[ad_1]

Tolerances are vital to successful engineering. Precision instruments maker Renishaw has sometimes shown little tolerance of its own for City of London investors. Co-founders Sir David McMurtry and John Deer will have to deal with close scrutiny after putting the business up for sale.

This will be particularly intense if foreign bidders emerge. Renishaw, with a market worth of almost £5bn, is a prime example of a homegrown UK technology success story. Resistance to foreign purchasers is growing. This is reflected in a new law to restrict takeovers of strategically important UK companies. A Renishaw sale could fall under its purview.

The weight of this law is most likely to be felt via conditions imposed by ministers. McMurtry and Deer, who are chairman and deputy chairman and hold 52.8 per cent of the shares, will themselves require “commitment to the local communities in which . . . operations are basedâ€.

That should warn off aggressive cost cutters. Others will be deterred by a price that is already steep. The enterprise value is some 35 times estimated ebitda, following a 20 per cent pop in the share price to £68. That valuation multiple sets a new record. Even a bull such as Berenberg’s Anthony Plom saw £66 per share as a target price.

Bidders are unlikely to offer substantially more than £68. Possible purchasers include Sweden’s Hexagon and US industrial conglomerate Danaher, both of which trade well below Renishaw’s earnings multiple. These two at least make some sense as bidders, given the main purpose of the new UK security law is to block bids with Chinese or Russian state backing.

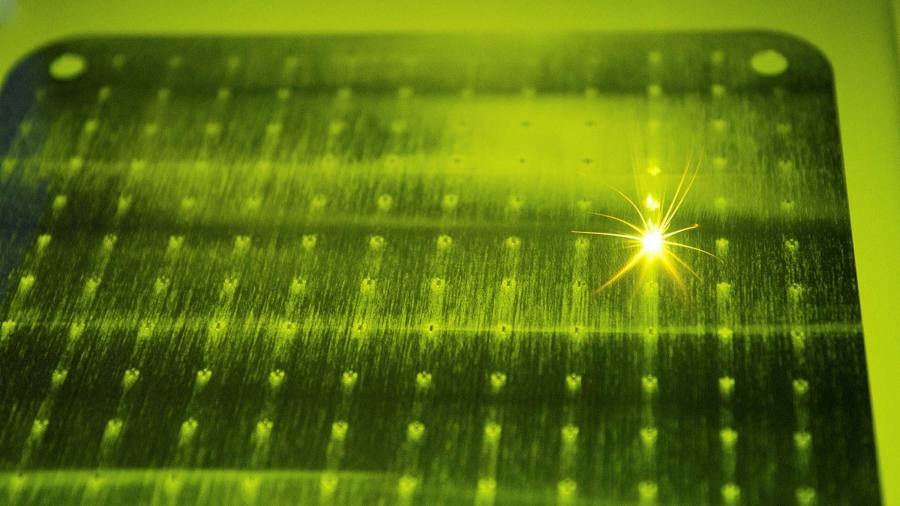

McMurtry invented a sensitive probe to measure tubes in a prototype jet engine half a century ago. His stake in the business that his innovation spawned is now worth some £1.8bn. The value of any sale to the wider group of stakeholders has yet to be assessed. Purchasers will need to gauge the politics of a deal as delicately as its price.

Our popular newsletter for premium subscribers Best of Lex is published twice weekly. Please sign up here.

[ad_2]

Source link