[ad_1]

Hedge fund manager Pierre Andurand has emerged as one of the early winners from the big commodity market rebound, drumming up returns of almost 15 per cent since the start of the year thanks to bets on rising oil and European carbon prices.

The French oil specialist, who returned investors as much as 152 per cent in 2020 betting on the coronavirus-driven collapse in crude, has now taken to betting on oil’s recovery.

Andurand Capital Management’s main fund was up 14.8 per cent as of March 5, according to people familiar with its performance, while its Discretionary Enhanced fund, which can at times take more risk, was up by a similar amount. Combined the two funds have about $700m in assets under management.

Oil and other commodities have extended a rally at the start of 2021 as investors bet raw material markets will strengthen as the world economy starts to rebound from the depths of the coronavirus pandemic.

Brent crude, which has also been boosted by large cuts to supply by Opec and its allies, hit a 14-month high above $70 a barrel this week.

While the fund declined to comment on its returns, Andurand told the Financial Times that he saw further gains for oil this year, with Opec members indicating they are in little rush to increase production.

Andurand said the Opec+ group, which has been restricting output since the spring last year, was likely underestimating how quickly demand would rebound as vaccines are rolled out in wealthier countries and travel restrictions ease.

“The oil price firmly is in the hands of Opec this year,†Andurand said. “We will probably see $80 sometime as demand is likely to surprise to the upside in the second half of the year and the market will beg for extra production.â€

While Andurand has a reputation for making big bets on the oil price, a large part of his returns in 2021 are also coming from European carbon allowances.

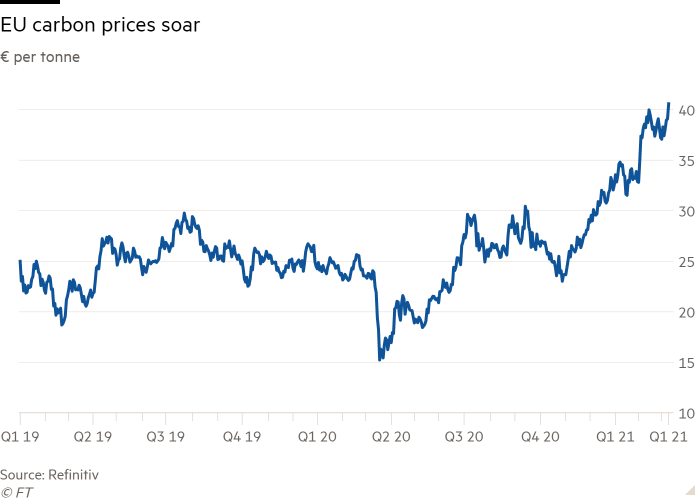

The European carbon market, which is designed to cut CO2 emissions by putting a price on pollution, has soared more than 70 per cent in the past four months, hitting a record high above €41 a tonne on Wednesday.

The fund manager, who revealed last year that he was dipping a toe into the carbon market, diverted a bigger portion of his fund to carbon in 2021, betting prices will rise much further, according to a person familiar with the matter.

Late last year the European Commission pledged to reduce carbon emissions by 55 per cent by 2030, up from a target of 40 per cent previously.

European carbon prices still have “a long way to goâ€, Andurand told the FT. One of Andurand Capital’s analysts told Bloomberg in February that the fund believed the EU carbon price would eventually rise to about €100 a tonne, a level that would make alternative fuels like hydrogen produced from renewable energy sources competitive.

The EU carbon market is seen as a key tool for reducing emissions in the bloc, with the number of allowances available to utilities and industry expected to tighten over time.

[ad_2]

Source link