[ad_1]

After a year reeling from the pandemic, one of the world’s most lucrative aviation markets is braced for further disruption. JetBlue, one of the most successful US low-cost carriers, is making its transatlantic debut this summer.Â

But it is the plane — a single-aisle Airbus on routes that are dominated by large, twin-aisle planes — that may have ramifications just as profound for the aviation industry as the carrier’s low-cost business model.

The New York-based airline is launching its assault with the Airbus 321LR, a long-range version of a plane best-known as a workhorse for short-haul services such as those between London and Frankfurt.

The model is just one of Airbus’s A320 family of jets, whose success has given the Toulouse-based company a 60 per cent share in the single-aisle market and the upper hand over fierce rival Boeing.

After the worst year in decades for airlines — and with a return to pre-pandemic travel, particularly among business customers, far from clear — the market for cheaper, nimbler single-aisle planes is now the hottest in the aviation industry.

“The recovery will be led on the short-haul part of the business, on the narrow-body side,†said Aengus Kelly, chief executive of leasing company AerCap, one of the world’s biggest purchasers of aircraft.

The A321 can fly 4,000 nautical miles, several hundred further than a normal short haul Airbus. Boeing does not yet have a plane to match it.

The long-range versions of the A321 are “creating new routes . . . that were there before but in smaller quantities,†Christian Scherer, chief commercial officer at Airbus, told the Financial Times. “It is a very effective and efficient way to link two points with 180-200 passengers.â€Â

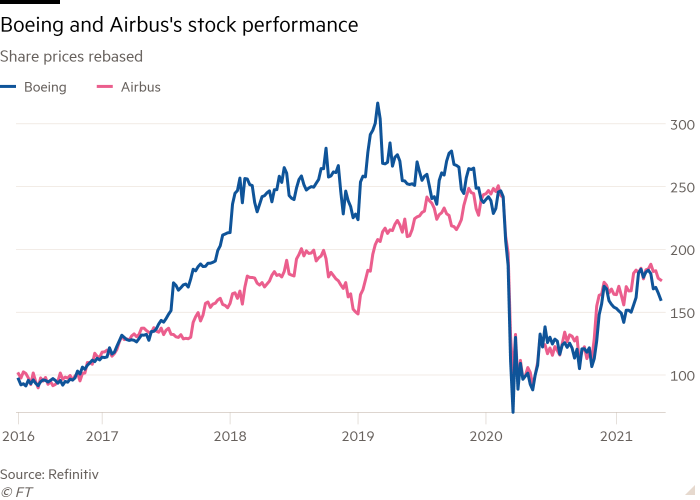

While its rival has stolen market share, Boeing has grappled with the fallout from the grounding of its 737 Max following two fatal crashes.

The backlog of Max deliveries built up during their grounding has begun to clear, but Chicago-based Boeing has also faced quality problems with its wide-body 787 Dreamliner. In the meantime, plans for a giant new wide-body airliner, the 777X, are also running late.Â

Boeing’s initial response to the A321 is the larger Max 10 due to enter service in two years’ time but, given it has a shorter range than the latest A321 variants, the model is considered less capable.

Even before the Max accidents, Airbus was pulling in orders for its A320neo and A321 family of narrow-body aircraft at a faster rate than Boeing’s 737 Max. Industry experts have suggested it needs to launch a completely new aircraft to take on the threat posed by the A321.Â

A previous plan to launch a mid-range twin-aisle, the so-called NMA, was shelved in the wake of the Max accidents.Â

“The strategic issue that the NMA was meant to deal with is still there and has, if anything, gotten worse,†said Rob Stallard of Vertical Research Partners. “Airbus is rampant at the top end of the narrow-body market and Boeing doesn’t have anything to match it.â€

If Boeing’s need to close the ground on Airbus in the single-aisle market is clear, how it does so is less so.Â

For both manufacturers, short-term pressures are not the only consideration when deciding whether to launch a new plane.

With airlines under mounting pressure to reduce their contribution to global warming, one big question facing Boeing is whether to launch a conventionally powered plane, or wait until next-generation technology allows them to make something much greener.

“Typically, each new aircraft generation would be expected to deliver about a 20 per cent improvement in unit costs, mainly through fuel efficiency,†said Robert Boyle, former strategy chief of British Airways and founder of Gridpoint Consulting.Â

“In the past, a lot of that has come from engine technology. I’ve not seen much evidence for where the next 20 per cent will come from to underpin the business case for the next generation of aircraft.â€

Failure to commit to a new aircraft, however, could see Airbus entrench its dominance — leaving Boeing with nothing but price cuts as a competitive weapon.

“If Boeing doesn’t launch a new plane, they could easily lose 10 points of market share. And if they don’t launch a new plane, they could lose the ability to do so,†said Richard Aboulafia, vice-president at Teal Group, the aerospace consultancy.Â

The dilemma comes after a brutal period for the finances of the aerospace industry.

Boeing ended 2020 with net debt of nearly $64bn compared with Airbus’s net cash of €4.3bn. The US group’s cash flow has begun to recover, however. It reported free cash outflow — operating cash minus capital expenditures — of $3.7bn for the first quarter, compared with an outflow of $4.7bn a year ago.

“Boeing is in a disadvantaged position financially to consider development and launch of a new product in the narrow-body segment. Environmental pressures are also a critical factor in any new design,†said Rob Morris, head of consultancy at Ascend by Cirium.

It is one of the reasons some industry executives are urging caution.

John Plueger, chief executive of Aer Lease, one of Boeing’s largest customers, said: “We’ve been clear with Boeing that they really need to get their house in order first before we have an interest in talking about new aircraft.â€Â

AerCap’s Kelly sounds a similar note of caution, noting that “the reality is that airlines are fed up with new technology being introducedâ€.Â

“They have had more change of technology over the last 12 years than ever before . . . there is fatigue with it.â€Â

Boeing, he added, “need to get the Max up in the air, hold on to the customer base that they have and make sure they have a competitive price offering. Then, they can work with the engine manufacturers to see if there is a propulsion system that can make a difference.â€

Boeing declined to comment for this article. However, industry sources said the company is talking to potential customers and engine makers about a new plane.Â

Asked “what’s next†on its first-quarter earnings call last month, chief executive Dave Calhoun suggested the company was looking at ways of improving cost efficiencies through deploying different engineering and manufacturing techniques.Â

“I expect the next product to get differentiated probably in a significant way on the basis of the way it’s engineered and built and less dependent on the propulsion package that goes with it,†he told analysts.Â

Back in Toulouse, Airbus’s executives are watching for Boeing’s next move. The pressure on manufacturers to decarbonise is growing. Before the pandemic, aviation accounted for about 2.4 per cent of global emissions. Airbus has thrown its weight behind a plan to have a zero-emission, hydrogen-powered aircraft ready for service by 2035.

“Plan A today is hydrogen. Sustainable aviation fuel would be the intermediate step,†said Scherer, adding that “for the overall ecosystem and for the staying power of our industry, I think it is preferable that we all concentrate on decarbonising our industryâ€.Â

Nevertheless, he insists the company is keeping its “options open†and will not rule out launching another conventionally powered aircraft.Â

“We are today the number one aircraft manufacturer in the world. You have to expect us to want to maintain that.â€

[ad_2]

Source link