[ad_1]

Turbulence is picking up in the wind energy business. Siemens Gamesa has warned on profits three times. At best, the Spanish turbine maker will break even this year. Undeterred, oil companies are teaming up with generators to tackle the next frontier: floating offshore wind.

Shell and Iberdrola have declared a plan to develop large floating wind farms off the coast of Scotland, as have BP, Equinor and RWE. Crown Estate Scotland said on Thursday that offers would be made to successful bidders for ScotWind leases in January.

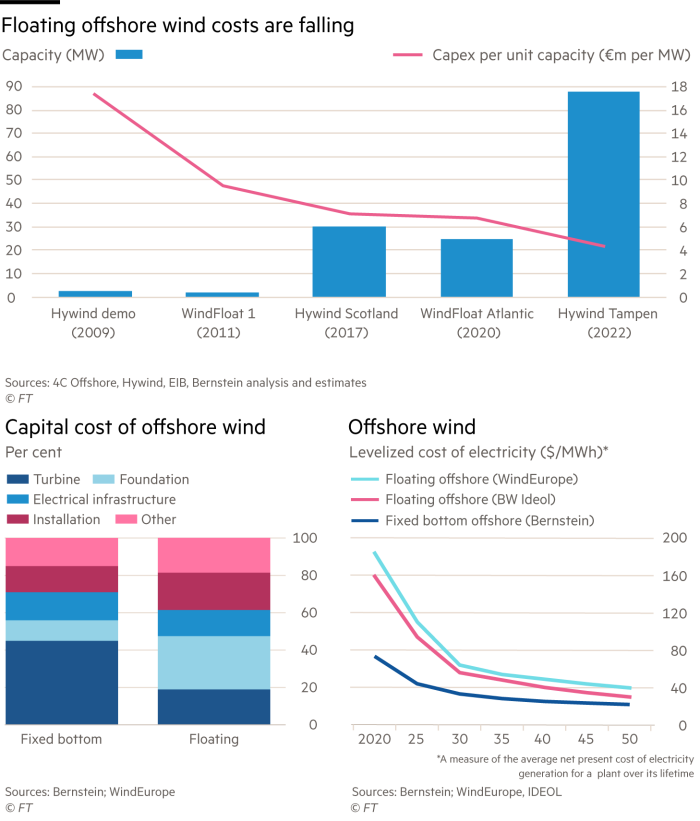

Floating offshore wind represents an opportunity for oil companies to bring expertise in deep water exploration and drilling to renewable energy. Floating generation could capture up to 80 per cent of available offshore wind resources. The catch is that costs are double those of turbines permanently fixed to the seabed.

Commodity inflation is unlikely to change that differential. But the gap could test the premise that renewables are the cheap power option of the future.Â

Siemens Gamesa’s problems relate to onshore wind farms in Brazil, however. Difficulties in the local supply chain for its 5X platform plus the doubling of the steel price this year have hit profits. Shares have lost almost a third of their value in the year to date.

The onshore contracts are not indexed to input costs, unlike the majority of offshore wind projects, which have elements of inflation protection built in. The company also made mistakes in its hedging, the cost of which will now be shouldered by shareholders.Â

So far, costs have risen too little to challenge the raison d’être of renewables as competitive alternatives to fossil fuel. Steel represents between 10 and 15 per cent of turbine input costs. Price rises are more than offset by increases in wholesale power prices. Two-year forward prices have surged 20 per cent this year in Germany, pushed higher by rising carbon and gas expenses.Â

As a result, offshore floating wind farms still look like viable economic prospects. The main problems are engineering ones. Fortune may be throwing a much-needed lifeline to oil businesses more challenged by the deep waters of energy politics than the real kind.

Lex recommends the FT’s Due Diligence newsletter, a curated briefing on the world of mergers and acquisitions. Click here to sign up

[ad_2]

Source link