[ad_1]

The bitcoin flash crash has exposed how “systemic issues†under the surface of the cryptocurrency market, combined with leverage offered by many leading exchanges, exacerbate episodes of volatility.

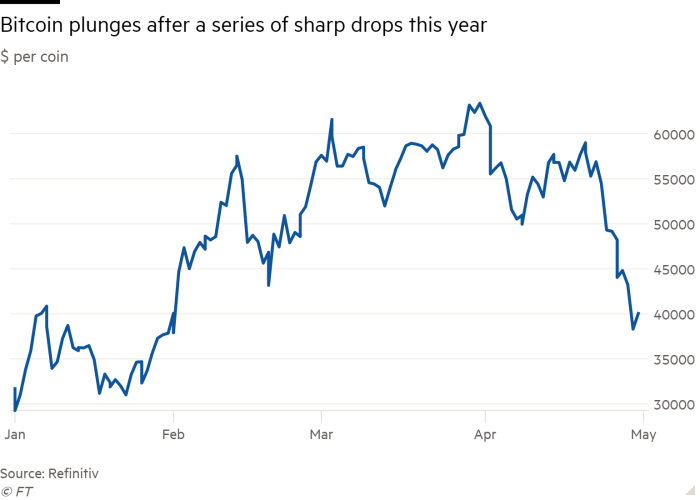

Bitcoin prices plunged $10,000 in less than an hour on Wednesday from $40,000 in one of the most severe drops since the world’s most actively traded digital coin began its meteoric ascent to record peaks last autumn. It rebounded almost as spectacularly as it fell later in the day, and continued its rebound on Thursday, climbing above $42,300.

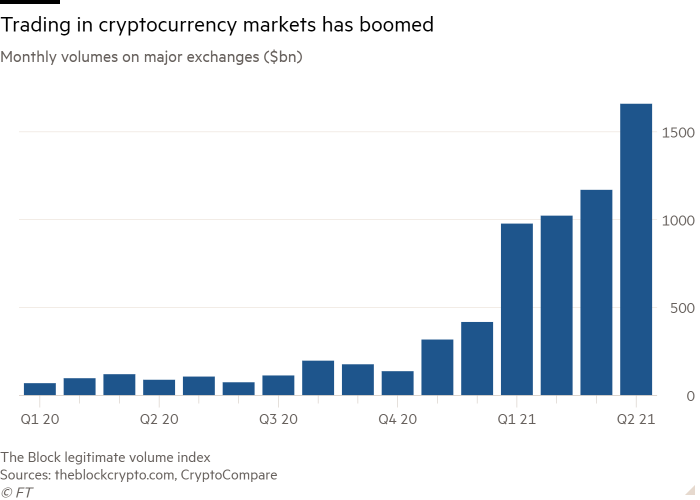

The scale of the losses and recovery in such a short time, coupled with the frenetic nature of the trading, illustrate how even as the digital asset industry has grown rapidly, many systems underlying the market remain fragile and stutter during unusually busy periods.

Coinbase and Binance, two of the highest-profile digital currency exchanges, were among the venues that suffered technical issues during the shake-up on Wednesday.

At the same time, analysts said some retail and institutional traders’ use of leverage — borrowing to amplify potential returns — also heightened the velocity and magnitude of the fall in prices as bets rapidly unwound.

“When the price is crashing, everyone that leveraged and [bet on rising prices] sees their leverage ratio blow up,†said David Fauchier, a fund manager at crypto specialist Nickel Digital, noting that the market went through two so-called “liquidity cascades†in less than an hour when bitcoin crashed.

In established asset markets, traders use cash as collateral to finance leveraged bets. In cryptocurrencies, however, they often use bitcoin. That meant that when bitcoin fell heavily, leveraged bets were quick to fold.

This created a self-reinforcing cycle, which prompted widespread selling and highlighted a number of “systemic issues,†according to Michael Bucella, a partner at crypto hedge fund BlockTower Capital.

Sentiment in the market had been fragile for several weeks, but the trigger for the collapse was a warning from Chinese authorities not to accept cryptocurrency as payment, or to sell services on it.

“There were probably about $20bn of [bets that bitcoin will rise] liquidated yesterday, which was a large part of the price drop. It was an initial unrelated spark which grew because of the leverage,†said Sam Bankman-Fried, chief executive of FTX, the Hong Kong exchange.

The turmoil left retail and professional traders counting their losses, especially those who borrowed to maximise their potential gains.

One 21-year-old, who asked not to be named, said that looking at his trading screen flashing red brought back unwanted memories. “It’s like looking at my [school exam results],†he wrote in a message.

[ad_2]

Source link