Spac deal The hyperlocal social media platform has agreed to go public through a merger with a special purpose acquisition company, in a tie-up that it said would give the business an implied valuation of $4.3bn.

Coronavirus digest

-

Joe Biden urged more Americans to get vaccinated against Covid-19 as cases begin to rise again across the US, fuelled largely by the Delta variant.

-

UK health secretary Sajid Javid warned that daily Covid-19 cases could rocket to a record 100,000 after restrictions are lifted on July 19.

-

India’s state of Maharashtra is reimposing tough Covid-19 restrictions as public anxiety mounts about a potential third wave of infections. Even as sites like the Taj Mahal open, fear remains.

-

The contrasting fortunes of Singapore and China highlight how efficacy of jabs is key to reopening, Tom Mitchell writes in our Trade Secrets newsletter. (FT, NYT)

Follow our live coronavirus blog and sign up for our Coronavirus Business Update newsletter for more Covid-19 news.

The day ahead

OECD Employment Outlook 2021 With figures being released today, the biggest concern about economic recovery is for developing countries, which have yet to feel the full economic impact of the coronavirus crisis.

Federal Reserve minutes The US central bank surprised market participants in mid-June when it signalled a potential policy shift in the face of higher inflationary pressures and strong growth. Investors will gain more clarity on Wednesday when minutes from central bankers’ meeting last month are released.

EU growth forecast The brightening prospects for the European economy will grab attention in Brussels today when the European Commission looks set to upgrade its growth forecasts for the next two years.

Ever Given released from Suez Canal The ship that blocked the Suez Canal earlier this year will be released from Egypt today after a formal settlement was reached in a compensation dispute. The Ever Given had been detained in the country since it was dislodged from the canal. (Reuters)

Keep up with the important business, economic and political stories in the coming days with the FT’s revamped Week Ahead newsletter. Subscribe here. And don’t miss our FT News Briefing audio show — a short daily rundown of the top global stories.

What else we’re reading and listening to

China watches Afghanistan anxiously as the US withdraws As Washington pulls out of Afghanistan, the burning questions are not only whether the Taliban can fill the power vacuum created by the US withdrawal but also whether Beijing — despite its longstanding policy of “non-interference†— may become the next superpower to try to write a chapter in its neighbour’s history.

Climate change should already be in the company accounts The wait for new ESG standards doesn’t mean environmental pledges can be missing from the bottom line, writes Helen Thomas. Yes, the world needs better, more consistent standards around sustainability. But that’s no reason to luxuriate in the status quo while those are developed.

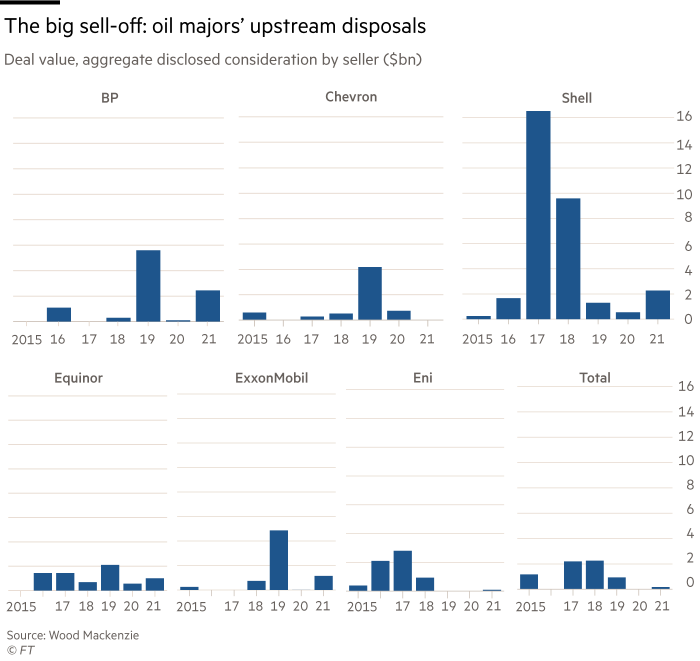

Cashing in on Big Oil’s push to net zero One company’s transition away from fossil fuels is another’s opportunity to double down. Under intense pressure to take action on climate change, the world’s biggest oil and gas companies are putting billions of dollars’ worth of assets up for sale.

The internet wants to watch you eat Watching strangers eat is one of the weirder spectacles on the internet — simultaneously gross and mesmerising. If that sounds unappealing, it may come as a surprise to hear how popular the trend is, writes Elaine Moore.

The end of EU migration will reshape the UK economy We are only learning how big a deal European migration was for the UK as we are confronted by life without it, writes Sarah O’Connor. In meat processing, where EU workers account for more than 60 per cent of staff, employers are complaining of acute labour shortages.

Wellbeing and fitness

Rosa Alpina Hotel & Spa in the Italian Dolomites is legendary. Equal parts luxury chalet and rustic mountain lodge, with a multi-Michelin-starred destination restaurant. It joined the Aman stable of hotels and resorts last year and is part of a new programme of multi-day extreme sports retreats. Discover more getaways guaranteed to push you to the limit.

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to firstft@ft.com

[ad_2]

Source link