[ad_1]

Merlin Swire’s appointment as chair of the storied Hong Kong trading house in 2018, which bears his family’s name, was billed as the beginning of the group’s “next chapterâ€.

The 47-year-old was the first member of the family since the 1860s to hold the role of “taipanâ€, the traditional name for the head of a British-owned, colonial-era Hong Kong trading house.

But three years later, that chapter seems to have ended to the surprise of some observers of the company, given the crisis facing the group in Hong Kong. It announced last month that he would be returning to London to run the Swire holding company, leaving the airline-to-property group, whose flagship is Cathay Pacific Airways, facing some of the biggest challenges in its history.

The 205-year-old company has been rocked by political turmoil on its home turf and by the Covid-19 pandemic. Cathay is struggling for survival and Swire’s vast Hong Kong property portfolio has taken a hit.

“In the whole of the company’s history, it’s the worst time to have a stint as taipan,†said Richard Harris, a fund manager at Hong Kong-based Port Shelter Investment Management.

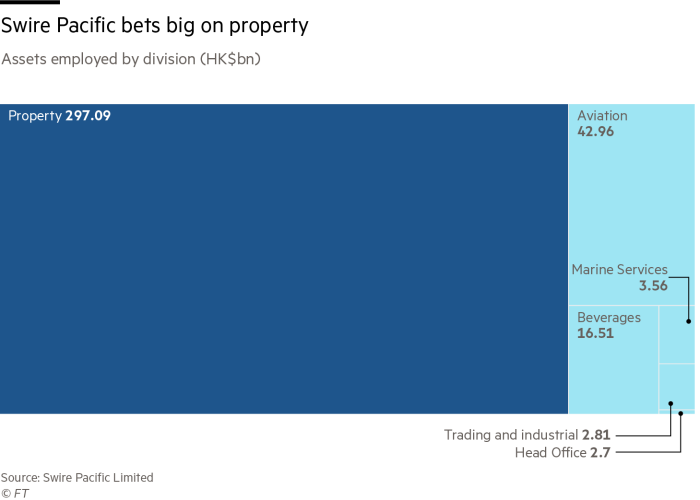

The departing chair’s replacement is Guy Bradley, previously head of Swire’s property business. That indicates the group is likely to focus more on real estate and less on Cathay, which has been pummelled by the closure of international borders.

But analysts question whether the leadership change will be enough to get the conglomerate back on track.

“They need to adjust their strategy . . . They need a shake-up to get everybody to wake up,†said Kevin Au, director of the Centre for Family Business at the Chinese University of Hong Kong. “Swire has been too conservative . . . because of the history of their success.â€

John Samuel Swire, son of John Swire, founder of a Liverpool textile company, started trading with China in 1861 and opened a company branch in Hong Kong in 1870. Merlin Swire is John Swire’s great-great-great-grandson.

Investors and observers say Merlin Swire is leaving Hong Kong having made only a modest impact on the conglomerate’s empire in Asia. A year after he took the helm, Cathay staff participated in anti-government protests in the territory, prompting China to threaten the company with regulatory action. After Merlin Swire met government officials in Beijing, Cathay ousted chief executive Rupert Hogg while chair John Slosar resigned shortly after.

Those developments, while appearing to smooth relations with Beijing, underscored how the Communist party government increasingly expects the Swire group to publicly support its positions even when they clash with UK foreign policy.

In 2018, the group hailed Merlin Swire’s appointment and move to Hong Kong as a sign of the company’s unwavering commitment to the former British colony. “This move back to Hong Kong reflects how important Hong Kong is to the group’s business,†the company said.

Today, Hong Kong has become a drag on its performance. Swire Pacific announced a rare underlying annual loss in March of HK$3.9bn (US$502m), as the pandemic hit Cathay and its Hong Kong property business. Jardine Matheson, a rival colonial-era trading house that has diversified more extensively in south-east Asia, clocked a US$1bn underlying net profit for the same period.

Hong Kong, while part of China, is also separated from the mainland by border controls, meaning Cathay has no domestic market to fall back on. Hong Kong’s coronavirus quarantine measures, among the world’s toughest, have not helped.

“Cathay is in ICU [intensive care] for the foreseeable future,†said David Blennerhassett, an analyst at Ballingal Investment Advisors.

Swire needs to “try something different†and focus on the mainland Chinese property unit previously run by Bradley, said one senior Hong Kong businessman familiar with the company.

Swire’s other interests include bottling Coca-Cola in China, marine services for the energy industry and Taikoo Sugar, a business dating from the colonial era. But it is increasingly focusing on property in greater China, having developed mixed-use commercial and retail districts on the mainland.

Merlin Swire will still occupy an important role as head of holding company John Swire and Sons, which sits above Hong Kong-listed Swire Properties and Swire Pacific. “The really important strategic decisions are still made by the family in London,†a person familiar with the company said.

A guest at a dinner party attended by Merlin Swire described him as quiet and observant. “He was one of the most unassuming, humble people I have met in business,†said a former business partner.

Insiders said Merlin Swire and his family take the underground or taxis in London, while the former business partner told the Financial Times he flew with Australian low-cost carrier Jetstar on a trip to New Zealand.

According to a person who worked closely with Merlin Swire, his tenure represented a “decent minimum†but he “never quite clicked†with his position as chair. Swire defended his record, saying its leadership had “done an excellent job maintaining our progress†and the company was focused on “sustainable growthâ€.

Some Hong Kong establishment figures say Merlin Swire is just one in a long line of leaders at Swire and Jardines who never picked the Asian city as their long-term home.

“There’s more prestige being back in London than being in Hong Kong, where it’s hot and humid and crowded,†a veteran Hong Kong businessperson familiar with the company said. “When you are extremely wealthy, you can have that option and hire good people to run things for you.â€

Some company insiders said they were not surprised at Merlin Swire’s move back to the UK. The need for a leadership change so that Bradley could boost the business’s focus on property became clear, they said, when the pandemic first hit Cathay financially last year.

A former Swire executive said the big challenge for Bradley would be repositioning the company. Swire’s recent losses in Hong Kong office and retail properties have been partly offset by its China real estate business, which has been boosted by the country’s economic rebound from Covid-19.

However, a slightly greater share of the company’s property assets by square feet are still in Hong Kong and most of those in mainland China have already been developed. Swire said it had a “good pipeline†across mainland China, Hong Kong, Indonesia and Vietnam.

“In China, they are moving very, very slow, they are very conservative,†the former Swire executive said. “The Swire family needs to show how confident they are in China . . . and put their money where their mouth is.â€

[ad_2]

Source link