[ad_1]

This article is an on-site version of our #techFT newsletter. Sign up here to get the complete newsletter sent straight to your inbox every weekday

The US and its allies switched focus from Russia to China on Monday, in allotting blame for damaging cyber attacks on government institutions and private companies.

While Russian-based hackers have been held responsible for a series of ransomware attacks, such as the Colonial Pipeline security breach, a senior White House official said today that China’s Ministry of State Security was using “criminal contract hackers to conduct unsanctioned cyber operations globally, including for their own personal profit. Their operations include criminal activities, such as cyber-enabled extortion, crypto-jacking and theft from victims around the world for financial gain.â€

The official added that the US had a “high degree of confidence†that attackers on the MSS payroll had carried out the offensive on Microsoft’s Exchange email application, which was disclosed in March and is estimated to have hit at least 30,000 organisations. The US move to condemn China was supported by a coalition of allies, including the EU, UK, Australia, Canada, New Zealand, Japan and Nato.

In addition, the US Justice department unsealed an indictment alleging that four Chinese nationals affiliated with the MSS had overseen a separate campaign to hack companies, universities and government entities in the US and overseas between 2011 and 2018, stealing information on sensitive technologies such as autonomous vehicles.Â

China itself is more concerned about the overt acquisition of key information, stemming from the US passing the Cloud Act in 2018, which allowed law enforcement to request data stored outside its territory.

Our Beijing team reports this shot data security to the top of China’s political agenda, and intertwined data with national security. Beijing rushed to create legal barriers against what it saw as “long-arm†tactics used by foreign governments to access data. This has led to the MSS pushing for a sweeping new Data Security Law to be introduced in September, while in the meantime, its staff have been based inside New York-listed ride-hailing service Didi to review its handling of data.

Closer to home, Roula Khalaf, the editor of the FT, was among more than 180 journalists listed as potential targets by users of the Pegasus spyware tool licensed by Israel’s NSO, according to a Forbidden Stories investigation. A forensic analysis found 37 phones belonging to journalists, human rights activists and other prominent figures were infected or faced attempted infections by NSO spyware.

The Internet of (Five) Things

1. Pentagon drones disappoint

Concern about use of Chinese technology in sensitive areas prompted the Trump administration to ground every one of the defence department’s 810 drones in 2019. This scoop from Kiran Stacey in Washington reveals the Pentagon’s replacements cost far more and are far less capable than the Chinese-made models.

2. Driverless tech’s new direction

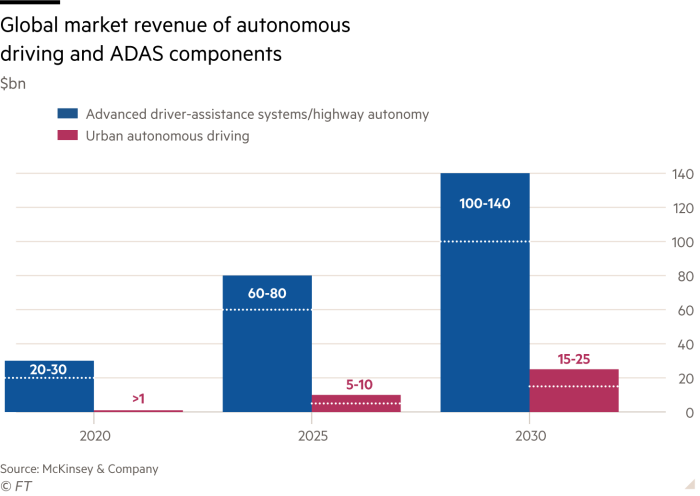

Suppliers of advanced driver-assistance systems, or ADAS — a bottom-up approach to building autonomous technology — are making massive strides, with some experts saying this is a better pathway to scaling driverless tech. If they are right, reports today’s Big Read, then the central risk for robotaxi hopefuls like Waymo is not whether full autonomy can succeed, but whether an entirely different approach to the problem will get there first.

3. Zoom buys Five9, Tencent takes out Sumo

Booming video conferencing app Zoom is to buy cloud software provider Five9 for about $14.7bn in its first major acquisition, designed to expand the Zoom Phone offering. In the video game world, China’s Tencent has struck a £919m deal to buy the UK games developer Sumo. Lex says the 33 times ebitda multiple trumps the 30 times one paid by Electronic Arts for Sumo’s compatriot Codemasters last year.

4. India’s tech IPO boom

Food delivery app Zomato has kicked off a flurry of stock market debuts by Indian start-ups that hope crackdowns on Chinese tech could prompt global investors to turn their attention to India’s tech offerings. Investor demand for Zomato’s IPO outstripped supply by 32 times as of Friday and it is expected to be followed by the $2.2bn listing of payments app Paytm. (In the US, online brokerage Robinhood is seeking a valuation of up to $35bn in its initial public offering, a filing revealed on Monday)

5. Ackman changes plan

Bill Ackman’s special purpose acquisition company has abandoned plans to buy a $4bn stake in Universal Music Group after a backlash from regulators and investors. The acquisition of a 10 per cent stake will be done by the billionaire’s Pershing Square hedge fund instead. Universal has profited from streaming services, but Nic Fildes reports politicians are aiming to close the gap between what record companies are making and what is trickling down to artists.

Tech week ahead

Monday: IBM, which recently unveiled a management shake-up, publishes second-quarter earnings after the US markets close.

Tuesday: Netflix is expected to post a rise in second-quarter revenues when it reports. Slower production of TV shows and movies during the pandemic in the quarter could have hurt the world’s largest streaming service’s subscriber growth. Days after Richard Branson flew the flag for Virgin Galactic, Jeff Bezos aims to match him — on the anniversary of the first Moon landing — by climbing the full 100km to the edge of the atmosphere in his Blue Origin rocket.

Daily newsletter

#techFT brings you news, comment and analysis on the big companies, technologies and issues shaping this fastest moving of sectors from specialists based around the world. Click here to get #techFT in your inbox.

Wednesday: Chipmaker, Texas Instruments is expected to post a rise in second-quarter revenue as its in-house manufacturing capacity gives it an edge to meet demand in a supply-constrained atmosphere compared to its peers. Dutch chip equipment supplier ASML reports on its second quarter as well. Telecoms operator Verizon and business software and services provider SAP will also report earnings before the US market opens.

Thursday: After the bell, Intel is expected to post a fall in second-quarter revenues as it loses market share to its rival AMD. Investors in AT&T, having seen it split off its media assets, are anticipating a glimpse of a return to past times when Ma Bell just provided phone services. Expect Thursday’s earnings call to put the focus on its wireless business after a couple of positive quarters. Twitter and Snap also report.

Friday: Mobile operator Vodafone should have a good first-quarter trading update as it hopes to regain ground after the Covid-19 hit to last year’s numbers, when the drop in roaming revenue and business activity weighed on the company. Foxconn chair Young Liu answers shareholders’ questions at the key iPhone assembler’s annual general meeting in Taipei, and offers his outlook on business prospects for the second half of the year. He is expected to give an update on the company’s growing electric vehicle business.

Tech tools — Security ‘daleks’

SmartWater boss Phil Cleary affectionately describes his VideoGuard 360 fleet of miniature, CCTV-enabled robots as “daleksâ€. The battery-operated sentinels patrol their turf 24/7, but can sit inert until their attention is piqued by unexpected moveÂment. Then they swing into action, blazing a spotlight at a would-be burglar while blaring an announcement that the police and security team have been alerted to their presence. Mark Ellwood looks at these and other cutting-edge home-protection tools for FT Weekend.

[ad_2]

Source link