[ad_1]

Government bond prices sustained a fresh blow on Thursday, prompting benchmark stocks to wipe out close to all gains for the year, after comments from Federal Reserve chairman Jay Powell failed to reassure investors.

With prices falling, the yield on the 10-year US Treasury note climbed as high as 1.55 per cent, up 0.07 percentage points from the previous day and continuing a sharp rise that has spread to debt issued by other nations.

In stocks, the benchmark S&P 500 index extended recent losses, briefly wiping out its gains for the year with a fall of as much as 1.7 per cent. The index later clawed back some of its losses, and was down 1.3 per cent in the afternoon in New York. The technology-focused Nasdaq Composite slid by 2 per cent, turning negative for the year.

“When yields go up — and we had pretty high valuations of the overall markets — the market rebates,†said Shana Sissel, chief investment officer at Spotlight Asset Group. “I look at this sell-off as the market taking a breather, it was very very hot, and you could argue overbought.â€

Investors had been waiting to see if the Fed would react to the broad sell-off in government bonds in recent weeks with a stronger message or hints of fresh intervention to calm the market.

At an event hosted by The Wall Street Journal, Powell said he would be “concerned†by consistent tightening of financial conditions and that the central bank would be “patient†in the face of a temporary rise in inflation.

“Today was a really interesting day because the market was really firm, a little tentative but firm, and then Powell spoke,†said George Cipolloni, a portfolio manager at Penn Mutual Asset Management. “He really didn’t say anything dramatically different, other than that they’re not at their target yet . . . which is rattling markets.â€

The yield on the 10-year Treasury, which acts as a benchmark for borrowing costs and asset prices worldwide, has risen rapidly from about 0.9 per cent at the start of the year. Long-term Treasury prices have tumbled about 10 per cent so far this year, according to a Bloomberg Barclays index.

Goldman Sachs revised higher their 10-year Treasury forecast on Thursday, pencilling in the benchmark note to trade at 1.9 per cent by year-end. In November, they predicted yields would hover at about 1.3 per cent.

In currencies, the dollar jumped 0.6 per cent against a basket of half a dozen big currencies on Thursday, tracking the rise in Treasury yields.

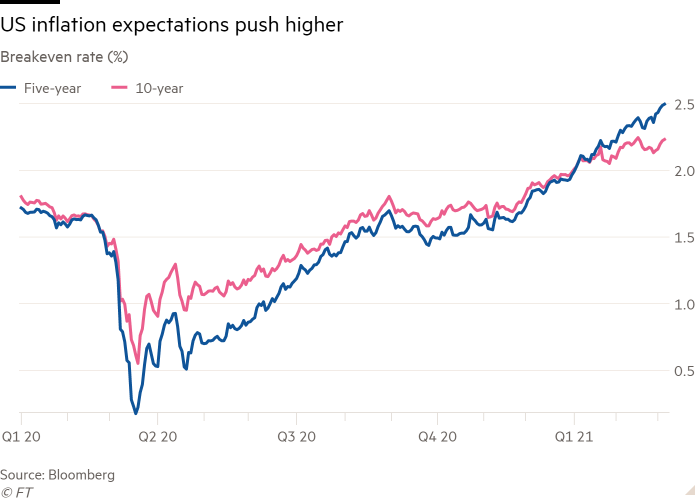

Investors have offloaded the Treasuries as President Joe Biden pushes his $1.9tn coronavirus relief package through the US legislature, raising expectations that the heavy stimulus spending will create strong economic growth and feed inflation. A measure of medium-term inflation expectations, known as the five-year break-even rate, touched 2.51 per cent on Thursday, the highest level since 2008.

The Fed continues to buy at least $120bn of financial assets each month to add liquidity to financial markets, as part of its emergency response to the pandemic that has helped drive global stock markets to record highs.

In Europe, the Stoxx 600 equity index and the FTSE 100 both ended the day down 0.4 per cent. Brent crude, the oil benchmark, gained 5 per cent to just under $67 a barrel after Opec and its allies refrained from making large increases to their production.

[ad_2]

Source link