[ad_1]

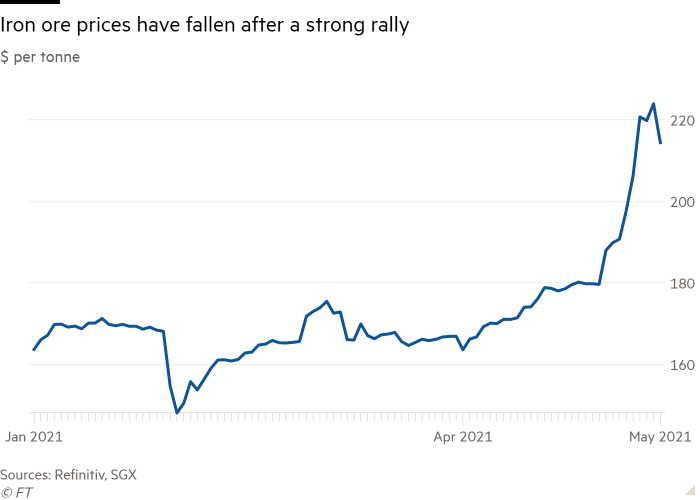

The scorching rally that propelled the price of steel-making commodity iron ore to a record high came to a shuddering halt on Friday on concerns China will crack down on speculative activity.

The main iron ore futures contract in Singapore fell as much as 14 per cent to $190 a tonne before recovering to $209, while there were also big drops in China where the most active contract on the Dalian Commodity Exchange slumped almost 8 per cent.

The sell-off came as the local government in Tangshan, China’s main steel-making city, said it would examine illegal behaviour and suspend production at mills found to be manipulating market prices by spreading rumours and hoarding material, according to reports from Reuters and Bloomberg.

“China’s central government seems to be very concerned about this major input for its steel-intensive economy,†said Tom Price, head of commodities strategy at Liberum. “I think what the pullback reflects is the government trying to rein in prices.â€

Authorities in China have sought to cool hot commodity markets, with Premier Li Keqiang calling this week for stable prices. Iron was trading at $90 a tonne a year ago and hit a record high of $230 this week. Tangshan, which accounts for 14 per cent of China’s steel output, has introduced production curbs as part of a crackdown on pollution.

However, these measures have been slow to take effect as mills in the rest of the country have rushed to crank up output to take advantage of reduced capacity in Tangshan and cash in on record domestic steel prices. A decision to remove the export tax rebate for some steel products on June 1 has also led to other mills increasing production.

As a result, China’s steel production hit a record level in March, with output up 19 per cent year on year to 94m tonnes, according to financial group ANZ. The firm said production was even higher in April, with exports up 20 per cent year on year. That in turn boosted iron ore, which climbed 35 per cent over the past month.

“What the Chinese government is trying to do is incrementally contain the steel market, mindful of the fact they have spent a fortune resurrecting their economy over the past 12 months and they don’t want to kill the recovery,†said Price. “The measures are quite clever.â€

Iron ore has led a broad advance in commodity markets over the past year, fanning talk that another “supercycle†— a long period of high prices — has arrived.

That has been a boon for big iron producers such as Anglo-Australian company BHP and its Brazilian rival Vale, which require a price of just $50 a tonne to break even.

However, most analysts think the iron ore market will remain tight and prices elevated for the rest of the year. That view is based on rising steel demand outside China as big economies accelerate and while important producers in Australia are operating at full capacity.

“While the price has been thumped in the past couple of days, demand remains robust, helped by the fantastic margins the steel industry is enjoying,†said Andrew Glass, Singapore-based founder of Avatar Commodities.

Elsewhere, copper was set for its first weekly loss in more than a month amid worries that a tightening of credit in China could hit demand for the metal, used in everything from household goods to electric vehicles. Copper, which started the week at $10,412 a tonne, was trading at $10,245 on Friday.

[ad_2]

Source link