[ad_1]

This article is the third part of an FT series examining the future of retail

Japanese billionaire Hiroshi Mikitani is fond of deals that burnish his reputation as the biggest evangelist for ecommerce in a country that has been slower than many to embrace it.

Rakuten, the company Mikitani founded in 1997 and built into Japan’s largest online retailer, has taken stakes in messaging app Viber and US coupon and cashback site Ebates.

It is a record that explains why his latest deal has generated such interest. Instead of ploughing money into a newfangled app, Mikitani agreed in late March to sell an 8 per cent stake in Rakuten to Japan Post, the former state-owned postal service and a potent symbol of brick and mortar’s role in the country’s $5tn economy.

Coming more than a year into a pandemic that has delivered the biggest shock to the retail sector in decades, the deal was seized upon as evidence that it is too soon to write off the role of a network of physical stores in reaching Japanese consumers.

Alongside the investment, Rakuten will dramatically expand its delivery network and put its brand in front of older shoppers who use post offices. Japan Post, meanwhile, can tap the online retailer’s savvy in payments and use of customer data.

“The essence of this deal is that Japan Post, which has the largest retail branch, is partnering with Rakuten, which is operating the biggest digital business,†Hiroshi Takasawa, managing executive officer, told the Financial Times.

If the agreement is a reminder that the country’s retail roots in brick and mortar run deeper than in other major economies, no one is disputing that the pandemic has changed the way Japan shops.

Akio Yoshida, the president of Aeon, Japan’s biggest supermarket chain, was unequivocal when he addressed investors last month.

“The expansion of Covid-19 has vastly altered consumer behaviour, mindset and value,†he said. “Digital technology has now penetrated every part of our lives.â€

Flat-footed

That marks a radical challenge to a sector that employs 7m people and for the last decade has straddled a sharply divided customer base: a large elderly population brought up on physical shopping and a cohort of younger, more digitally savvy shoppers.

Demographics is one of the main reasons why a country synonymous with tech innovation has been slower to adopt ecommerce.Â

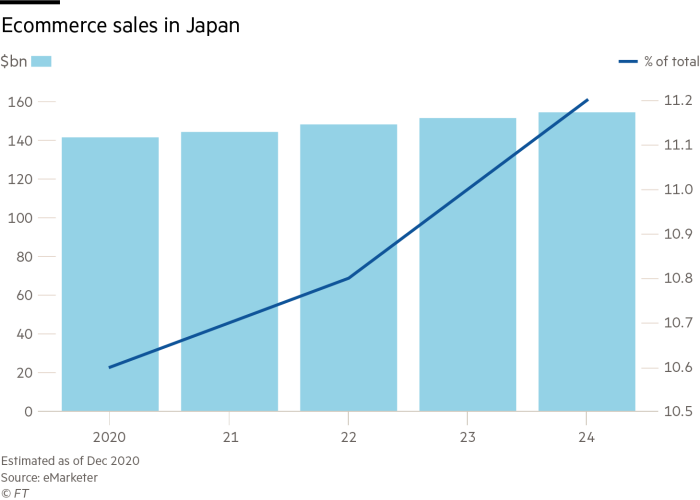

The web will account for almost 11 per cent of Japan’s retail sales by the end of this year, according to research by eMarketer. By contrast, the consultancy forecasts that online sales will account for 52 per cent of the total in China by the end of the year, 15 per cent in the US and 13 per cent in western Europe.

But as Japan imposes another state of emergency in an effort to keep the rate of Covid-19 infections low before the Olympics, retailers are uncertain of how profound the effects of the pandemic will prove.

There are signs some fear being caught flat-footed as new habits become permanent. Nowhere is this clearer than in the case of Isetan Mitsukoshi, a 348-year-old department store operator that sells everything from luxury bags and bedroom furnishings to traditional sweets.

FT Series: Future of retail

Articles in this series will look at:

Walmart vs Amazon: the battle to dominate grocery

How china is shaping the future of shopping

Can online marketplaces live up to their hype?

When the government first declared a state of emergency a year ago, the company was forced to quickly develop new habits. Staff turned to Zoom video calls and messaging app Line to meet a deluge of requests from customers wanting to be able to buy online backpacks in time for the start of the school year in April.

The group has since developed its own smartphone app that theoretically makes all the 1m products sold at its flagship store in Shinjuku available online. The app also allows customers to consult its sales staff virtually.

“We felt we could offer services that are not available on Amazon or Rakuten if our stylists can offer advice to customers who are looking for such encouragement before making a decision to buy something [online],†said Tomohide Sanbe, a senior executive at Isetan Mitsukoshi.

“We are at a point where we need to consider once again the meaning of our existence,†he added.

Yuko Shimomura, who works at a brokerage firm in Tokyo, said that the Covid-19 crisis has changed the way she shops.

“I don’t mind physically going to department stores but I find better deals online,†said Shimomura, who is in her forties.

Nearing the end game

It is not hard to find sceptics who believe the efforts by the likes of Isetan will prove too little, too late as the web expands its grip on consumers.Â

“Management underestimated the pace of the digital shift because of their reliance on physical stores,†Sho Kawano, co-head of Japan equity research at Goldman Sachs, said of Isetan. “The situation would have been drastically different if Isetan had strengthened digital efforts 10 to 15 years ago. It is nearing the end game.â€

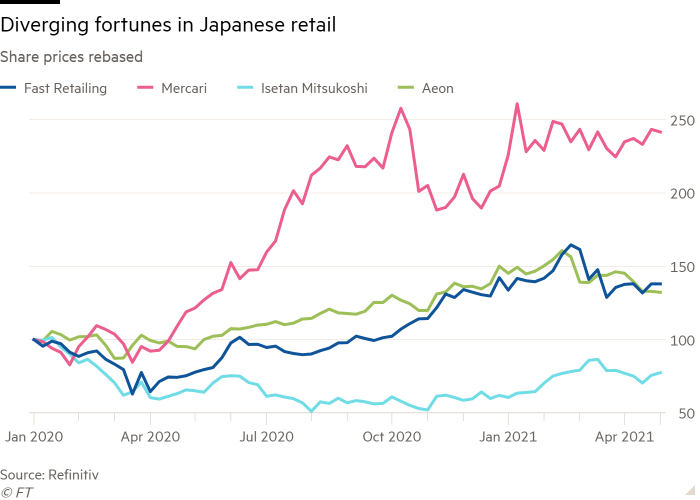

Even before the pandemic, a mixture of complacency and intransigence by some traditional retailers had created an opening that digital rivals such as fashion site Zozo and flea market app Mercari had seized upon. Since the crisis, they have fared even better.

Shares in Mercari, which went public in 2018, set a new record earlier this year as younger generations of Japanese consumers used the app to sell second-hand clothing, handbags and other accessories. Revenues jumped 41 per cent to a record ¥28.6bn ($261m) in the first three months of the year.

The popularity of internet fashion empire Zozotown, owned by Yahoo Japan operator Z Holdings, has also exploded.

Unlike these online specialists, physical stores remain at the heart of Ito- Yokado, one of Japan’s largest supermarket chains. Galvanised by the crisis, however, the company is testing a new approach designed to bridge the gap between its 132 stores and its ecommerce operations.

In September, just as Yoshihide Suga took over as prime minister with a promise to revive the economy, the company began a delivery service supplying 400 varieties of vegetables, fruit, meat and fresh fish directly to the homes of the elderly who ring in their orders by phone.

“We’re going to see more of a world that merges online with offline and there will need to be various co-ordination between online supermarkets, delivery services, physical Ito-Yokado stores, and convenience stores,†Futoshi Shibata, a senior executive said in an interview.

As the crisis disrupts traditional retailers, there is one company that offers encouragement.

Record profits

Fast Retailing, the owner of the Uniqlo fashion chain, has been hailed as a rare example of a company able to grow its online sales while also harnessing technology to smartly operate its now ubiquitous stores.

Uniqlo’s same-store domestic sales climbed 5.6 per cent between September and February from a year earlier, while online sales rose 41 per cent. Fast Retailing, which has a market capitalisation of $86bn, expects record annual profits this year.

That unlikely outcome, say analysts, is down to the effort Uniqlo has put into both its online and physical operations. Robots now dominate its warehouses, speeding the selection of goods for delivery. It launched its own cashless payment app, its latest effort to harvest more valuable data on its customers.

“Whether it is online or offline, customers ultimately want to buy products they want at their convenience,†said Xiaozhou Wang, an executive in charge of Fast Retailing’s global ecommerce efforts. “People want to try on their clothes and we need a physical connection with our consumers. But online also has its merits since it is open 24 hours and you have more information about customers.â€

Few doubt that Japanese consumers in the long term will shift more of their shopping online. But as the industry confronts its worst losses in decades, the message from shoppers to retailers about future success is an unforgiving one: get better online and in stores if you want our business.

[ad_2]

Source link