[ad_1]

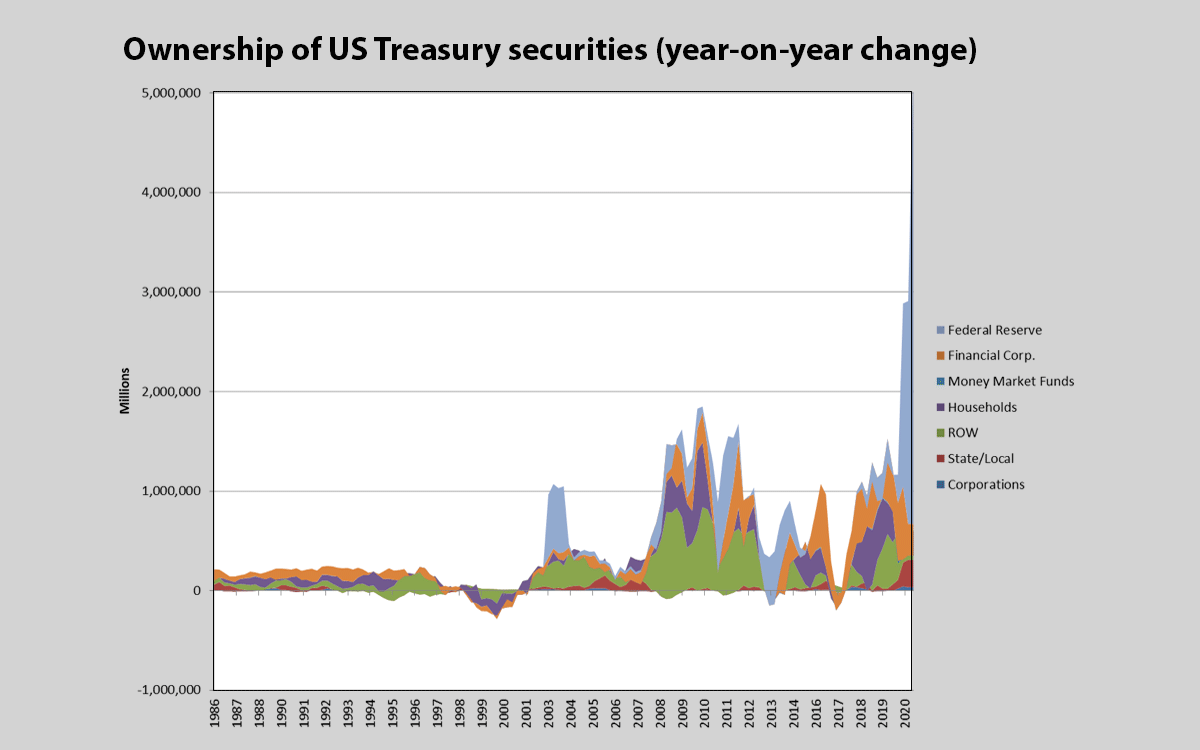

The US has the largest deficit since World War II at 16% of GDP, and the Federal Reserve is financing virtually all of it, with a small contribution from financial corporations (mainly banks). Foreign purchases of US debt (the green area labeled “Rest of World†are minimal). Holdings of Federal debt securities by the Fed jumped by more than $3 trillion in the year through the third quarter.

Chinese economist Gao Deshing comments at the guancha.cn website: “With the special status of the U.S. dollar as a world currency, the United States never has to worry about the repayment of national debt, because it can be repaid by expanding the issuance of U.S. dollars…. As long as the world still has demand for U.S. dollars and U.S. bonds, its debt can expand indefinitely, and it has the ability to repay its original debt by issuing more debt. At the same time, as long as the Fed keeps interest rates low enough or even zero, it does not need to worry about interest costs. This is a situation that has been repeated in the United States for many years.â€

Gao asks, “But can the United States continue to issue bonds to stimulate the economy and increase wealth. Can it last forever? In other words, can the U.S. debt grow without limits? The surge in US Treasury yields means that U.S. debt expansion is unsustainable, and it is destined to hit a ceiling set by the market.â€

Perhaps China’s grand strategy is to watch and wait while the US goes bankrupt.

[ad_2]

Source link