[ad_1]

Interested in ETFs?

Visit the FT’s ETF Hub for news and analysis, investor education and tools to help you select the right ETFs.

Three years after the #MeToo movement highlighted the widespread incidence of unwanted sexual advances in the workplace, fewer than half of FTSE 100 companies published an anti-sexual harassment policy, research shows.

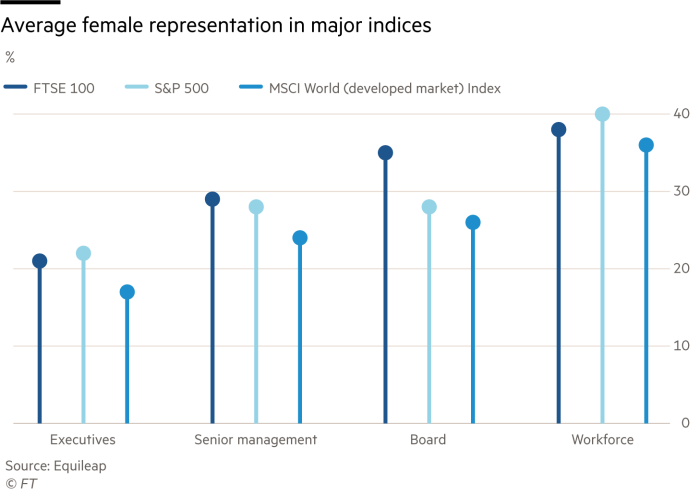

Equileap — which provides data on gender equality used by fund and index providers to construct so-called gender lens investment strategies — found just 49 per cent of FTSE 100 companies published an anti-sexual harassment policy in 2020 compared to 69 per cent of S&P 500 companies and 60 per cent of companies in the MSCI developed markets world index.

The data on the major indices are significant because of the increasing amount of money invested passively. There is more than $12tn invested in index funds globally, and trillions more are benchmarked against the major indices including the S&P 500, the FTSE 100 and the MSCI DM.

Investing in an index fund means an investor cannot choose to withhold money from a company with a questionable record on environmental, social or governance criteria.

“In choosing a fund, and therefore the underlying index, people are choosing the underlying ESG metrics. It might not be a conscious decision but it is an active decision,†said Rumi Mahmood, senior associate of ESG Research at MSCI.

The data Equileap collected for its annual Global Report on Gender Equality also revealed that FTSE 100 companies were the best at reporting on the gender pay gap with 85 per cent of FTSE 100 companies publishing such information in 2020 compared to 18 per cent of MSCI DM companies and only 9 per cent of S&P 500 companies. The research showed overall progress in all three indices over the past year across the metrics that Equileap considers important.

Deborah Gilshan, adviser on investment stewardship and ESG, said the requirement to publish gender pay gap introduced in the UK in 2017 had been “just brilliant†in improving reporting on the metric. But she said that passive fund managers had a particular responsibility to try to improve companies’ performance on diversity.

“Engagement by passive funds is even more important because they don’t have the divest option,†Gilshan said.

Until more companies choose to improve standards, the only option for passive investors who care about gender equality is to do some due diligence on the underlying index.

Mahmood pointed out that the percentage of the MSCI developed markets World index market value exposed to companies where women comprise at least 30 per cent of the board of directors stands at 58.7 per cent, whereas that of the MSCI Emerging Markets index stands at 4.5 per cent.Â

However, there are concerns that progress remains patchy.

“The number of women at executive level is low everywhere and parental leave is abysmal in the S&P,†said Ann Cairns, global chair of the 30% Club and executive vice-chair of Mastercard. “FTSE companies aren’t much better,†she added.

However, Gilshan said she felt encouraged by the progress that had been made on gender and its knock-on positive effects in other areas.

“I absolutely believe the conversation started with gender, but it has become about the barriers to entry faced by other marginalised groups,†she said.

Click here to visit the ETF Hub

[ad_2]

Source link