[ad_1]

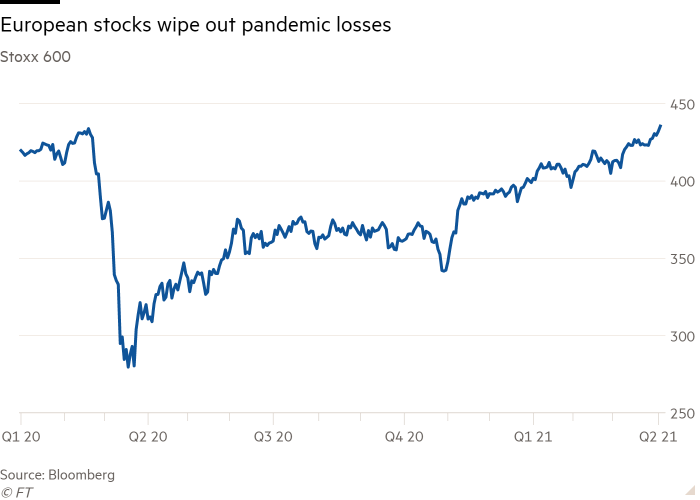

European equities have roared to a new record, erasing deep losses sustained during the pandemic as investors piled into economically sensitive stocks.

The Stoxx 600 index gained 1 per cent in early trading on Tuesday, exceeding the previous record set in February 2020, before the coronavirus crisis triggered a heavy slide in global markets.

Stocks across Europe rallied on the day, with the UK’s FTSE 100 up 1.1 per cent, Germany’s Dax index up by 1.2 per cent and the French CAC 40 gaining 0.7 per cent.

European stock markets have taken longer to recover than their Wall Street rivals since the region has a greater proportion of cyclical companies whose prospects are more closely aligned with the economic outlook. The US, by contrast, is home to the world’s largest growth companies, particularly in technology, which were able to sustain rapid sales increases during the pandemic.

The Stoxx 600 has gained 9 per cent this year after crashing almost 40 per cent last spring and ending 2020 down 4 per cent. The US benchmark S&P 500 has risen a similar margin in 2021, but it rallied more than 16 per cent last year.

Europe’s biggest gainers this year have been industries including automakers, travel and leisure companies and banks — all of which are up at least 19 per cent since the end of 2020.

Tuesday’s gains in Europe came after most markets in the region were closed on Monday for the Easter holiday. On Wall Street, the S&P 500 reached another high after a report showed activity in the vast US services sector expanded at the swiftest rate on record last month — an indication that the world’s biggest economy is rebounding at a rapid pace from the Covid-19 crisis.

“We think investors should not fear entering the market at all-time highs,†said Mark Haefele, chief investment officer for global wealth management at UBS, referring to US stocks. “We recommend continuing to position for the reflation trade as the economic recovery gathers paceâ€.

In the latest sign of how global economies are recovering from the pandemic, UK prime minister Boris Johnson announced on Monday that England would move to step two of its “road map†for lifting the lockdown on April 12, when premises including outdoor pubs, non-essential shops, hairdressers and indoor gyms will be able to reopen.

The outlook was muddier in parts of continental Europe, where several countries have reintroduced social restrictions as a result of a wave of infections and slower vaccine rollouts.

Still, economists expect the eurozone economy to grow 4.2 per cent this year, after a 6.6 per cent drop in 2020. The UK is forecast to expand at a slightly more rapid rate of 4.7 per cent following last year’s 9.8 per cent fall, according to economists polled by Bloomberg.

[ad_2]

Source link