[ad_1]

Stock pickers are hoping for a sustained comeback as the market dominance of technology companies wanes in a recovering US economy.

The initial pandemic-era rally in US stocks, which has reached its first anniversary this week, has been all about big tech, with a handful of giants such as Apple and Facebook at one point accounting for about one-quarter of the entire S&P 500 benchmark stocks index.

But now economically sensitive industrial, energy and financial companies are on the up. In addition, companies within sectors are likely to chart very different paths out of the pandemic crisis. That all provides better opportunities for stock pickers such as hedge funds and actively managed share market portfolios.

“This is a time to be focused on stock picking and conviction investing,†said Tony DeSpirito, CIO of US fundamental equities at BlackRock. “This business cycle will be faster and there is a lot of pent-up demand. The dynamics of the cycle will play to the strengths of stock pickers.â€

A majority of active managers have not outperformed the broad S&P 1500 index of US stocks since 2013. But signs of a broader market rally in late 2020 helped active managers perform better than in previous years, according to S&P Dow Jones.

A majority of US domestic equity funds still underperformed the S&P 1500 in 2020, but that figure of 57.1 per cent is well down from 70 per cent in the two previous years.

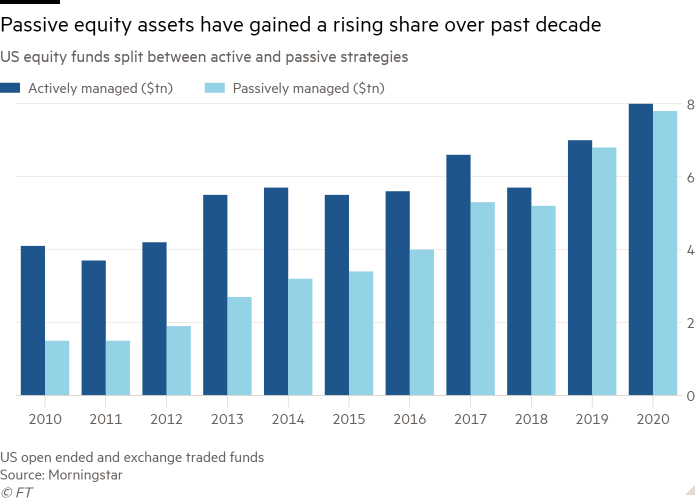

Client money has followed the years of passive outperformance. At the end of 2010, actively managed US equities funds held $4tn in net assets, well above the $1.5tn in index-tracking passive strategies, according to Morningstar. A decade later, passive US strategies reached almost $8tn in assets, a whisker behind active funds.

Fund managers say the weakening reliance on tech stocks at this stage of the economic recovery will help to throw up more opportunities. In February, 70 per cent of large-cap actively managed funds outperformed their benchmarks — the best performance since 2007 according to Bank of America.

Investors say companies are likely to perform very differently to each other in the economic upswing. Some have done a stronger job of cutting costs, setting them up for a strong rebound in earnings. Others have done a better job of latching on to technology shifts, especially in retail.

Some stocks, however, are cheap for a reason. Troubled companies, loaded up with debt, are unlikely to prosper after the pandemic ends.

“The long term trends of technology and disruption are accelerating and the challenge for stock pickers is distinguishing how Covid transforms companies,†said DeSpirito at BlackRock. “It means there are opportunities for stock pickers among both value and growth companies. You need to find new tech disrupters and avoid value traps.â€

An equal weighted approach to the S&P 500 is another way to play a broader equity market rally, spreading out allocations evenly between index constituents rather than tilting towards those with the biggest market capitalisation.

“Robust economic growth is a good environment for active managers to outperform the index, either through stock picking or via an equal weighted approach,†said Marco Pirondini, head of US equities at Amundi Asset Management. “Economic forecasts will be revised higher during the year.â€

In a sign of the wider range of stocks that are now pushing higher, an equal-weighted version of the blue-chip S&P 500 index has gained around 32 per cent over the past six months, 11 percentage points better than the same index weighted in favour of the biggest companies.Â

The broader equity rally has also attracted net inflows in to actively managed global equity funds so far this year, for the first time since 2013 according to Citi strategists. The biggest beneficiaries have been in global equities, emerging markets, and funds with a sustainable investing focus, the bank said.

A long-lasting resurgence is a difficult task. “It is a better time for active managers, but they need to be more discretionary and they still have a lot of work to do,†said David Bianco, chief investment officer for the Americas at DWS Group.

Picking stocks with low price to earnings ratios “is not a long lasting strategy,†said Bianco. “For active management to have the legs over this new cycle, they will need to continue assessing the economic outlook and how that benefits companies.â€

But expectations of a significant rebound in economic activity are building, and are likely to push corporate profits sharply higher in the next 12 months. That is likely to support stocks of smaller and midsized companies, which typically prosper during a sharp economic upswing. Although these sectors have rallied strongly in the past six months, they still remain cheap compared to larger companies.

“Small companies retain a significant valuation discount to large-cap stocks,†said Jill Carey Hall, head of US small and mid-cap strategy at Bank of America.

Click here to visit the ETF Hub

[ad_2]

Source link