[ad_1]

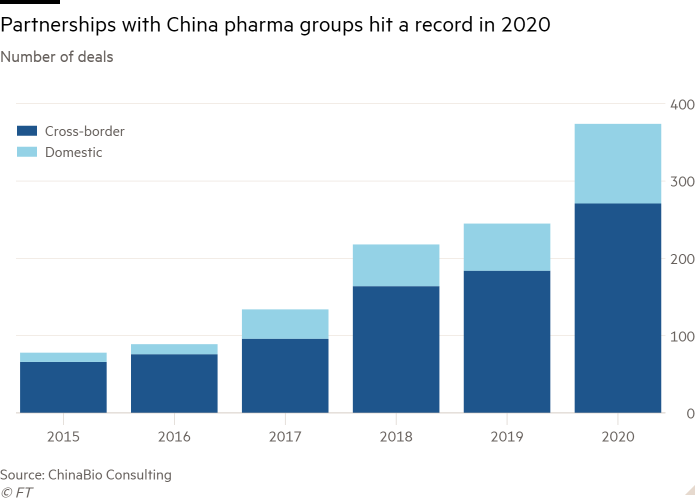

Pharmaceutical groups signed partnerships with Chinese biotechnology start-ups at a record rate last year despite geopolitical tensions and concerns over intellectual property rights and data security in the country.

China has opened up its healthcare industry over the past five years, prompting US and European companies to seal deals with local companies to access the world’s second-biggest drug market.

A record 271 cross-border licensing partnerships were agreed in 2020 between multinational groups including Roche, Bayer, AbbVie and Pfizer and Chinese pharma companies, according to data from consultancy ChinaBio. The collaborations involve clinical trials, development and commercialisation and sharing data and are up nearly 50 per cent from 2019 and more than 300 per cent since 2015.

Deals are being signed despite concerns over intellectual property protection and the safety of US healthcare data in China, with analysts saying the market is too big and fast-growing to ignore.

China’s healthcare industry overtook Japan in 2016 to become the world’s second-biggest and is expected to surpass the US within three years. Pharmaceutical spending in China totalled $137bn in 2018 and will reach $140bn-$170bn by 2023, according to data provider IQVIA.

“There has been an increase in both deals where Chinese companies will develop and commercialise innovative drug candidates discovered by western companies and where multinational companies will do the same with cutting-edge Chinese-invented pharmaceuticals outside China,†said Sam Thong, chairman of Goldman Sachs’ healthcare group in the Asian investment banking division.

$170bn

Potential size of pharma spending in China by 2023

Under the Made in China 2025 strategy, a scheme designed to advance the country’s technology and manufacturing goals, Beijing has set targets for domestic drug companies to make progress on innovation and has streamlined the drug approval process.

China’s state medical insurance scheme has also added more branded, non-generic drugs to a list of those that qualify for patient reimbursement, including products by foreign companies such as Novartis, in a move that could boost demand.

Western groups have already reported the financial benefits of their China strategies.

Eli Lilly, the US pharma company, agreed a $255m deal with Shanghai-listed biotechnology business Junshi Biosciences last May to collaborate on a Covid-19 antibody treatment and reported a 41 per cent jump in quarterly profit in January. Eli Lilly’s chief scientist lauded the “exciting†phase 3 trial results for the treatment with Junshi that showed the antibodies reduced risk of hospitalisation and death by 70 per cent.

Junshi said the record string of partnerships proved China’s drugs were of “international qualityâ€.

Pfizer agreed a $480m deal in September with CStone Pharmaceuticals that gave the US group a 9.9 per cent stake in the Hong Kong-listed company, which focuses on immuno-oncology medicines, as well as an exclusive licence to commercialise CStone’s cancer drug in China.

For Chinese start-ups, the partnerships can be used as a launch pad for their global ambitions, enabling companies to carry out trials and win commercial approval for their products in the west.

Eli Lilly signed a licensing deal worth more than $1bn with Suzhou-based oncology group Innovent in August for the exclusive rights to its lung cancer therapy outside China.

AbbVie, another US pharma group, agreed to pay mainland biotech I-Mab up to $2bn for access to its experimental cancer drug in September.

“This is an important step for Chinese companies because it validates their capabilities — their R&D is reaching a global standard,†said Cathy Zhang, Morgan Stanley’s head of healthcare for global capital markets in Asia.

But China remains under pressure to better protect intellectual property, a longstanding grievance for overseas companies.

Patent law changes in 2020 gave foreign groups more confidence they would be protected, but “enforcement is still a big issue in practiceâ€, said Rocky Wu, a Shanghai-based partner for KPMG, the professional services firm. “The detailed guidelines on implementation of patent linkage has not officially been published.â€

US national security experts are also worried about Beijing gaining access to American healthcare data, particularly genomic information, for both privacy reasons and concerns about the ability to use such data to help develop biological weapons.

The US-China Economic and Security Review Commission, which evaluates the national security risks attached to doing business with China, last year said Beijing had made the collection of foreign healthcare data a priority and tried to gain access to US information through “licit and illicit meansâ€.

Chinese entities have done this through investments, partnerships and sales of equipment and services, the commission said in its 2020 report to the US Congress.

The commission added that “Beijing has placed increasingly tight restrictions on foreign firms’ ability to access and share healthcare-related data collected in Chinaâ€, despite officially encouraging foreign participation.

Additional reporting by Wang Xueqiao in Shanghai, Thomas Hale in Hong Kong and Hannah Kuchler in New York

[ad_2]

Source link