[ad_1]

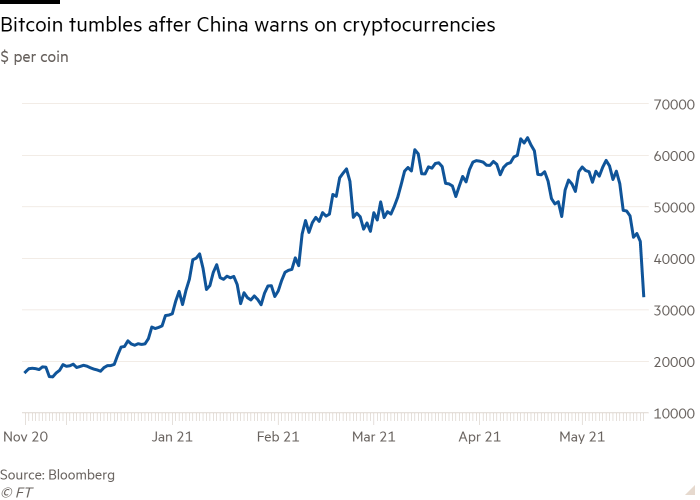

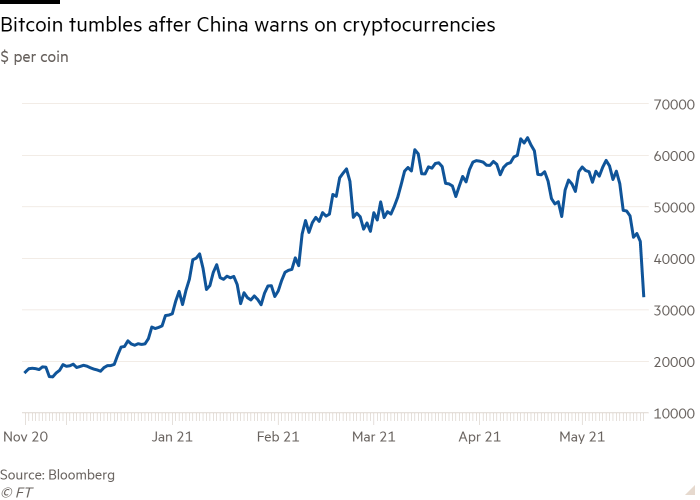

Bitcoin tumbled 14 per cent to its lowest level since early February after Chinese regulators intensified efforts to crack down on the use of cryptocurrencies by financial institutions.

In a joint statement issued on the People’s Bank of China’s WeChat account, banking and internet industry associations said that financial and payment institutions should not accept cryptocurrencies as payment or offer services and products related to them.

Virtual currency “is not a real currency†and “should not and cannot be used as currency in the marketâ€, the groups said in the statement issued late on Tuesday, which referred to a recent surge in prices as “speculationâ€.

Bitcoin was trading at a low of just over $38,500 on Wednesday morning in Asia, according to the Bitstamp exchange.

The development reflected China’s campaign to limit institutional activity in cryptocurrencies as it prepares to launch its own digital currency. Other markets such as the US have remained comparatively open to institutional involvement.

“Part of it is they have their own digital renminbi, part is the lack of control in terms of cash outflows and part of it is trying to make sure people don’t get scammed,†said Paul Haswell, a partner at law firm Pinsent Masons in Hong Kong, of China’s crackdown.Â

China’s pressure on cryptocurrencies gained momentum in 2017 when it closed the country’s bitcoin exchanges, which had previously accounted for the majority of global trading.

The government’s plans for a digital renminbi, which would provide the central bank with a record of all currency transactions in real time, could provide a rival cashless payment mechanism to compete with vast online fintech platforms from Ant Group and Tencent.

In the US, regulators have made it easier for retail investors to buy cryptocurrencies and permitted the listing of crypto exchanges on public markets. Large US financial institutions such as Goldman Sachs and JPMorgan are exploring offering investments in digital currencies to wealth management clients.

The price of bitcoin has soared 300 per cent over the past 12 months, despite its recent sell-off.

“I would not be surprised to see other regulators and policymakers do the same [as the Chinese restrictions] over the coming weeks as they warn investors over the risks of speculative trading or crypto market volatility,†said Henri Arslanian, global head of crypto at consulting company PwC.

“The reality is that we are seeing the continuous entry of institutional players and institutional investors in this space and that is unlikely to slow down anytime soon.â€

Recent volatility in cryptocurrency prices has raised doubts among some institutional investors about their value, with UBS Wealth Management and Pimco expressing reservations about digital currencies’ potential as an asset class.

Cryptocurrencies are largely unregulated in Hong Kong, a semi-autonomous Chinese territory. However, in November, the city’s Financial Services and the Treasury Bureau published proposals that would ban retail investors from trading cryptocurrencies.

“If anything I feel like the market’s growing in Hong Kong in terms of the cryptocurrency industry,†said Haswell.

Additional reporting by Wang Xueqiao in Shanghai

[ad_2]

Source link