[ad_1]

Chart of the May for March 21, 2021

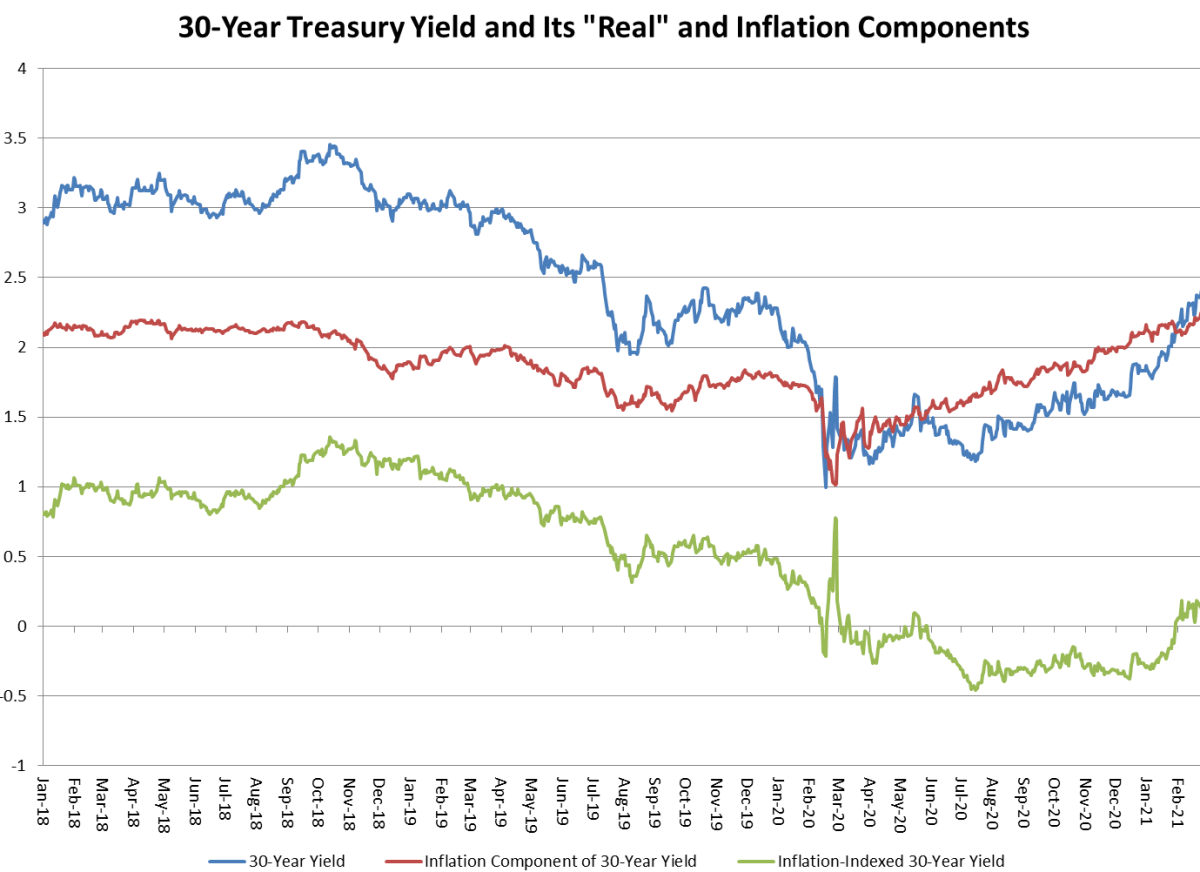

The 30-year Treasury yield has climbed all the way back to its 2019 level, mainly because inflation expectations built into the yield have risen to the highest level since 2014. A US government deficit equal to 20% of GDP, a falling dollar and rising commodity prices mean more inflation in the future.

The Federal Reserve bought most of the Treasury debt issued in the past year, and will have to buy most of the Treasury debt issued during the coming year, as Bridgewater’s Ray Dalio told the China Economic Forum on Sunday.

Unlike the period after the 2009 crash, when foreigners financed roughly half of the US government deficit, foreigners haven’t increased their holdings of US debt during the past twelve months. Dalio, one of the world’s most successful investors, warns that they might start to sell the debt they already own. “The situation is bearish for the dollar,†Dalio concluded.

As the late Herbert Stein said, anything that can’t go on forever won’t.

Budan University Professor Bai Gang told China’s Observer website last week: “For the past year, the US has continued to issue more currency to ease its internal situation. The pressure will eventually seriously damage the status of the US dollar as the core currency in the international payment system.â€

The first cracks have appeared. It make take weeks, months, or years for the US government’s borrowing binge to damage the dollar’s reserve status. The results will be unpleasant for investors. Be afraid. Be very afraid.

[ad_2]

Source link