[ad_1]

Yes — Free float and dual-class share structures need reform

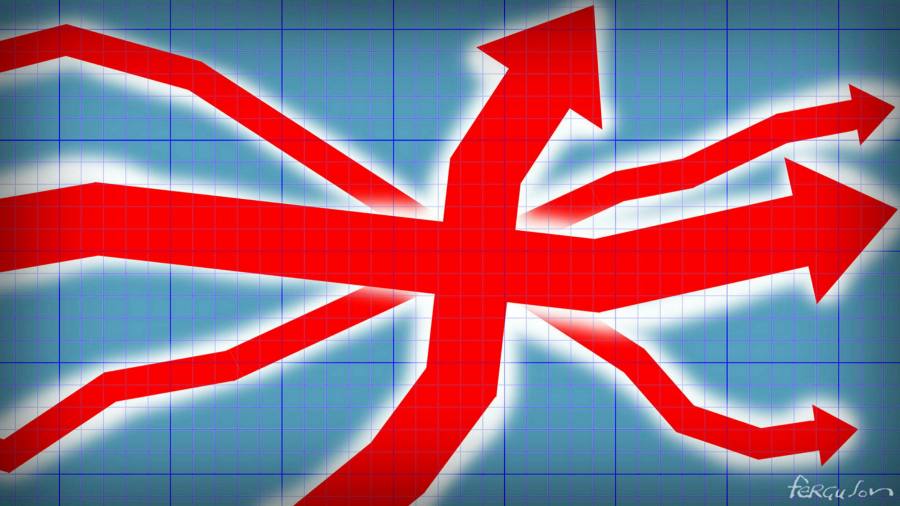

Late last year, the UK launched a review of its rules for stock exchange listings as part of a broader effort to strengthen London’s “position as a leading global financial centreâ€, writes Lorna Tilbian.

Brexit and the pandemic make it critical for the UK to seize this chance to reshape our rule book. The listings market must be made more attractive to fast-growing tech and other new economy companies that will create the growth and jobs of the future.Â

This would put Britain at the forefront of the fourth industrial revolution, as it was at the first, and cement London’s reputation as a world-class market with high standards of governance, shareholder rights and transparency.Â

Here are two key areas where change is needed to make the UK more competitive: the rules on free float and dual-class share structures. The UK requires listed companies to have at least 25 per cent of their shares in public hands, as opposed to insiders. US rules do not preclude free floats as low as 10 per cent. Similarly, the US and Hong Kong allow companies to list with multiple classes of shares with different voting rights, while the UK does not.

These firm rules are major obstacles to the London Stock Exchange’s efforts to attract fast-growth businesses. Many founders worry about retaining control of their businesses after an initial public offering and early investors are concerned the free float requirements will force them to sell shares earlier — and cheaper — than they would like.

Most founders want the higher valuation and liquidity that are seen to be part of a “premium†listing, as well as membership in the FTSE indices. So, it would do little to create another type of listing with looser rules. The dual-class share issue is also a problem for founders who want enhanced voting rights to help guard against a hostile takeover.

The UK has an interest in strengthening founders’ rights as well, as it would make listed companies less vulnerable to acquisition early in life by a foreign company. Such purchases impoverish the British ecosystem of tech companies and listed companies more broadly. Not all dual-class shareholder systems are alike, and a balanced conversation about types and limits is welcome.

Many UK founders would like a home listing, to be famous here and give back, but they feel pulled to the US, where tech founders are feted on Wall Street, Main Street and in the media and can obtain higher valuations.

Indeed, valuation is London’s overarching challenge. For most companies contemplating an IPO, the major goal is to achieve the highest price, to reward employees and investors, and facilitate future growth. Until the UK has a critical mass of businesses with attractive valuations, we will need rules that actively draw them here.

We need an ecosystem and potentially new FTSE sectors to attract entrepreneurs, bankers, analysts and investors. The media sector was created after the early 1990s recession by merging agencies with broadcasting and publishing, plucked out of other sectors. This helped spawn a dozen FTSE 100 media companies by 2000, including Sky and WPP.

The debate over listing rules is often framed as high regulation versus cutting rules to win IPOs, but it is really about striking the right balance. The dilution of shareholder rights should be minimised, but anything that deters listings will be a pyrrhic victory.

UK public markets must embrace founder-led businesses and celebrate fast-growth companies that represent jobs and the future of an independent Britain. The US’s Nasdaq must not remain the natural destination for aspirational tech companies and London must stave off increasing competition from European exchanges.

If we miss this opportunity, the UK’s pipeline of growth companies could go to the US or be sold to private equity or competitors. London already has a time and language advantage; we must create a regulatory advantage to attract these IPOs before it is too late.

The writer chairs Dowgate Capital

No — Britain’s high standards must not be sacrificed

Re-energising the UK’s capital markets has never been more important, but it requires more than reassessing the listing rules, writes Chris Cummings. We need a wider look at the capital market ecosystem for fast-growing companies. Only then will we boost our reputation as an attractive centre for companies to list and investors to do business.

The Covid-19 pandemic has highlighted the importance of public markets and the role investment can play in delivering benefits for the economy, society, and the planet. By attracting high-growth companies of the future to list, a healthy public market which embraces innovation will deliver the long-term returns that savers and investment managers need. We want these companies to list and locate their operations here, bringing new jobs and much-needed tax revenue.

But success is not just about increasing the number of initial public offerings. We must be confident in the quality of companies looking to list and their ability to provide long-term value. The UK’s ambition to be a global leader in stewardship and sustainability must also be reflected in the listing requirements and they must give shareholders sufficient ability to hold companies to account. If we make any changes to attract high-growth, innovative companies, we must keep the rules sufficiently robust to protect savers’ money.

For the “premium†segment, which has the highest standards, this is particularly important, as tracker funds must buy shares in these companies to replicate the FTSE index. With more than £250bn invested in these funds, it is paramount that investors have the powers they need to oversee these companies and confidence in their governance.

A 25 per cent free float requirement protects investors by guaranteeing liquidity and ensuring there are enough minority shareholders to raise concerns with the management. There is an argument for reducing the free float if the company’s market capitalisation is sufficiently large, but such flexibility would need to include voting safeguards for independent shareholders.

The current listing regime offers flexibility for companies that want multiple classes of shareholders in the “standard†segment, but it is perceived to be a poor relation. By rebranding it, we can increase its appeal to entrepreneurs. Founders could maintain voting control, while at the same time using a standard listing as a springboard to a premium listing.

Attracting more companies to this segment and making it easier for groups to move between segments will increase the UK’s appeal as a place to list. More work also needs to be done to promote the flexibility offered by the current system and categories — done well this can be a selling point for the UK. There should be a proactive unit which brings resources from within government and the regulators to help achieve this.

The pandemic has also highlighted areas where the UK should look to reduce more onerous listing requirements. Between March and the end of November, 73 members of the FTSE All-Share index raised more than £22bn of additional capital using mainly trading updates rather than full prospectuses. This suggests that prospectus and record requirements can and should be cut, making it easier for companies to list and raise additional capital.

There are also lessons to be learnt from wider trends. The number of IPOs globally dropped in the 2010s as more companies opted to stay private and is only beginning to recover. For public markets to flourish, we need to tailor our listing regime to support companies in different phases of growth, restructuring and into maturity.

The listing rules are not the only barrier on companies’ appetite to list in the UK. Companies also consider the wider ecosystem. The UK needs to grow the pool of specialist tech-focused lawyers and advisers who can support the high-growth companies we wish to attract.

The listing review is important, but we need to consider it in the context of much wider issues and not sacrifice the high standards for which the UK is known. The prize — wider access to capital for UK and international businesses, more high-growth companies operating in the UK and robust governance delivering long-term returns for British savers and the wider economy — is one we can all agree is worth striving for.

The writer is chief executive of the Investment Association

[ad_2]

Source link