[ad_1]

Shares in GameStop slid 27 per cent on Thursday, after the video game retailer announced it was planning to issue new shares and disclosed that the US Securities and Exchange Commission was investigating trading activity in its stock.

The company, which was one of the first to become a retail-favoured so-called meme stock in January, said after markets closed on Wednesday that the SEC had contacted its staff on May 26 for assistance in an investigation into its stock activity. GameStop said it did not expect the inquiry to “adversely impact usâ€, and that it planned to “co-operate fully with the SEC on this matterâ€.

The retailer also said it planned to file a registration with the SEC for up to 5m additional shares, which, if issued, would dilute the value of the shares of current investors.

“When you dilute for shareholders your stock price is supposed to go down, so in a way that is some sense of normalcy. Outside of that, GameStop trades on pixie dust and dreams,†said Anthony Chukumba, managing director at Loop Capital, who covers the gaming industry.

“The stock has completely disconnected from fundamentals and that hasn’t changed. So whatever GameStop reported yesterday, it wouldn’t make any difference to the Reddit traders.â€

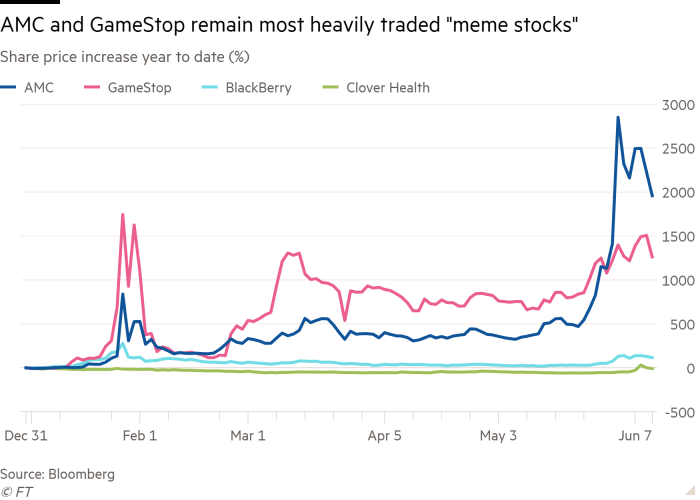

Shares in GameStop, as well as a handful of other retail-favoured stocks, have bounced around widely in the past two weeks, as amateur investors revamped their enthusiasm for trading from earlier in the year. At the end of January retail traders organised on online messaging boards and managed to inflict losses on hedge funds betting against GameStop by pushing up its shares.

But industry experts note that the speed of the latest swings in company valuations of retail favourites suggest that heavier-hitting investors are also now participating alongside retail investors.

“Retail cannot cause these sharp moves alone,†Chukumba said. “Hedge funds are not idiots, there are a bunch who have figured out this game and how to exploit this.â€

Despite the drop on Thursday, chatter about GameStop on the Reddit messaging boards was muted compared to other popular stocks, according to data providers. Again, that suggests that retail investors may not be as active in this latest drop.

The company registered in the bottom of the top 10 most discussed stocks on the platform, according to data provider BreakoutPoint. “It’s surprisingly little. They’re not so excited, they’re not so angry,†said Ivan Cosovic, founder of BreakoutPoint.

Retail activity had cooled down in the months since shares GameStop and other companies first jumped, but pushed higher again in recent weeks, led by cinema chain AMC Entertainment. Last Wednesday, shares in AMC rose 95 per cent.

On Thursday, AMC also fell more than 13 per cent in New York. Its stock is still up more than 2,000 per cent since the beginning of the year. GameStop is up more than 1,177 per cent since the start of the year.

So far, the resurgence of the retail trading craze has not infected broader equity markets. The blue-chip S&P 500 and the technology heavy Nasdaq Composite closed up 0.5 per cent and 0.8 per cent, respectively, in New York, after trading in a tight range for the past sessions.

“There’s been these small, mini-fires happening all over the forest, but they have not led to a broader forest fire as of yet,†said Maneesh Deshpande, head of US equity strategy at Barclays. “It’s worrisome, but it’s not been a macro-event.â€

[ad_2]

Source link