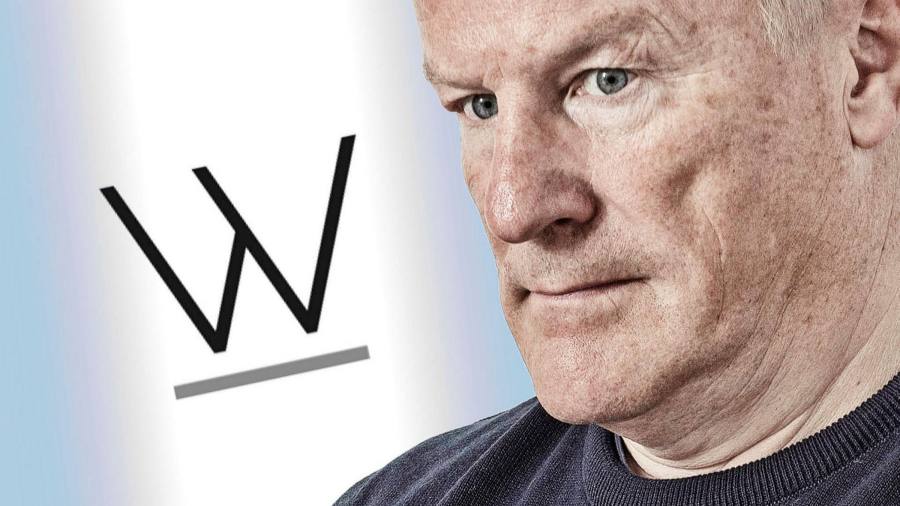

Neil Woodford’s plan to relaunch himself as a money manager less than two years after the collapse of his investment company has prompted a furious response from investors who have been left nursing losses and calls for an independent inquiry.

The disgraced stockpicker is preparing to launch a Jersey-based fund management company, even though the Financial Conduct Authority, the UK regulator, has not yet concluded its investigation into his previous outfit, Woodford Investment Management. It imploded in 2019 while still holding assets worth £3.7bn on behalf of more than 300,000 investors.

An independent investigation into the Woodford affair should be established, according to Gina and Alan Miller, co-founders of the True and Fair Campaign, which seeks improvements in consumer protection standards.

“It ought to be a very serious source of public concern that Mr Woodford can be allowed to recommence trading with the slate ostensibly wiped clean,†the Millers wrote in a letter to the Treasury select committee on Tuesday. “The British public deserve better.â€

The pair also called for parliament to examine the role of the FCA in supervising Woodford, given that it has yet to publish any findings after an investigation that has lasted 20 months.

Woodford said in an interview with the Sunday Telegraph at the weekend that he planned to establish a new venture, Woodford Capital Management Partners, in Jersey. It would cater to professional investors only.

The local regulator, the Jersey Financial Services Commission, has so far not authorised Woodford to restart business. It declined to comment on whether it was considering any licence application.

“There are currently no relevant funds which are authorised to operate in Jersey,†said Martin Moloney, director-general of the JFSC. “We assess all applications we receive in accordance with the robust standards and requirements which apply in Jersey.â€

John Everett, who has served in the past as deputy director-general of the JFSC, said the Jersey regulator would discuss an application, such as that of Woodford, as part of normal business practice with its UK counterpart.

Mark Steward, director of enforcement and market oversight at the FCA, said in a statement late on Tuesday that the regulator was “in contact with the Jersey Financial Services Commission and agreed with them that we will both share information on any application made in our respective jurisdictionsâ€.

Steward added that the length of an investigation could cause frustration to those affected but that “it is vital we investigate thoroughly†and do not “prejudge†the conclusion.

About £2.54bn has been returned to investors from Woodford’s flagship equity income fund and its remaining assets are valued at £192.6m, according to Link Fund Solutions, the fund’s administrator.

This suggests investors will have lost close to £1bn by the time the winding-up process is complete.

Cliff Weight, a director at shareholder rights’ group ShareSoc, said Woodford’s plan to return to managing money had “appalled†retail investors.

“It is a huge kick in the teeth for those whose money Woodford lost,†he said.

ShareSoc is supporting a group claim on behalf of investors against Link, the authorised corporate director of the collapsed Woodford Equity Income fund.

Law firm Leigh Day is bringing the legal action. It said it believed that Link had breached FCA rules because it allowed the Woodford Equity Income Fund to hold excessive levels of illiquid or difficult-to-sell investments, which led to significant losses for investors.

Woodford apologised to investors in the Sunday Telegraph interview, saying that he was “very sorry for what I did wrongâ€. He said that the decision to close the fund in October 2019 was made by Link and presented to him as a fait accompli.

Link on Monday said the decision to suspend the fund was reached in conjunction with Woodford and that the suggestion that he was not involved in the discussion was “incorrectâ€.

[ad_2]