[ad_1]

Good morning from New York. One thing we have heard repeatedly over the past year is how the pandemic has put social issues front and centre for responsible investors. And as we start gearing up for the 2021 proxy season, it looks like the “S†in ESG (environmental, social and governance) will indeed be under a spotlight.

Read on for more on how banks are coming under pressure for not living up to their commitments to stakeholders and how US companies that donated to politicians in the “coup caucus†are being called to account. And if you are looking for “E†coverage, fret not! We have a one-on-one with the chief of National Grid in the UK to talk about the energy transition.

Investors hold BRT members’ feet to the fire

When the Business Roundtable announced in 2019 that it was embracing a kinder, gentler form of capitalism, it immediately received a challenge.

B Lab, the non-profit behind the B Corp movement, took out a full-page ad in the New York Times calling on the group’s members (which are some of the most powerful chief executives in the US) to “walk the walk†and convert their companies to public benefit corporations.

If these companies were to become benefit corporations (a legal designation that allows management to consider more than profit maximisation in their decisions) it would clear the way for them to put their words into action, B Lab argued.

Of course, none of the BRT’s signatories have done so. This comes as little surprise, given the overall lack of follow-through on the announcement.

But supporters of the benefit corporation movement are not letting them off the hook. And the BRT companies are no longer just ignoring — or laughing off — their requests.

This week JPMorgan Chase, whose chief executive Jamie Dimon also previously led the BRT, published an extensive report outlining why it believes such a move would not be appropriate for the bank, after facing pressure from shareholder Harrington Investments.

The report, prepared by Delaware law firm Richards, Layton and Finger, is 32 pages long, which means JPMorgan was probably on the hook for a few billable hours. Those fees may be mere pocket change to an institution of JPMorgan’s size, but the fact that it didn’t just tell Harrington to kick rocks indicates it is taking the matter at least somewhat seriously.

John Harrington, the head of Harrington Investments, told Moral Money that he disagreed with the bank’s findings, but this response was enough to satisfy him for now.

He has no plans to go away quietly, however. He will be back next year with a resolution calling for the bank to become a benefit corporation.

Harrington has already filed a similar resolution at Bank of America, which he expects will be on the ballot at its annual general meeting.

Will he succeed? Probably not. Passing such a resolution can be notoriously difficult and Bank of America’s management plans to recommend its shareholders vote against the measure.

But putting the issue to a vote will give a view into where large institutional investors and proxy advisers stand on the issue. Many have been advocating for ESG issues over the past few years, and this will be an important test to see how far they are willing to go.

Sometimes, calling attention to an issue is enough to bring about some change. See Bank of America’s announcement yesterday that it is setting a goal of net-zero emissions for its lending portfolio.

Critics were quick to point out that BofA’s climate plan was more aspirational than action-oriented. But the fact that banks are even acknowledging climate risk and “financed emissions†is a big change from a few years ago. And it has come after years of pressure from groups such as As You Sow and Arjuna Capital, which have filed multiple climate resolutions.

Will something similar happen with the benefit corporation movement? I doubt that JPMorgan would ever join companies such as Ben and Jerry’s and King Arthur Baking and become a certified B Corp. But could investors put enough pressure on BRT members to compel them to live up to their purported commitment to stakeholders? The odds are not great, but stranger things have happened. (Billy Nauman)

US businesses face pressure to say more on dollars and democracy

The January 6 assault on the US Capitol, which senators have been reliving in this week’s impeachment trial, prompted companies from Walmart to Microsoft to halt contributions from their political action committees. But how widespread was the donors’ revolt?Â

Fifty-five per cent of companies stopped PAC contributions — for a while, at least, according to a new Conference Board poll. Yet just 28 per cent disclosed that fact publicly, suggesting a reluctance to wade into political waters — even after an attack on the democratic stability on which business depends.Â

Of those cutting off funding, just half targeted what Bruce Freed of the Center for Political Accountability calls “the coup caucus†— members of Congress who encouraged the baseless theory that the election had been stolen. And just 3 per cent said that penalty was permanent.

Paul Washington, executive director of the Conference Board’s ESG centre, says companies may be tongue-tied because of qualms about blurring the line between their company and its employee-funded PAC or “the view that action here speaks louder than words, particularly with lawmakersâ€.

Money talks, in other words. But not always very loudly.

Companies may have to explain their decisions more vocally, however, after the Interfaith Center on Corporate Responsibility rounded up 81 investors with almost $1.7tn under management to push members of the Business Roundtable to halt political contributions for at least six months.

The investors, ranging from Legal & General Investment Management Ltd to Grey Nuns of the Sacred Heart, are also urging companies to consider a permanent end to their political spending, whether through PACs or “dark money†intermediaries — not just because of its “corrupting influenceâ€, but because of the reputational risk it carries. (Andrew Edgecliffe-Johnson)

Winds of change at National Grid?

To get another sense of changing times, Moral Money’s Gillian Tett and Nathalie Thomas, the FT’s energy correspondent, recently sat down with John Pettigrew, chief executive of National Grid — the gigantic electricity and gas utility that has its headquarters in the UK. It is in the ESG spotlight since Boris Johnson’s government made bold pledges to go carbon-neutral, raising the stakes for rapid decarbonisation.

In response, Pettigrew is developing bold new plans to build North Sea wind farms that would be hooked up directly to giant power cables that connect to Europe beneath the English Channel. See the FT story for details on how this could supercharge the trade of renewable electricity between Britain and the continent.

Moral Money: How do you assess the British government’s commitment to go green?

Pettigrew: We now have a level of ambition that aligns with what business has been starting to talk about. So the jigsaw is starting to come together particularly around decarbonisation of generation and electrification of transport. Investors can see potential in terms of the capital investment that is going to be needed. [But] they want to know how you convert that ambition into a set of policies that you can actually invest against. It is hugely ambitious, not just from an engineering perspective but a delivery perspective.

MM: What proportion of Britain’s electricity generation will come from renewables, say, by 2030, or by even 2025?Â

Pettigrew: The 2025 internal ambition we have set ourselves, as the electricity system operator, is to be able to operate the system with 100 per cent zero-carbon power generation. Now, that’s not a forecast — the reality is there will still be lots of gas generation in the UK, but we must be in a position where we can operate the network, irrespective of whether there is any. In 2025 there will be days when we would expect that there’s only nuclear, solar and wind meeting the needs of the UK electricity demand.Â

MM: Are we are moving to the scenario where renewables will be so much cheaper than fossil fuels that there will be growing incentive within the industry to keep moving that way, without government regulation?

Pettigrew: I think everybody has been surprised just how quickly the prices for offshore wind have come down to a point [close to] the realms of fossil fuel pricing, in terms of a typical gas turbine. As the turbines offshore get bigger, as the supply chain gets more robust, we will continue to see lower prices coming through in terms of offshore wind, and therefore, it will be competitive.Â

But it’s intermittent. So what do you need to back up on those days when wind doesn’t blow, or the sun doesn’t shine? Things like storage have a really important role to play.Â

MM: Are you going to invest in storage capabilities yourself?

Pettigrew: We’re prohibited [inside the UK]. But we don’t have those restrictions in half of the US. So we have just created a battery initiative with Tesla and are building some storage in Long Island. We see it as an important source of renewable generation, but also it’s a really good technical solution to help operate the grid.Â

MM: What specific policies do you want to see from the UK government right now?Â

Pettigrew: I’ll give you three examples that I think are quite important. First, [the government announced] a hugely ambitious target of getting 40 gigawatts of offshore wind. The amount of infrastructure investment needed, both offshore and onshore, is absolutely huge, so we need clarity on how do we deliver that: are we going to build offshore networks? Who’s going to build them? How are we going to get the onshore infrastructure built?

The second is around electric vehicles. I was talking to some folks in the US, including the CEO of Ford last week, and you can see how quickly we’re going to see the increasing utilisation of electric vehicles in the US and UK. But in the UK, we need to see ambition around things like developing an ultra-fast charging network. How? Forty per cent of the UK doesn’t have off-road parking, so they’re going to need public charging. How?Â

The third is the national planning standards. It’s really important that the government thinks about its policies and takes local communities and customers with them on the journey to net zero, and that means talking about the infrastructure and national planning standards. It takes time. In our experience on the Hinkley [Point] C nuclear power plant, it was seven years from initiation to the shovel in the ground.

MM: How worried are investors that the gas side of your business could become stranded assets?

Pettigrew: I think that investors are just trying to understand what the road map looks like for heat and for gas. It’s pretty clear what the decarbonisation route looks like in the UK for power generation. Also for transport — it’s going to be electrification, predominantly, although you might see some hydrogen for larger vehicles. But when it gets to gas and heat there is no immediate, obvious road map that meets the needs of being low cost, with technology that’s ready, and that’s flexible for customers.

MM: Are people getting a bit too carried away with the hydrogen story?

Pettigrew: Through the industrial clusters in the UK [being backed by the UK government] there is the potential for a significant role for hydrogen. But what we need is clarity on the [future]. Once you’ve done that, you’re then into hundreds of millions of pounds of investments.

Grit in the oyster

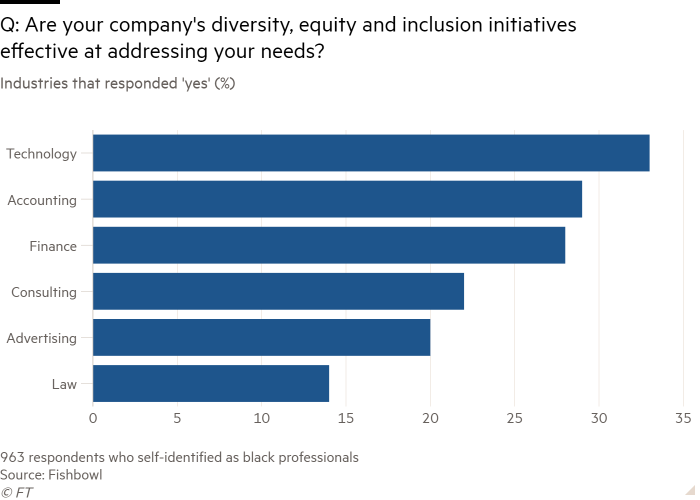

Since last year’s upheaval after the police killing of George Floyd, companies have been bending over backwards to show their commitment to diversity. But a new survey found that only 28 per cent of black professionals in finance believe their employers’ workplace diversity and inclusion policies are effective. (Kristen Talman)

Further reading

-

Gen Z deserves more support from employers (FT)

-

ECB urged to ‘decarbonise’ its €2.4tn corporate credit holdings (FT)

-

Asian and Pacific Islander Employees Feel Left Behind by Manager Diversity Efforts (FundFire)

-

Providing Timely ESG Information Is Becoming More Crucial for CFOs (WSJ)

-

Hundreds of millions in green grants for English homes pulled despite delays (Guardian)

[ad_2]

Source link