[ad_1]

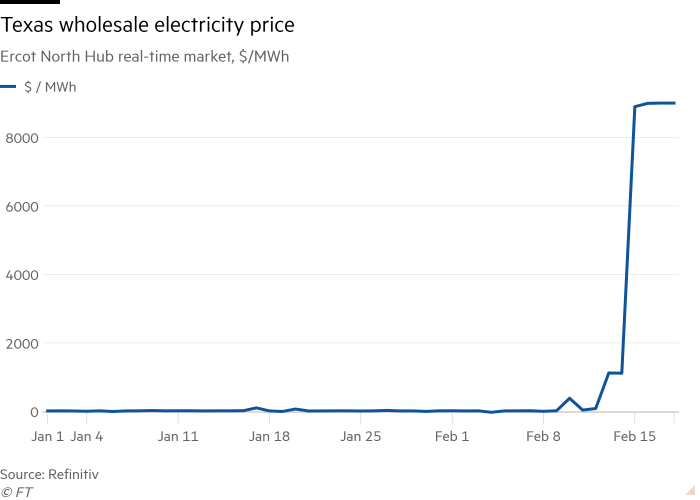

When a deep freeze shut down half the power generation capacity in Texas this week, the wholesale price of electricity exploded 10,000 per cent, with the financial consequences now being felt all the way from individual households to huge European energy companies.

Astronomical bills face customers who opted for floating-rate contracts tied to wholesale prices in the state’s freewheeling electric market.

The organisation that runs the wholesale market is making participants post more collateral to cover what could be a wave of defaults.

And RWE, the German utility, disclosed a loss on frozen Texas wind farms that could be as much as 15 per cent of its annual operating profit forecast.

As the lights flicker back on this weekend, the monetary cost is just starting to be counted.

The wholesale power price was at the maximum allowable $9,000 a megawatt hour for five days from last Sunday. For a household, that translates to a $9 a kilowatt-hour electricity rate, compared with a typical cost of 12 cents.

In Burleson, a suburb of Fort Worth, Valerie Williams has been charged more than $6,000 by her electricity retailer Griddy to power her 1,400 sq ft home over the past few days. As the storm approached, Griddy told its customers to switch to more typical fixed-rate plans from other providers, but not everyone did, since there was little indication of just how extreme prices would become.

Griddy was charging her credit card multiple times a day, Williams said. She struggled to find a new provider during the crisis before finally identifying one that would switch her service on Friday.Â

“I’m guessing it will be close to $7,000 by the time we get moved,†she said of her bill. Griddy did not respond to requests for comment.

Pressure on electricity retailers

Some energy retailers selling to customers whose neighbourhoods were spared blackouts now face financial pressure, having been forced to buy extra power in the spot market to meet unexpected demand.

Their credit has worn thin with the energy traders that give them access to the market, such as BP, Royal Dutch Shell, the French utility EDF and Macquarie, the Australian bank, industry executives said.

The pressure is hinted at in data provided to the Financial Times from the Electric Reliability Council of Texas (Ercot), which runs the wholesale power market and serves as the central counterparty for transactions.

It demanded companies post more collateral as prices soared. Cash held in its collateral pool reached $4.2bn on Monday, up from $600m two weeks before, as its calculation of credit exposure soared.

$50bn

Texas wholesale power sales this week

Ercot declined to provide more recent data, but the value was likely to have grown sharply over the week, since it is based on a formula that encompasses average prices over the preceding several days, traders said. Ercot hosted a record $50bn in sales during the week, said BloombergNEF, a research group.

On Friday, the city council in Denton, Texas, met to approve emergency borrowing to cover $300m the city-owned utility would pay Ercot this week — more than quadruple its purchases in full-year 2020.

Whether the collateral demands have pushed any groups to the financial brink will only emerge in the coming days and weeks.

Late on Friday, Ercot announced it would adjust collateral for trading counterparties on a case-by-case basis, “in an attempt to protect the overall integrity of the Ercot market by mitigating the disruption of defaultsâ€.

‘You might have super-winners’

As well as financial casualties, there will also be winners, though.

Retailers whose customers were among the millions who suffered outages might have scored a windfall if they had bought power ahead of time when prices were lower, said Trent Crow, chief executive of Real Simple Energy, a Houston-based residential electricity broker. They may have sold supply they did not need back to the wholesale market this week at a huge profit.Â

“You might have retailers that go bankrupt, but perversely, you might have retailers that come out super-winners. We will not know that for a few weeks,†Crow said.

7%

NRG Energy share price decline this week

Some companies own both electricity retailers and power plants, balancing the risks. Stock market investors have been paying particular attention to Vistra and NRG Energy, big merchant power producers that between them own the majority of Texas’s electricity retailers.Â

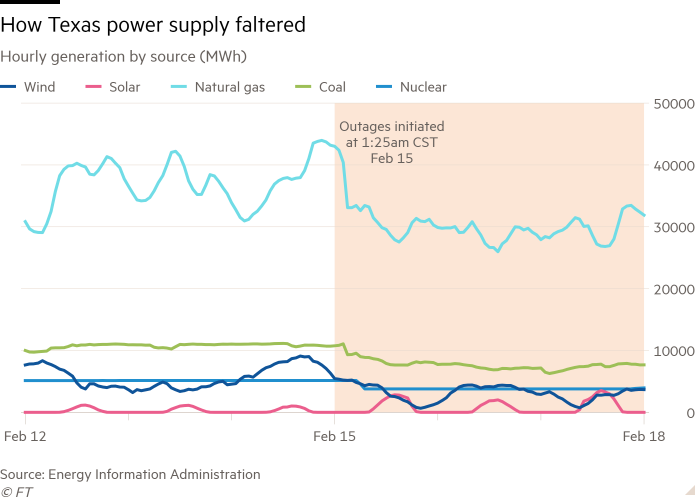

Irving-based Vistra owns 18 natural gas, coal and nuclear-fuelled power plants in the Texas market accounting for almost 19 gigawatts of output. It said plants totalling 1GW of capacity were “not able†to produce electricity and others were “capacity constrained†due to low fuel supplies. But investors, optimistic the company was still able to sell ample electricity into the tight market, drove Vistra’s shares up 6 per cent this week.Â

NRG, which owns a dozen Texas gas, coal and nuclear generating units with a capacity of 12GW, said that “power generation from fossil, renewable, and nuclear sources were all affected by the coldâ€. NRG’s shares fell 7 per cent on the week.

Casualties in wind power

Some wind power producers were among the financial casualties of the crisis. Turbines accumulated ice as they spun in cold, sleet-filled skies — lacking the heating kits that are standard issue further north — and their electricity production fell.Â

That was a particular problem for wind farms that have contracts with Wall Street banks requiring them to deliver a set amount of power every hour, said Joan Hutchinson, managing director at Marathon Capital, an energy and infrastructure investment bank. Those unable to generate it need to buy it on the open market.

RWE said some of its Texas wind fleet went offline on February 9 because of ice and grid problems. Having sold a portion of energy production in advance, the outages meant “the company had to purchase these volumes to fulfil its supply obligations†at prices of up to $9,000 a MWh.Â

The estimated cost of €100m- €500m would account for a big chunk of earnings, which RWE forecast in the range of €2.7bn-€3bn for 2020, according to S&P Global Market Intelligence.

Canada-based Innergex Renewable Energy warned of a C$44m-C$60m hit to its Texas wind farms due to “contractual obligations to supply a pre-determined daily generationâ€. The company was exploring force majeure, a clause that can break a contract by invoking extraordinary circumstances such as natural disasters.

Wind projects typically have credit lines from banks to allow them to cover unexpected expenses, Hutchinson said, but for many companies these were now stretched. “They’re really caught in a bit of a credit crunch,†she said.

Some ordinary Texans also felt strain. As Valerie Williams put it: “We now have to figure out how on earth to pay this bill.â€

Â

[ad_2]

Source link