[ad_1]

As the first wave of the coronavirus pandemic swept across Britain a year ago, a billionaire banker made a televised pitch to the nation offering assistance.

Lex Greensill, a 44-year-old Australian who had made his name by devising ingenious ways for companies to pay their bills faster, announced a plan to ease the pressure on NHS staff fighting the virus.

Sandwich chain Pret A Manger had just offered every NHS worker in the country a free cup of tea. Greensill went one better: his company would enable doctors, nurses and even hospital janitors to cash a part of their pay cheque every day — rather than waiting until the end of the month — at no additional cost.

“In a way,†Greensill told Sky TV, pausing for dramatic effect, “it is our free cup of tea.â€

It was a characteristically bold pledge, mixing the skills that had turned the son of a sugarcane farmer into one of Australia’s richest people — a flair for financial engineering, an ability to navigate the blurry line between public and private sectors and a heightened sense of bravado.

But one year later, Greensill’s vision is in tatters.

Greensill Capital, the company he founded, teeters on the brink of insolvency. The group’s German banking subsidiary is in even greater legal peril: financial watchdog BaFin, still reeling from the Wirecard scandal, this week filed a criminal complaint against Greensill Bank’s management for suspected balance sheet manipulation.

The company had frequently portrayed itself as a saviour of small business, proclaiming that it was “making finance fairer†and “democratising capitalâ€. Yet, Greensill’s lawyers this week painted a stark picture of the chain of destruction that a messy collapse could unleash: many of their corporate clients were “likely to become insolventâ€, putting over 50,000 jobs around the world at risk.

The crisis at the company is a humbling reversal for a figure who had rapidly become a fixture of the British establishment. Prince Charles presented him with a CBE for “services to the economy†in 2017. The following year, former prime minister David Cameron signed up as Greensill’s adviser.

Some victims of the Greensill fiasco will elicit little sympathy.Â

SoftBank’s $100bn Vision Fund poured $1.5bn into the company in 2019, bewitched by its financial engineering. The fund is now expecting to lose its investment. Cameron, meanwhile, has seen a long-awaited personal windfall from share options turn to dust.Â

But small business owners, many of whom have never even heard of Greensill, could become collateral damage. The British and German governments are also scrambling to halt any risk to taxpayers.

The insurance industry — a key cog in Greensill’s machine — is watching events unfold with a nervous eye. One insurer has already laid the blame for the scale of cover it extended to the company at the feet of a rogue underwriter.

“This is similar to what blew up AIG in 2008,†says one person close to the brewing disputes, in reference to the complexity of the contracts involved.

Over a decade after the financial crisis, the unravelling of Greensill has again shone a harsh light on the dangers of little-understood financial products.

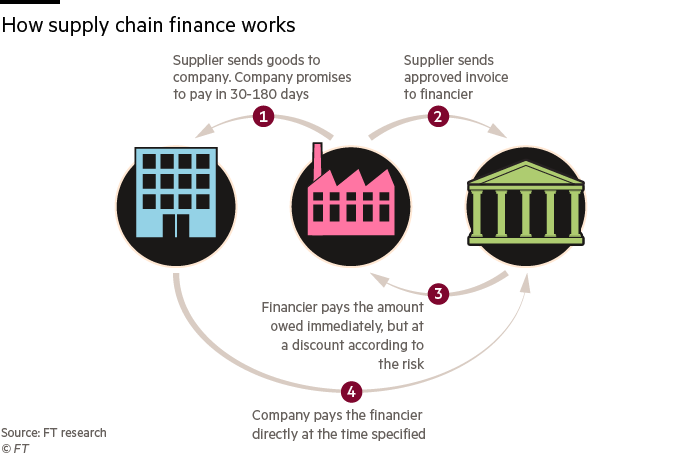

Greensill Capital emerged as one of the dominant players in supply chain finance, a once-staid method of corporate funding that exploded in popularity over the past decade, due in part to lax disclosure requirements.Â

Lex Greensill became the dominant figure in a seemingly niche, yet increasingly important, corner of finance. But now, some of his biggest backers have severed ties.

Credit Suisse, having put $10bn of client money into Greensill’s complicated financial products, pulled the plug on these funds this week and started returning cash to investors.Â

Sanjeev Gupta, the metals magnate once hailed as Britain’s “Saviour of Steelâ€, halted payments to the firm, even after Greensill’s financial alchemy proved vital in helping him forge a global industrial conglomerate from ageing and unloved steelworks.

Even as his empire crumbles, Lex Greensill remains defiant. Reached by phone on Thursday, he accused the Financial Times of engaging in a “significant amount of character assassinationâ€.Â

He declined to comment further.

Reckless ambition

To hear Lex Greensill tell it, his mission is very simple: to help small businesses get paid faster. Growing up on a farm in Bundaberg in Queensland, Greensill’s often repeated origin story hinges on the financial hardships of his parents. Their suffering when large corporations delayed payments to the family business moulded his corporate vision.

Greensill moved to the UK in 2001 aged 24. Four years later, he joined investment bank Morgan Stanley. At the time, the US firm was expanding in supply chain finance, where companies enlist banks to pay their suppliers upfront.Â

He thrived in this once obscure backwater. Barely half a decade later in 2011, he struck out and established his own eponymous supply chain finance specialist, aged just 35.Â

His rising profile soon bagged him a plum role as an adviser to then prime minister Cameron, who furnished him with an office in the heart of government.Â

“It’s a long way from Bundaberg to London to 10 Downing Street,†Greensill told an Australian radio station in 2017. “It, hopefully, shows other folks that there is nothing that you can’t do if you set your mind to it.â€

The reality behind the self-mythologising is more complex, however.Â

The financial product Greensill champions is divisive. Some regulators and rating agencies have sounded alarm at the potential for supply chain finance to mask ballooning borrowing levels.Â

The controversial technique was at the heart of last year’s alleged fraud at NMC Health, the former star of the FTSE 100 that fell dramatically into administration last year. The Middle Eastern hospital operator quietly borrowed hundreds of millions of dollars via Greensill through funds at Credit Suisse.

Carson Block, the famous short seller who in late 2019 first exposed NMC’s hidden debts in an explosive report, recalls that the company had downplayed its use of supply chain finance.

“When we saw its [debt] in the Credit Suisse fund, we automatically knew that management was lying,†he told the FT. “We therefore thought it was probable that they were lying about far more than just supply chain finance.â€

NMC’s collapse hit its hospital staff hard. Many in the UAE were left facing anxious waits for delayed wages. In the same month Greensill was pledging selflessly to help doctors and nurses in the UK get paid faster.

“Lex is a great salesman,†says one of his early backers. “He’s got this ‘good old boy farmer made good’ story. But I think his ambition is reckless.â€

This ambition nearly drove Lex Greensill’s own business over the edge in 2016. Public accounts show that Greensill Capital lost $54m that year due to bad loans — more than its revenue and over 10 times its 2015 losses.

In his hour of need, two very different British men helped rescue Greensill: a blue-blooded star fund manager and an Indian-born trader reinventing himself as a captain of industry.

An unlikely saviourÂ

“Dear Sanjeev, your fund is now up and running.â€

In October 2017, Lex Greensill emailed a trusted business partner after helping him open an account with GAM, his favourite Swiss investment firm.

GAM ended up managing £50m for British steel baron Sanjeev Gupta. But the fund it was invested in was far from straightforward: it channelled a circular flow of financing, which took money from the metals magnate, before quietly investing the cash back into his own companies’ supply chain. The Swiss fund manager, which has never publicly identified the sole investor in the fund, told the FT it returned the money at the end of 2020.

The investment vehicle’s formation epitomised the financial complexity that had bound Greensill, GAM and Gupta.

Tim Haywood, once one of GAM’s star fund managers, had started investing in Greensill-structured deals in 2015.Â

The following year, when the financial start-up experienced its near-disastrous losses, the Swiss firm took things a step further: Haywood’s fund lent over $120m to Greensill Capital itself, through a shell company named after a creek on the Australian financier’s family farm.Â

Around this time, Greensill also ramped up business with Gupta, who having built a commodities trading business out of a Cambridge university dorm room in the 1990s, was now turning his hand to rescuing decrepit steelworks around the world.

In 2017, Greensill’s revenues nearly tripled and the group swung to a profit. But documents seen by the FT show the secret behind its dramatic recovery: $70m of the company’s $102m net revenue was derived from Gupta’s companies.

The following year, the close relationship started to come unstuck: GAM suspended Haywood after an internal investigation into risk management and internal record-keeping.Â

Nervous investors ran for the exits of his funds, which had invested heavily in Greensill products, many funding Gupta. Unable to dispose of them easily, GAM was forced to liquidate its flagship $7.3bn fund range. Investors waited the best part of the year for final payment.

For many observers, the fact Greensill and Gupta emerged from the wreckage of the GAM fiasco unscathed seemed miraculous.Â

Yet, behind the scenes, a series of 2019 transactions that helped repay GAM, shifted substantial debts related to the Gupta companies on to the balance sheet of a seemingly staid lender in the industrial heartland of Germany: Greensill Bank.

These facilities, first revealed in the FT last year, were a time-bomb that has only just exploded: the billions of euros of Gupta-related debt is what first sparked the concern of German regulator BaFin in 2020. Gupta’s GFG Alliance declined to comment.

As the pressure has mounted, the flamboyant side of the Greensill empire and the role of the German lender have started to come under closer scrutiny. GAM’s investigation into Haywood also focused on his use of Greensill’s private jets. Greensill Bank purchased the jets and leased them to an Isle of Man subsidiary of Greensill Capital, allowing the humble Australian farmer’s son to fly aboard a fleet of corporate planes until last year when, under pressure from the board, the aircraft were sold.

How Greensill was able to afford such a luxury always baffled the company’s rivals. As one supply chain finance executive puts it: “This is a great industry, but I fly Ryanair.â€Â

[ad_2]

Source link