[ad_1]

Royal Dutch Shell, Italy’s Eni and several of the energy groups’ current and former executives were cleared of corruption charges on Wednesday in a long-running Italian case over a 2011 oil deal in Nigeria.

After dozens of hearings over three years, judge Marco Tremolada said he had acquitted all 15 defendants because “a crime was not committedâ€.Â

Prosecutors had accused the companies and senior managers of knowing that most of the $1.3bn they paid in 2011 for the licence to the OPL 245 block went towards bribes for businessmen, middlemen and Nigerian officials, particularly Dan Etete, the former oil minister who was convicted of money laundering in a separate case.

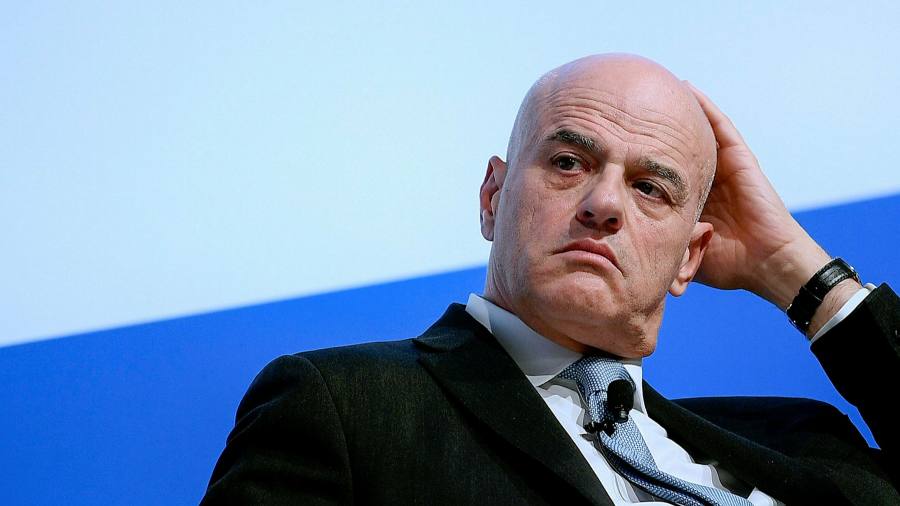

They had sought prison sentences of eight-years for current Eni chief executive Claudio Descalzi and his predecessor Paolo Scaroni, 10 years for Etete and 88 months for former Shell executive Malcolm Brinded, along with a total of $1.1bn in fines.

The defendants had all denied wrongdoing.Â

“Descalzi’s and Eni’s reputations were finally restored,†Paola Severino, the chief executive’s lawyer, said immediately after the decision.Â

Nigeria, which has argued that it has been the victim of a serious fraud, said it was “disappointed†in the ruling and that it would await the written judgment “before considering its positionâ€.

“Nigeria will continue to hold those responsible for the OPL 245 fraud accountable, not only to ensure the people of Nigeria benefit from this valuable resource, but also to make clear its commitment to rooting out corruption in all of its forms,†the government said in a statement.

The verdict is the latest twist in one of the oil industry’s most notorious corruption cases, a saga that began in 1998 when Etete awarded OPL 245 to a company he allegedly controlled, Malabu. Shell agreed to acquire a 40 per cent stake in the plot from Malabu in 2001, only for the government to revoke the Nigerian company’s licence months later. That set in motion years of legal wrangling over the plot’s ownership as successive governments awarded and revoked the block from one party to the other.

Eni entered into talks with Malabu and Shell to buy a stake in OPL 245 in 2010. The $1.3bn deal a year later for the plot off the Niger Delta — which remains undeveloped — was meant to settle the ownership dispute but instead led to the bribery probe in Milan and investigations in the US and the Netherlands.

Nigeria is pursuing separate legal proceedings in the UK against JPMorgan Chase, which it alleges knowingly facilitated the misappropriation of $845m in state funds related to OPL 245 via transfers from Malabu accounts. The bank denies wrongdoing.

A fast-tracked 2018 Italian trial of two middlemen involved in the OPL 245 deal found both guilty of corruption offences.

The oil majors, which still operate in the country, have said the deal was legitimate and sanctioned by the state. Money, they have said, was transferred into a government account and they had no part to play in what happened to it afterwards.

“We welcome today’s decision by the Milan tribunal,†said Shell chief executive Ben van Beurden. “We have always maintained that the 2011 settlement was legal.†However, he acknowledged “this has been a difficult learning experience for usâ€.

Oil companies are coming under intense scrutiny from investors and activists over their environmental, social and governance credentials — and increasingly over their operations in foreign countries.Â

Barnaby Pace, a senior campaigner at Global Witness who has tracked the case for years, said: “We await the details of how the judges reached this ruling but believe that this verdict shows just how hard it is to hold the fossil fuel industry to account.â€

In an interview ahead of the verdict, Etete called the case “shameful†and said Nigeria’s involvement was political payback by president Muhammadu Buhari, who had headed the country’s Petroleum Trust Fund under Etete in the late 1990s. “I’m being persecuted,†he said, arguing that the deal had been signed off by the Nigerian government. “This is heinous.â€

Descalzi, who was head of oil exploration for Eni at the time of the deal, was reappointed to his post at the helm of the company in May 2020. Last year he told the FT: “For sure, I don’t feel guilty. I’m absolutely calm and clear in my mind. I know what Eni did and what I did . . . there is no point to this issue.â€

Shell is embroiled in other legal challenges linked to its operations and environmental pollution in Nigeria. Van Beurden said this year the company needed to re-evaluate its onshore oil operations in the country.

Shell and Eni share prices held steady after the news.

[ad_2]

Source link