[ad_1]

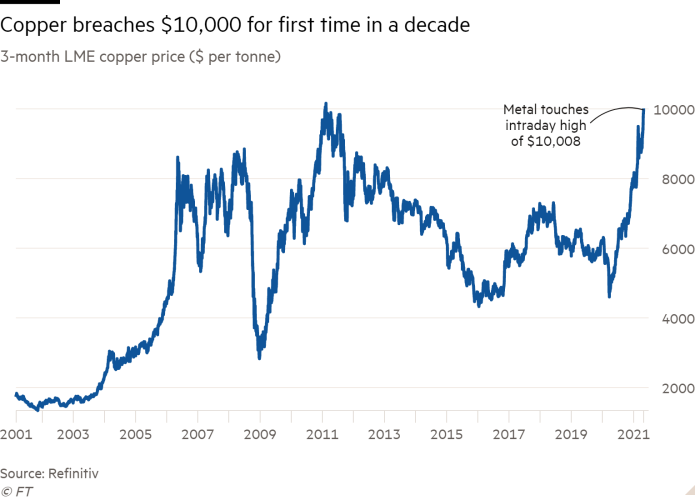

Copper, the world’s most important industrial metal, has traded above $10,000 for the first time in a decade as the rebound from the coronavirus pandemic unleashes a surge of demand from China and the developed world that could not be matched by supply.

After a wobble in March due to concerns about fresh lockdowns in Europe and a strengthening US dollar, copper has resumed the powerful rally that started a year ago when it sank to $4,300 a tonne.

The price has climbed 11 per cent since the start of the month and is now closing in on the record high of $10,190 set during a commodity boom in 2011. It reached $10,008 on Thursday before paring gains and trading at $9,850.

“With reflation signals on fire, copper could test all-time highs,†said Bart Melek, head of commodity strategy at TD Securities.

Copper is used in everything from household appliances to electric vehicles and wind turbines. As the most cost-effective conductive metal, it is expected to play a crucial role in the shift away from hydrocarbons to more sustainable sources of energy, including solar and wind.

This has fuelled talk of a copper supercycle, or a prolonged period of strong demand that pushes prices to record new highs. In a recent report, Goldman Sachs declared copper as the “new oil†and said green demand will match, then quickly surpass, the incremental demand China generated in the 2000s.

However, the recent run in the price of copper reflects a coronavirus-induced supply-demand imbalance that could result in a 500,000-tonne reduction in refined metal stockpiles this year, according to Max Layton, analyst at Citi.

“The ‘super’ part of the copper supercycle is in full swing right now reflecting a strong cyclical rebound in China and unusually swift and metals intensive rebound in the US and Europe,†said Layton.

Outside of peak construction periods, it is highly unusual to see a significant draw of refined inventories. One occasion was in the first half of 2011 when copper hit a record high, and the other in 2003 and 2004 when China’s industrialisation started to gather pace.

“This is the only third time in 20 years that copper has the potential to really draw refined inventories and it’s because of the scale and pace of the consumption recovery,†said Layton, who reckons copper could hit $12,000 a tonne later this year. “We are in a really rare period.â€

On the supply side, copper production has been disrupted by coronavirus-related lockdowns and restrictions.

Escondida, the world’s biggest copper mine, recently reported an 8 per cent drop in production to 821,000 tonnes in the nine months to the end March. It also warned of a tough operating environment across Chile because of escalating Covid-19 infections.

While the increase in copper prices will eventually lead to new supply, it will take time before that comes on line. It takes about 10 years to bring a new copper mine into production and two to three years to expand an existing mine, according to analysts

“Significant demand growth is inevitable,†Richard Adkerson, chair and chief executive of Freeport-McMoRan, the world’s biggest publicly listed copper company told investors last week after publishing results. “Supply to meet this growth is severely challenged. It’s going to require meaningfully higher prices to support mine investment.â€

[ad_2]

Source link