[ad_1]

When markets went into freefall last spring, investors fled mutual funds apart from one sector: sustainable investing.

This area — where environmental, social and governance issues are factored into investment decisions — had long been viewed as niche, often the preserve of charitable foundations and religious orders.Â

But 2020 “was the year ESG came of ageâ€, said Mirza Baig, global head of ESG research and stewardship at Aviva Investors, the UK fund house.

Despite the big sell off last March, sustainable funds ended the first quarter of 2020 with net sales of $38.8bn globally compared with outflows of $373bn for all long-term mutual funds, according to Morningstar, the data provider.

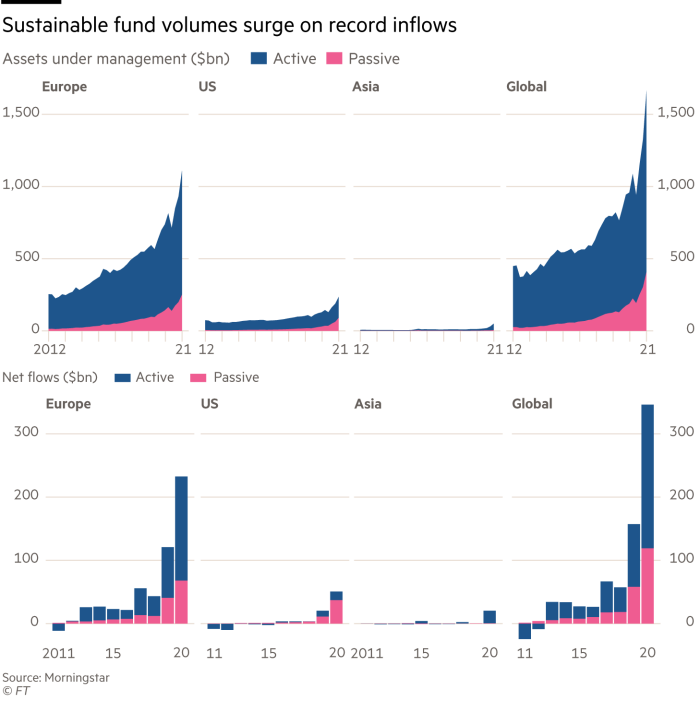

By the end of the year, the total assets in sustainable funds hit a record of almost $1.7tn, up 50 per cent over the year, on the back of a record year for sustainable fund sales.Â

“From the investment perspective [the rise of sustainable investing] was the dominant story parallel with the [Covid-19] crisis. Lots of ESG funds outperformed and that galvanised appetite to start allocating more capital,†Baig added.

Research from BlackRock, the world’s largest asset manager, also found that ESG strategies outperformed during last year’s period of intense volatility, with 94 per cent of leading sustainable indices beating their parent benchmarks in the first quarter.

The strong sustainable fund sales and performance came in spite of predictions the pandemic would damage the growth of the industry. Sceptics argued that a recent focus on ESG issues would be ditched as companies simply battled to stay afloat.Â

Instead, big asset managers said the pandemic highlighted how catastrophic events such as climate change would impact investment returns. The crisis has also increased attention on the S of ESG, with investors and society increasingly focused on how companies treat all their stakeholders — from employees to suppliers to shareholders.

But the growing interest in ESG is not shared equally around the world. Europe is by far the most developed market, accounting for close to 70 per cent of the global sustainable fund universe, according to figures from Morningstar. Assets under management in sustainable funds have grown almost fourfold from $450bn in 2011.

Signs exist that interest is picking up in other markets, including the US. Last year, sales of sustainable funds in the US stood at $50bn, far below Europe’s $233bn but more than double the previous year’s numbers. The election of Joe Biden, who has promised green reforms, is expected to further drive interest.

Many active managers have piled into ESG investing in recent years, believing it will help revive their fortunes after struggling to compete against the rise of passive funds — which track an index rather than actively choose stocks. Active funds account for almost $1.3tn of the $1.67tn assets under management in sustainable funds, but passive funds are also growing rapidly.Â

Last year, the assets under management in sustainable actively managed funds jumped 45 per cent, but this was up more than 80 per cent for passive funds.

But greenwashing looms large, with fears that some asset managers are rebadging funds as ESG investments, with little changes to their strategies.Â

This repurposing of existing funds to turn them into a sustainable fund remains very much a European phenomenon. In some cases, existing funds are rebranded with green credentials to avoid having to start a new ESG fund from scratch, but critics warn that this could be just masking ailing portfolios, while trying to attract flows to struggling investments.

Concerns also exist that some ESG funds are not as sustainable as investors might expect. Some of the largest ESG funds, for example, still hold stocks of the largest carbon emitters in the world.

Three of the largest 12 ESG funds with combined assets under management of $85bn still have exposure to oil & gas groups such as ExxonMobil, Chevon and ConocoPhillips — some of the largest producers of carbon gases in the world. Morningstar does not have holdings data for two funds in the top 10.Â

Northern Trust World Custom ESG Equity index fund has more than 50 investments in oil and gas groups totalling $213m, according to Morningstar, more than any other of the large ESG funds analysed in our data set by number of oil & gas investments.

BlackRock’s iShares ESG Aware MSCI USA has the largest exposure in dollar-terms, with approximately $283m, about 2 per cent of its assets under management.Â

While energy exposure remains low, averaging roughly 2 per cent across the largest ESG funds, the holdings in oil and gas companies suggest investors who are concerned about the effects of fossil fuels need to pay close attention to which fund they choose.

Northern Trust Asset Management said it offered a range of sustainable investing solutions “designed to meet our clients wherever they are on the ESG spectrumâ€, adding that the fund in question is not designed to be free of fossil fuels.

BlackRock said its iShares fund “appeals to investors that are looking to invest in companies with strong sustainability characteristics across all industries and sectorsâ€.

Asoka Woehrmann, chief executive of DWS, the €793bn asset manager, said while greenwashing was a risk, there was huge appetite from retail investors and big pension funds for products that invest sustainably.

“The Covid crisis was an important stress test for theses products. There was a view that these products would be a good weather product,†he said. “But the resilience of these products is remarkable. They can beat or be equal to benchmarks.â€

[ad_2]

Source link