[ad_1]

The Biden Administration has the same reelection formula as its predecessor, the Trump Administration: Dump trillions of dollars out of a helicopter, issue bonds to raise the money and have the Federal Reserve buy the bonds. Consumers will spend the money and gross domestic product will rise.

But what if consumers don’t spend the money? What if they squirrel away their stimulus checks as a rainy-day reserve?

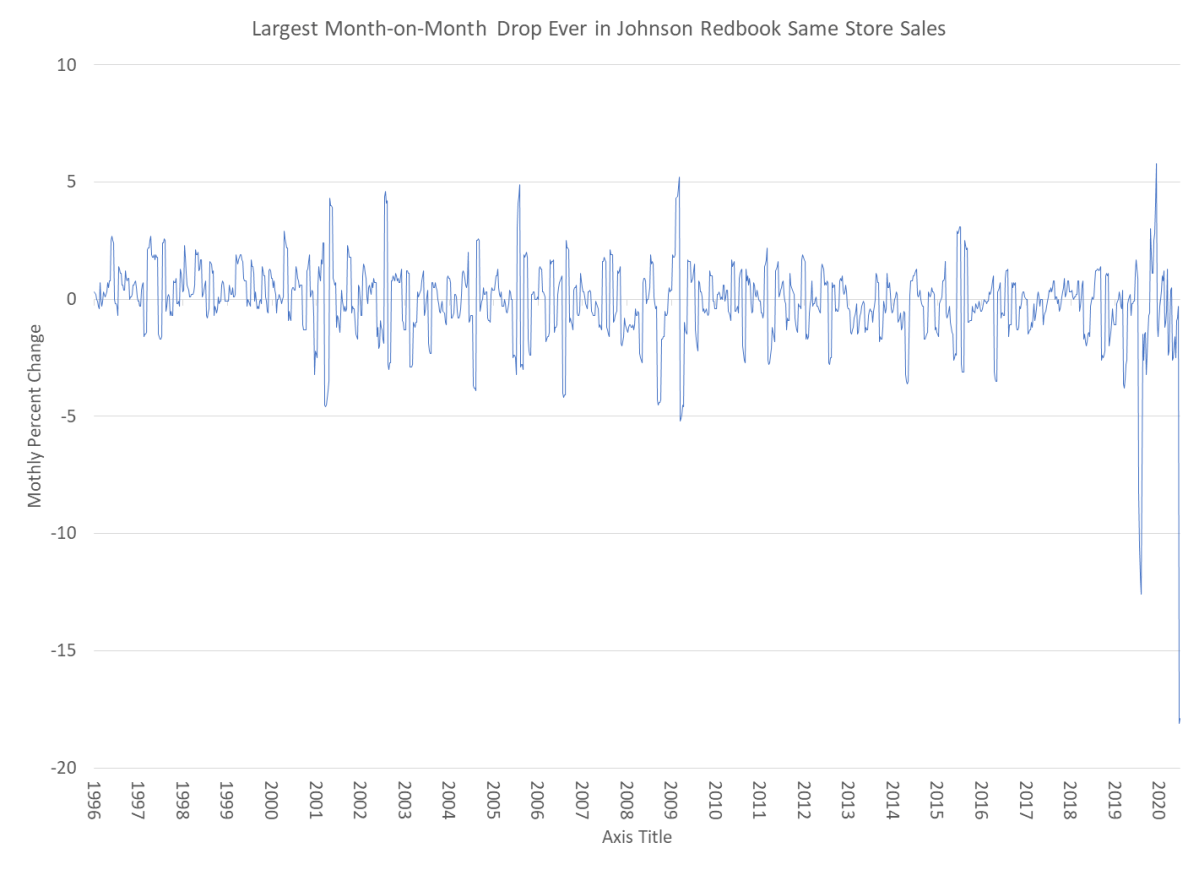

Unexpectedly, retail sales fell by 3% in February, and the first data available for March are gloomy. Johnson Redbook tracks US retailers and provides weekly comparisons of sales at the same stores over earlier periods. Relative to the free-fall of March 2020, at the peak of the pandemic, the Johnson Redbook numbers for the first half of March show some increase, but compared with February, they show a decline of nearly 18% month on month.

That’s the worst monthly number since the series began in 1996.

We caution against drawing conclusions from one bad data print, but it adds to our concerns. Federal Reserve Chairman Jerome Powell observes that the Consumer Price Index has been rising at less than the Fed’s magic number of 2% a year, and promises to keep interests low indefinitely.

But American consumers may not see things that way. Some things they need are cheap, for example, apartment rents, which doesn’t mean much when the federal government has a moratorium on evictions. A lot of things they need – cars, homes, and energy – are a lot more expensive.

Massive government deficits tend to cause inflation, and inflation doesn’t always encourage people to spend. It often encourages them to save, because it erodes their wealth, as Nobel Laureate Robert Mundell observed decades ago.

The risk to US economic policy is that the federal government will give a stimulus, and nobody will come. Consumers will save rather than spend. That will help the US government fund the $4 trillion plus deficit, but it will leave the US economy dead in the water. And that won’t be good for the stock market.

[ad_2]

Source link