[ad_1]

A combination of economic and structural problems hound China and contribute to its problems with the world, other than the ongoing trade controversy with the United States. Solving the problem requires a comprehensive approach that we have not yet seen in China or abroad.

Chinese savings can no longer drive domestic and international consumption, as international economists had hoped for some two decades, because it is used to support a gargantuan national debt.

The Economist recently noted, “When the global financial crisis erupted in 2008, some economists pointed to the Asian saving glut as an underlying cause of the housing boom and bust from Las Vegas to Dublin. With interest rates even lower now, some are again asking whether excessive saving in Asia is storing up trouble for the global economy.â€

In China, people save money because there is just a thread-bare welfare state in place. Individuals are largely responsible for their own education, health care, unemployment and retirement. This provides limited resources for consumption, besides the old well-established mindset of saving money for an uncertain future.

Before the financial crisis, there were plans for a welfare system. But it was never set up.

Now Chinese savings – standing at about 50% of income, the highest in the world – plus foreign reserves of more than US$3 trillion, and administrative restrictions are paying for and safeguarding an immense mountain of debt mostly accumulated after the 2008 financial crisis. This debt is mostly unknown, hidden in the accounts of provincial and county administrations, and with State-Owned Enterprises (SOE).

Including state debt, the total amount is estimated at more than 300% of China’s GDP, i.e. it could be about US$40 trillion, or about half of global GDP. China’s M2, money in circulation, potentially 40% of worldwide money in circulation. Moreover, the Chinese central bank may not be in control of what tech giants like Tencent or Alibaba do with their money and their B2B and B2C tech-credit. Due to the structure of the Chinese state, this debt weighs heavily on its shoulders.

The United States also has a large debt. The ratio of state debt to GDP in 2019 is about 104%. To this, one can add state and local debt, bringing the total to about 140% of GDP, or about US$28 trillion, reportedly the grand total of US debt. Total US debt including all forms of government, state, local, financial, and entitlement liabilities may come close to 2,000% of GDP or about 3-4 times global GDP. Here’s how it is composed:

• About 100% of GDP combines federal, state, and local government debt

• 150% for households and company debt

• 450% for financial debt, which carries “conceptual issues and risks,†namely that debt held by financial firms often represents potential in a worst-case scenario involving various derivative instruments that can carry high notional levels that are unlikely ever to be realized

• 27% in trusts for social insurance programs

• 484%, which values all the promises from current social insurance programs

• 633%, which tallies up an “infinite horizon†of obligations for social programs, rather than just the traditional 75 years used in computations

But the structure of this debt is very different from the Chinese one. Unlike in China, where people have money (savings) and the state has debts, in the US, debts weighing on normal people and companies are 90% of the total outstanding debt. Even if we take these figures for the American debt at face value, which is something many economists dispute, the US debt is well structured so that it is digestible on the global scene. A default on these private debts has very different political and social implications than a default on the national debt, as in China.

Moreover, as the US is a global debtor and the financial center of the world, a partial or total default on its debt would directly take the whole world with it, its consequences would be disastrous, and thus everybody will have a stake in supporting the present status quo. China – being relatively isolated, a net creditor, and most importantly with unclear, unstructured debt – poses challenges on a different level to the global economy.

As former Goldman Sachs CEO Hank Paulson said in Beijing last week: “For the United States – which has liquid, sophisticated, transparent, and hitherto open capital markets – financial services are an area of tremendous competitive advantage. For China, meanwhile – which has suffered from illiquid, underdeveloped markets, and too little transparency – this is an area that has been largely closed to the world for much too long. And this has contributed to the misallocation of capital, inefficiencies, hidden debt, and risk across the Chinese financial system.

And he suggested: “One of the primary issues of concern in financial services has been the difficulty of accessing the records of Chinese companies listed on US exchanges. If China permits the Public Company Accounting Oversight Board to conduct inspections of Chinese accounting firms, it would build trust and confidence in the quality and transparency of these listed Chinese companies. And I suspect it will also have a salutary effect on the US debate. But without such steps, we are moving not toward more financial integration but toward a potentially destabilizing decoupling.

Yet this is not simply a financial measure. In the late 1990s, around the time when China was discussing joining the World Trade Organization (WTO), China’s then-Premier Zhu Rongji considered opening its capital accounts by the year 2000. However, as the 1997–98 Asian financial crisis developed, China was clear about the social and political implications of opening its financial markets. Financial investment that had poured into Asia in the past years, looking for opportunities and banking on the fast growth of Asian rising economies, flew out at the first signs of unsustainable debt.

Companies went bust, currencies collapsed, inflation went sky-high, people were up in arms, and political systems fell apart. All over Asia, the old political outline changed in a few months. Balances of local power from Thailand to Indonesia to the Philippines were toppled, and new political systems came about. Basically, all authoritarian regimes fell and only democracies like Japan withstood the blow.

That is, in case of an economic shock, social turmoil is to be expected. In this situation, if the political system is flexible, the government will step down, a new election can be called, a new prime minister will move in, and life can restart almost effortlessly. If, however, the political system isn’t flexible, in case of economic and social turmoil, the regime may fall apart or it may crack down on the social upheaval – neither is an ideal outcome. Grounded in this analysis, China 20 years ago postponed until today its plans to open its capital market.

Accordingly, the same problem applies now, and even more so as China’s economy is larger and has far larger debts than two decades ago. China needs to have a flexible political system to withstand the likelihood of a financial and social crisis following a future possible sudden outflow of capital when and if its markets are seamlessly linked to global markets. In fact, a financial crisis in China is long overdue. Whereas in the past 40 years, since Deng’s policy of opening up, the US and the world went through several big and small crises, China fared almost effortlessly without any major economic jolt. Conversely, this time it went through several big and small political crises, although none would be of the quality and size promised by a major economic crunch.

Then to sensibly open its financial markets, China needs also to open its politics to prepare for a possible social and political fallout.

2008 Aftermath

Furthermore, China spent much of its money to prop up its domestic economy in the aftermath of the 2008 financial crisis. This also helped the global economy to weather the crisis. Most of the money was used for badly needed infrastructure and partly used in wasteful speculation and construction projects.

The result is that China is now without a proper welfare state (something that would encourage personal spending) and without money. Beijing possibly sits on top of the biggest bubble in economic history.

Moreover, if China were to open its market, as the US and the world demand, the burst would trigger perhaps one of the largest emergencies in history. A dramatic Chinese political crisis would ensue. This would be a reason to keep things closed. On the other hand, the bubble can’t be allowed to grow any bigger, because the world could simply not survive the consequences of China’s growing debt. It is a huge conundrum for China and everybody else.

Perhaps an international initiative for restructuring Chinese debt and for massive economic and political reform is needed to help China and the world quickly transition from the present situation.

But all of this is only part of the problem.

Structural fissures

China’s culture, its flesh and blood, was made by its bureaucracy. China actually invented bureaucracy, which came to the West through the work of the Jesuits in the 17th century.

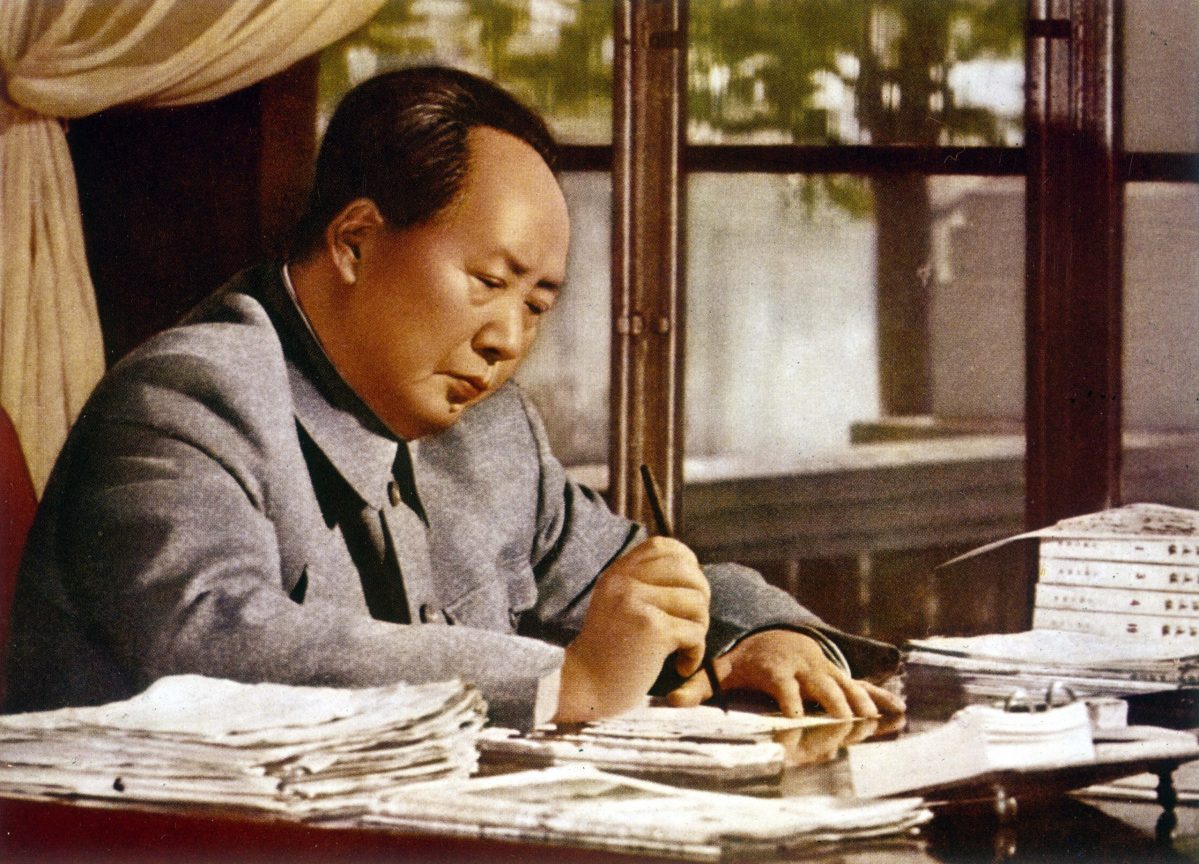

Maoist China expanded the bureaucracy to an unprecedented level, bringing for the first time in China’s history the central authority down even to the village. Previously the massive Chinese bureaucracy would stop at county level. Below that the local officials would rely on the heads of large families to keep order. This allowed reasonable wiggle room for both the county official and the local grandees to adapt to central orders and take administrative and entrepreneurial initiative. Their official duty was to oversee and direct; the local grandees were to do the hard work. It was the traditional patronage system.

With communism, anything that was not approved and sanctioned by Mao simply could not exist.

At Mao’s death, his absolute concentration of power was deemed the root cause of China’s poverty and backwardness. Deng in the early 1980s reformed the system by decentralizing power and giving freedom of decision and enterprise to officials. In a way, it meshed the old imperial system with the later Maoist system. It allowed new wiggle room for local officials who became entrepreneurs themselves and in fact were put in competition with one another. Promotions were dispensed to the officials who managed to push economic growth higher than other officials.

In the early 1990s, after the Tiananmen crackdown, youngsters were allowed to plunge into business and become rich, by any means, in return for keeping away from politics. It was a new major political and social contract: a promise of wealth in return for giving up political interests.

Just two decades before, during the Cultural Revolution (1966–1976), Mao had cut an opposite social contract. He gave the young his blessing if they took part in the political upheaval he had started. Youngsters were allowed to roam the country, disrupting all normal life and fighting with one another by proclaiming the reddest, most Maoist political ideals, in return for accepting their poverty and keeping away from any significant entrepreneurial activity.

In the early 1990s, a powerful model of patronage capitalism started moving – officials provided the “political permits†and entrepreneurs did the work. It all occurred under American goodwill that guaranteed the international political security and its own ample market, the market for most of the world for Chinese exports, and encouraged technological transfers that allowed China’s rapid production upgrade.

However, in the early 2010s, the situation started to implode. Decentralization of power had been accelerating, everything had to be done through consensus, and more and more people had to be part of this consensus. Ultimately, it was just too cumbersome, nobody was really in charge, and because of that, a group of people such as then Chongqing Party Chief Bo Xilai defied party discipline and basically tried to stage a coup to upend the agreement reached on making Xi Jinping the number one.

The party reacted and Xi Jinping concentrated power in his hands starting from the 2012 Party Congress. His vaunted goal was to reform underperforming SOEs sitting on over 70% of China’s assets yet producing possibly less than 20% of its GDP. For this he launched a massive anti-corruption campaign.

Xi managed to destroy the old system of patronage capitalism but didn’t manage to reform SOEs, didn’t replace the old system, and moreover after concentrating immense powers, he has not redistributed them in a different way. The result is a gargantuan bureaucracy, unparalleled in history and in the world, but without much autonomy and wiggle room, and that doesn’t take initiative. Xi decides everything, but for a country of 1.4 billion people, it means de facto paralysis. Xi is hostage to the bureaucracy, and the bureaucracy is hostage to Xi.

Moreover, entrepreneurs, without the old patronage and without a new system are scared and inactive. There is no welfare system to encourage consumption and therefore, the only way to push growth is through financing more infrastructure projects, which have steady, long-term returns but create a lot of debt. This sits on the massive debt created after the 2008 financial crisis and increases one of the biggest bubbles in history – the US $40 trillion mentioned above.

This debt is protected by administrative measures forbidding the free flow of capital in and out of the country. But this mechanism also has a massive impact on Chinese investment and policies abroad, economic and strategic. To feed this debt and push the economy forward, China needs savings from its people and earnings from its exports. Without a net surplus, people could put less money in the banks, and develop an even deeper mistrust of the government. For its exports, China’s investment plans abroad can guarantee captive access to a local foreign market.

Moreover, Hong Kong also plays a crucial role. It works as a safety chamber of communication between the closed Chinese economy and the open global economy. With Hong Kong, all exchanges with the open financial world outside are relatively easy. Without it, and with Chinese strict administrative controls, everything would be more difficult. That brings a strategic necessity for the present economic and political situation in China. Beijing needs to keep Hong Kong under control (to not have the territory become a springboard for political or economic sedition in the Mainland), and also relatively free, to avoid being basically isolated.

China’s loss of destiny?

Then China faces two forces that deeply threaten its viability in the near future:

• The first is a decision-making paralysis

• The second is a massive and ongoing accumulation of debt

And yet all of this is nothing compared to a deeper issue: China’s loss of destiny.

A state is made up of geography, history, and “destiny,†a great political project decided by politics and from which derives its “great military-foreign strategy.â€

This starts with the form of government.

In the history of the Mediterranean, since ancient times the debate was between three forms of government, as Aristotle summarized, monarchy, oligarchy, democracy, and their variants. But the internal organization of the societies was similar: there were landowners and below them a system of slaves or serfs kept the economy going. Their chance for social advancement came from being given a chance to serve in the army and rising through the ranks thanks to valor.

In ancient China, the debate was different. All philosophers were for the monarchy and some kind of bureaucracy. Oligarchy, democracy or other forms of governments were not considered. But then the debate was about how to fix these monarchies, and how to organize the state. Was the monarch be chosen by hereditary lineage or by cooptation? Moreover, was the bureaucracy to help the ruler run the country to be selected by merit (as Hanfei zi proposed), or family affiliation (as some rulers seemed inclined to do)? Was the bureaucracy to be managed only with punishments and prizes (as Legalists preferred) or instead with ethical norms (as Mencius wished)?

What model should the organization of the state and “Under Heaven†follow? Should it be the strict management described in Mozi’s Shang Tong and Shang Xian chapters, or the trust in the large, powerful families that would congregate with the state? And between states of the “Under Heavenâ€, should there be a hegemon or a relationship between equals (as described in Mozi’s Fei Gong)? Below the monarchs and the officials, a system of small farmers vexed by taxes and levies kept the economy going. Their chance for social rotation was staging or being part of a successful uprising or rising through the ranks of the bureaucracy thanks to hard study.

Imperial Rome

Imperial Rome was a synthesis of all previous political theories. The emperor was not a king and not a republican chief, and his power was balanced by those of the senate and of powerful generals. Even Byzantium, where the emperor became more “Oriental†and divine, had a system of balances with the generals and a new role for the Christian Church and its hierarchy.

Similarly, the Han empire synthesized the previous debate. The emperor ran the country with an efficient bureaucracy largely selected on merit, although imperial relatives had clear clout. A system of officials was put in place, but large, rich families kept a huge influence. Even when with Tang and Song objective system of examination was put in place, rich families kept power. In fact, the difficult dialectics of rich families and bureaucracy often tilted the dynastic cycles. Some farming families made more money than others, thus accrued more land, and with greater income bribed their way out of taxes. Tax burden then over time grew larger on poorer farmers who became poorer, were left with nothing to lose, and turned into bandits that eventually toppled the dynasty.

But this is the legacy. The problems of China now are the following. It has a sense of its geography, a certain sense of history (ancient), and a political project dictated by the Communist Party. But the meaning of this geography has changed: once its world was its territory, and its neighboring space confined by the northern and western steppes, the southwestern Tibetan plateau, jungles, and the ocean.

Now it is part of a global circulation and the idea of its geography has changed – will its sense of history also change? In a “global-Western†world, should China’s sense of history follow its new sense of geography? Then the meaning of history changes, does it belong only to “its†Chinese imperial history, or does it also belong to that of the West?

For instance, the sense of history of India (once also isolated from the Western world) has changed, following changes in its geography. New Delhi feels heir to the British Empire, and therefore is in a head-on collision with Pakistan, its split from which has carved up the unity of imperial India. At the same time, Pakistan perhaps is stuck between two senses of history, is it heir to the Mughals or the British Empire? In any case, both India and Pakistan know more and better than China that they belong to the world as a geography and also to its history.

So what is the fate of China today? That of Mao was universalistic, keeping its domestic system closed but willing to export its communism to the world. With Deng there was a lack of political-ideological exports, and it exported a growing quantity of goods adapting to some trade.

Now? What is the Belt and Road Initiative? A maneuver against the Western world (therefore a sort of new Soviet challenge) or an attempt to integrate into the Western world with its constructive contribution? It is not clear.

It is not clear whether China wants to sinicize the world, replace what it perceives as American hegemony, or accept a role in a world that is not its own.

These choices are also behind what to do with China’s debt, the opening of its financial markets, and the trust it has in this world and its sense of future. Past margins for ambiguity are gone. Protests in Hong Kong, trade disputes, and rising internal debt are forcing stark choices.

Either China accepts massive political and economic reforms, or it will have to close down. The longer it waits, lingering in its ambiguity, the harsher the necessary choice between political reforms and closing down will become.

This article first appeared in settimananews.it and is reprinted with permission.

[ad_2]