[ad_1]

Companies are preparing to launch a record wave of share buybacks as executives get comfortable with spending excess cash following a blockbuster earnings season and greater clarity on the trajectory of the world economy.

US companies announced $484bn in share buybacks in the first four months of this year, the highest such total in at least two decades, according to Goldman Sachs.

The figure foreshadows a big acceleration in the pace of buybacks, which have already begun to rebound from their nadir last year, when the pandemic encouraged companies to hoard cash in case of a long downturn.

In what its analysts dubbed a “buyback bonanzaâ€, Goldman projected shares repurchases by US companies would increase 35 per cent this year from 2020.

The pace in Europe appears to be lagging the US, but Société Générale predicted that buybacks on that side of the Atlantic could eclipse their pre-pandemic levels next year by some 25 per cent.

Howard Silverblatt, senior index analyst at S&P Dow Jones Indices, said companies were becoming more confident in their outlook, even if uncertainties remain.

“Things are getting better, and companies have a little bit better cash flow,†he said. “Before, you had a thousand scenarios, and now maybe you have only a hundred, so it’s a little bit easier to think.â€

Big tech groups whose businesses have accelerated under the pandemic have been among the companies expanding buyback authorisations most aggressively. Apple and Alphabet announced an additional $90bn and $50bn in repurchase plans, respectively, last month.

The planning for buybacks is widespread across industries, however. “We did suspend the buyback last year because of uncertainty,†James Saccaro, chief financial officer of healthcare company Baxter, said at a conference on Tuesday, but the company returned to the market in the fourth quarter last year. “We like doing it.â€

Analysts say banks are also eager to return to the practice at scale as the Federal Reserve loosens pandemic-era restrictions on returning cash to shareholders.

Jamie Dimon, chief executive of JPMorgan, whose board gave the green light to a $30bn buyback programme in December, said last month his bank was “buying back stock because our cup runneth overâ€.

Current spending on buybacks is still trailing behind last year’s levels, according to data by S&P Global.

As of last week, with more than 80 per cent of the S&P 500 having reported earnings, companies said they had, on aggregate, bought back $140bn in shares in the first quarter. That is more than in each of the previous three quarters, but less than the $199bn in last year’s first quarter.

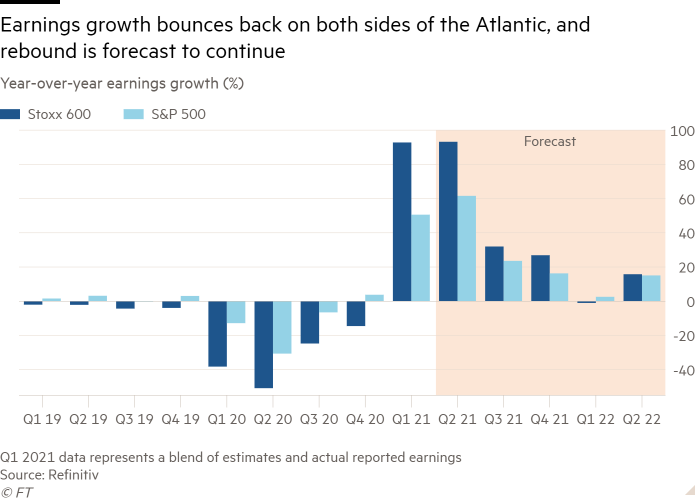

Companies in both the US and Europe have been reporting blowout first-quarter earnings over the past few weeks, sending analysts scrambling to revise their expectations upwards.

S&P 500 members are on course to report year-over-year earnings growth of about 50 per cent, while companies in Europe’s Stoxx 600 look set to have achieved a 90 per cent rebound when the last few results are in, according to Refinitv.

Strategists are predicting the pace of buybacks will increase more quickly than that of dividends.

“When you increase the dividend it’s painful for the company to cut it,†said Roland Kaloyan, head of European equity strategy at Société Générale. “When you have extra cash it’s easier to buy back some shares. If you have bad news or a new crisis you can always [pause] your buyback programme.â€

[ad_2]

Source link