[ad_1]

Investors who bought fallen angel ETFs at their lows in 2020 benefited from stellar returns by the end of the year, but a potential return to inflation could have a negative impact on this market in 2021, some industry figures say.

The number of fallen angels — investment-grade bonds that have been downgraded to junk status — sharply increased last year when the bonds of a swath of companies in the energy, transportation, retail and leisure sectors were downgraded when the coronavirus pandemic hit, causing their price to slide. Yet while most of these bonds rallied later in the year, 2021 could be a different matter.

“No different than any other fixed-income instrument, fallen angels and the ETFs that own them will see their value eroded by inflation. A sudden, unexpected inflationary shock would be especially harmful,†said Ben Johnson, director of global ETFs and passive strategies research at Morningstar.

A potential rise in inflation, in Johnson’s view, means investors should not expect a repeat of 2020 performance when, from its low point in March 2020, the Bloomberg Barclays US HY Fallen Angel 3% Cap Total Return Index had risen 47.6 per cent by the end of December, according to TrackInsight.

Fran Rodilosso, head of fixed income ETF portfolio management at VanEck, which offers a fallen angel ETF, said: “Fallen angels and high-yield bonds, from a credit fundamental and credit spread perspective, tend to do OK in an [inflationary] environment.â€

However, he added: “But overall with yields in credits at historically low levels, there is going to be some sensitivity to rates.â€

Also denting the outlook for 2021 is the expectation that there will be fewer downgrades of investment-grade bonds to junk — the volume of downgrades in 2020 also boosted the returns of fallen angel ETFs.

The iShares Fallen Angels USD Bond ETF held paper from 117 issuers in December 2020, compared with 100 at the beginning of the year, while the number of bonds in the underlying index skyrocketed from 233 to 392 over the same period.

“The large wave of downgrades last year coming in at very deeply discounted prices — higher than average — really was a tailwind to performance,†said William Sokol, senior ETF product manager at VanEck.

“More than two-thirds of the index, by market weight, ended up being comprised of bonds that had been downgraded to high yield in 2020,†Rodilosso said.

All three fallen angel ETFs ended the full year in positive territory, outperforming the broader high-yield universe, according to TrackInsight, despite suffering steep losses in March. The iShares Fallen Angels USD Bond ETF, which tracks the Barclays index, jumped 47.6 per cent from its low point in March 2020 to the end of December.

The VanEck Vectors Fallen Angel High Yield Bond ETF, which tracks the BofA Merrill Lynch US Fallen Angel High Yield Index, rebounded 41.9 per cent over the same period, while Invesco’s US High Yield Fallen Angels UCITS ETF gained 46.3 per cent.

However, despite the conventional wisdom that bonds perform badly in an inflationary environment, BlackRock’s Karen Schenone argued that fallen angels would still look attractive to yield-starved investors.

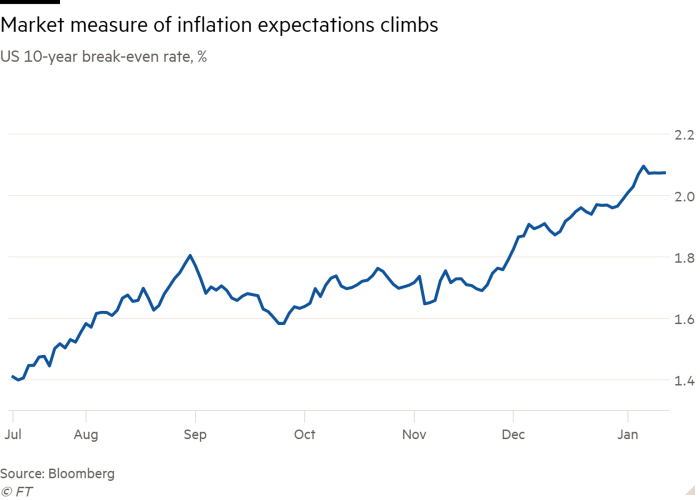

“Inflation can reduce the overall purchasing power of savings. With the US Federal Reserve signalling to the market that inflation can increase over their 2 per cent target, investors need to seek income above the inflation cost. With investment-grade bonds barely yielding 2 per cent, high-yield bonds in funds like FALN [the iShares fallen angel ETF] offer more income.â€

Asset managers such as BlackRock will also have been encouraged by assurances from the Federal Reserve’s chairman Jay Powell, who said last month that the Fed would not reduce the scale of its asset purchasing programmes, which include high-yield bonds, any time soon, even if there was a sudden inflation spike above the Fed’s 2 per cent target.Â

[ad_2]

Source link