[ad_1]

To do well in financial markets you need two types of skillsets: hard and soft. Royal Dutch Shell struggles with the latter, notably communications. Just over a year ago, the Anglo-Dutch oil producer made history by cutting its dividend for the first time since the second world war. Now it is preparing to raise shareholder payouts for the third time since October.

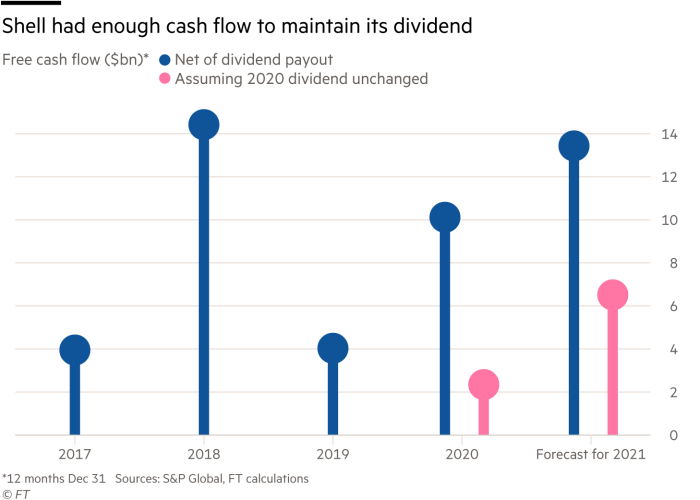

Shell used a pandemic-induced collapse in oil prices to reset an admittedly overgenerous payout. Ever since, a proportion of investors have signalled their displeasure by leaving Shell off their buy lists. That probably explains why Wednesday’s trading update included new payouts.

This time, Shell has promised to distribute 20 per cent to 30 per cent of its operating cash flow to shareholders. That works out to as much as an additional $2bn quarterly, including share buybacks. That total would nearly double last year’s pace. Markets received the message well, initially. The share price jumped more than 3 per cent, though good cheer faded quickly.

One reason for this was that Shell previously said such substantial payouts would not be made until debt had been reduced. At first-quarter results, Shell reiterated that once net debt dropped to $65bn the stated payouts from cash flow could begin. Suddenly Shell has retired that “milestoneâ€. This will confuse analysts and investors awaiting proof of balance sheet rectitude.

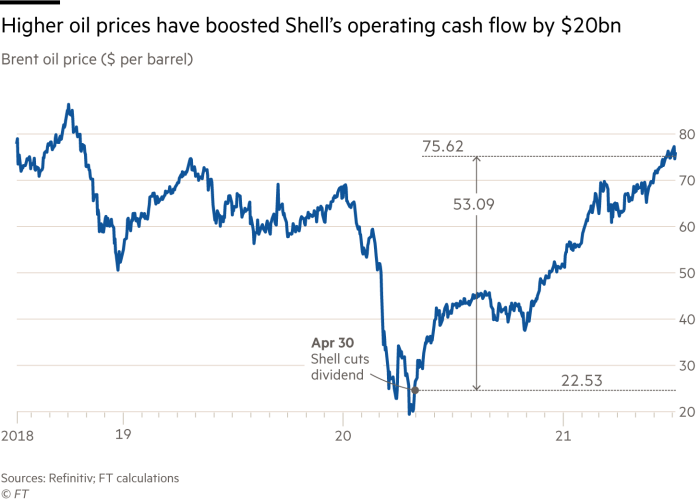

The clarity of Lex’s hindsight is unparalleled, correct 10 times out of nine. Few would have predicted that the Brent oil price would triple to more than $75 a barrel since Shell slashed its dividend by two-thirds. That jump alone probably added more than $20bn to operating cash flow. Yet last year, our simple sums suggested that big oil companies could get through the bear period without hammering dividends. Total of France held on. No surprise that the market has rewarded its shares with a period of outperformance.

Shell’s confusing communication strategy extends to carbon reduction. The group has more experience at evaluating climate change than many peers. Yet some analysts rightly carp that its strategy here remains muddled. To keep investors on side during this transition, Shell knows it must pay them more — and get its message straight.

Our popular newsletter for premium subscribers is published twice weekly. On Wednesday we analyse a hot topic from a world financial centre. On Friday we dissect the week’s big themes. Please sign up here

Twice weekly newsletter

Energy is the world’s indispensable business and Energy Source is its newsletter. Every Tuesday and Thursday, direct to your inbox, Energy Source brings you essential news, forward-thinking analysis and insider intelligence. Sign up here.

[ad_2]

Source link