[ad_1]

One scoop to start: WeWork lost $3.2bn last year as Covid-19 shut its co-working spaces around the world, the office provider has revealed in a pitch for $1bn in new investment and a stock market listing. Read more here.

And one invitation to start: for our next DD Forum, Ortenca Aliaj speaks with Tidjane Thiam and Jean Pierre Mustier on their new roles as Spac sponsors and the blank-cheque boom’s global reach.

Full details and registration for the event on March 31 can be found here.

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance from the Financial Times. Want to receive DD in your inbox? Sign up here. Get in touch with us anytime: Due.Diligence@ft.com.

Leon Black’s curtain call arrives early

When Apollo Global Management disclosed in a report the extent of its founder Leon Black’s financial ties to the late paedophile Jeffrey Epstein earlier this year, the Wall Street group said he would stay on as chair, even after handing over as chief executive to his longtime partner Marc Rowan.

Two months after that report by international law firm Dechert, everything has changed — and Black’s unexpected departure on Monday is barely half the story.

In an email to Apollo staff on Sunday, Black wrote of “relentless public attention and media scrutiny concerning my relationship with Jeffrey Epstein — even though the exhaustive Dechert report concluded there was no evidence of wrongdoing on my partâ€.

These “trying†weeks and months “have taken a toll on my health and have caused me to wish to take some time away from the public spotlightâ€, he said, although he added:Â

“I hope to return at some point.â€

He may need to do a double-take. If Black were to come back as soon as tomorrow, the $455bn investment group he founded 30 years ago would already have changed beyond recognition.

That is because Rowan wasted no time in reinventing Apollo as a weighty financial institution that functions less like a Wall Street investment partnership than a diversified national bank, as DD’s Mark Vandevelde and Sujeet Indap explain in this deep-dive.

By merging Apollo with Athene Holding, the insurance company that he helped to create a decade ago, Rowan is turning a nimble asset manager into a lumbering insurance company that itself carries more than $200bn in assets.

It underscores how Apollo has transformed itself from a scrappy buyout shop into a linchpin of the US financial system.

But it’s a risky move, which left some investors puzzled about why Apollo’s billionaire founders had decided to put so much more of their own wealth on the line.

Speaking of Apollo, Sujeet has just published a book on the bankruptcy fight of the famous casino Caesars from a half decade ago, The Caesars Palace Coup.

The $27bn 2008 Caesars buyout, led by Apollo’s Rowan and David Sambur, eventually degenerated into a free-for-all featuring the likes of GSO Capital Partners, Elliott, Oaktree and Appaloosa along with a who’s who of Wall Street bankers and lawyers.Â

Come for the juicy stories of corporate treachery, but stay for the intricate details of how the Masters of the Universe play a complex chess match to make fortunes in troubled companies.Â

Order the book Sujeet co-wrote with Max Frumes on Amazon or Bookshop.org, or many other online booksellers and enjoy this excerpt from Institutional Investor while you wait.

Canadian Pacific strikes biggest deal of 2021

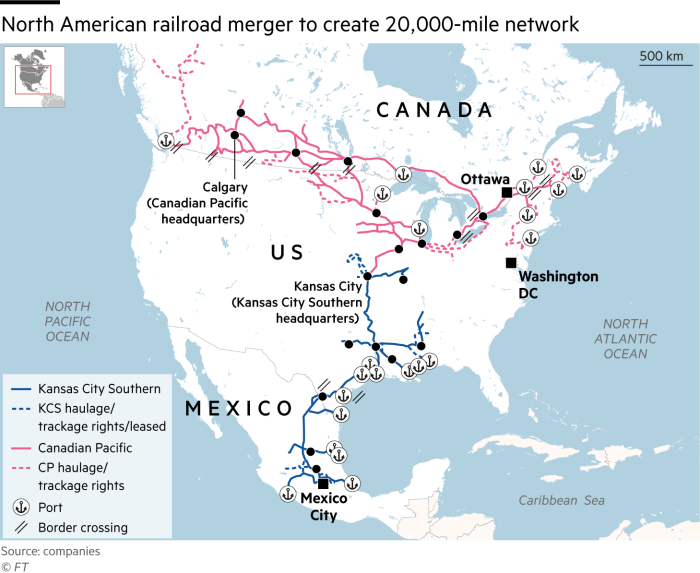

Two rail operators inked the largest takeover deal of the year this weekend.Â

But to understand Canadian Pacific Railway’s purchase of US operator Kansas City Southern for $28.9bn, we need to go back 10 years in time.

One late summer afternoon in 2011, railroad turnround legend Hunter Harrison and Bill Ackman lunched at Manhattan’s Museum of Modern Art.

The activist investor behind Pershing Square was hatching a boardroom coup at CP, and he wanted Harrison to be its new chief executive. “Bill, you can’t afford me,†Harrison said, half-jokingly, according to his biography. He could, as it so happened.

Under Ackman’s new regime, the Canadian operator unsuccessfully approached US rival CSX, and then Norfolk Southern, about potential mergers in 2014 and 2016. Both targets insisted that the Surface Transportation Board, the US regulator, was so unlikely to approve a deal that it wasn’t worth considering.

Harrison unexpectedly resigned and hopped aboard CSX in 2017, a move orchestrated by activist fund Mantle Ridge. He died less than a year later at the age of 73.

But the tenacious railway turnround artist, who at one shareholder meeting declared himself fit to run the company while hooked up to a portable oxygen machine, might’ve appreciated that CP has finally struck a deal after multiple failed M&A attempts.

News of the potential deal comes just months after Kansas City Southern rejected a takeover bid last September from a Blackstone and Global Infrastructure Partners-led consortium that valued its shares at $21bn.

If successful, the tie-up will connect railways between Canada, the US, and Mexico for the first time, emboldened by what the two parties hope to be a booming post-pandemic US economy and a new free trade agreement between the three countries.

But US regulators have stood in CP’s way before, reluctant to let the country’s seven “Class I†rail operators diminish in number.

Seeing that Kansas City Southern is the smallest of the lot, the acquirer may argue that the combination will be less of an antitrust headache, and create jobs in the process.

Four homes, a jet, a helicopter and an estate: inside Sanjeev Gupta’s world

The market for £42m houses in London’s Belgravia is small — or “very rarefiedâ€, as local estate agents say.Â

For the metals magnate Sanjeev Gupta, however, snapping up one such home (where neighbours include Russian oligarch Oleg Deripaska and Ukrainian oligarch Gennadiy Bogolyubov) was a matter of adding another multimillion-pound property to a collection.

Gupta also owns a £19.5m property in Sydney, a £3m estate in Wales, a villa on Dubai’s man-made Palm Jumeirah and the Jahama Highland Estates in Scotland.Â

“Sanjeev plants flagpoles in the ground by buying a home wherever he sets up a new business,†a family friend told the FT.Â

Other accoutrements include a private jet, a helicopter and an extensive collection of Scotch whisky — and Gupta is known to have entertained friends in Sydney on a 31-metre yacht.Â

Catch up here on the story of the remarkable wealth Gupta has amassed as he has built a global industrial empire using opaque financing and generous government support.

He bought the six-storey London townhouse the month after his ailing steel empire received hundreds of millions of pounds of taxpayer-backed loans in the UK to help it through the coronavirus pandemic.Â

Gupta’s empire now faces a potentially bigger crisis, the collapse of Greensill Capital, which it relied on heavily for financing.Â

Reminder: Greensill had funded Gupta’s empire based on invoices from ostensibly independent companies that were actually linked to the steel magnate.Â

The now-insolvent Greensill had $5bn of exposure to Gupta’s businesses — a number that Germany’s financial regulator had been pushing it to reduce.Â

Other developments in the Greensill story:Â

-

Investors in Credit Suisse funds linked to Greensill have enlisted law firms in preparation to sue the lender;Â

-

Credit Suisse is pointing the finger at Marsh & McLennan, the world’s largest insurance broker, in its internal review;Â

-

Conservative MPs have thwarted calls for an investigation into the collapse of Greensill, which could have left the former UK prime minister David Cameron facing difficult questions about his role as an adviser to the group.Â

Job moves

-

Mark Branson, the head of the Swiss finance watchdog Finma, is set to become president of BaFin as the German regulator looks to new leadership to restore its reputation after the Wirecard fraud scandal. Read more here.

-

James Anderson, who has managed the £17.5bn Scottish Mortgage Investment Trust since 2000, will step down in April next year. Read more here. Anderson has been nominated as the new chair of the Swedish investment company Kinnevik and plans to join in April 2022.

-

Simon Russell joined Nomura to lead its technology, media and online services investment banking division for the Europe, Middle East and Africa region from London. He joins from Macquarie Capital.

Smart reads

Inside ‘WhiteRock’ Essma Bengabsia was one of the first hijab-wearing women to work on the trading floor of the world’s largest fund manager until unchecked discrimination became too much to bear. Her story brings BlackRock’s “sustainable†capitalism ethos into question. (FT)

Trying for one-trillion On its quest to obtain $1tn in assets by 2026, Blackstone’s Jonathan Gray is flipping the script from its tried-and-true value-based investment approach to betting big on growth. (Wall Street Journal)

Billionaires go shopping Spacs were just the beginning. In addition to gambling on newly formed public companies without products, let alone profits, wealthy investors are exploring all sorts of new frontiers — from bespoke luxury furniture to baseball cards and crypto art. (New York Times)

News round-up

David Solomon commits to Saturdays off for Goldman Sachs bankers (FT)Â

UBS is in talks to buy Brazil’s biggest asset manager (Bloomberg)Â

BlackRock begins internal review into discrimination claims (FT)Â

Ardian and GIP make €11.9bn offer for large part of Suez (FT + Lex)Â

Blackstone makes $6.2bn bid for Australian casino operator Crown (FT)Â

Deliveroo targets IPO valuation of up to £8.8bn (FT)

Odey was cleared of sexual assault. Now other accusations emerge (BBG)

Cadbury maker Mondelez scoops up ‘Carb Killa’ in healthy push (FT)Â

Global investors seek freeze on China chip champion’s foreign assets (FT)

[ad_2]

Source link